Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a). Calculate the WACC show all working, use4 decimal for working and 2 decimal for final answer. b). explain the impact of business risk and

a). Calculate the WACC show all working, use4 decimal for working and 2 decimal for final answer.

b). explain the impact of business risk and financial risk of all equity and leverage firm on respective WACC.

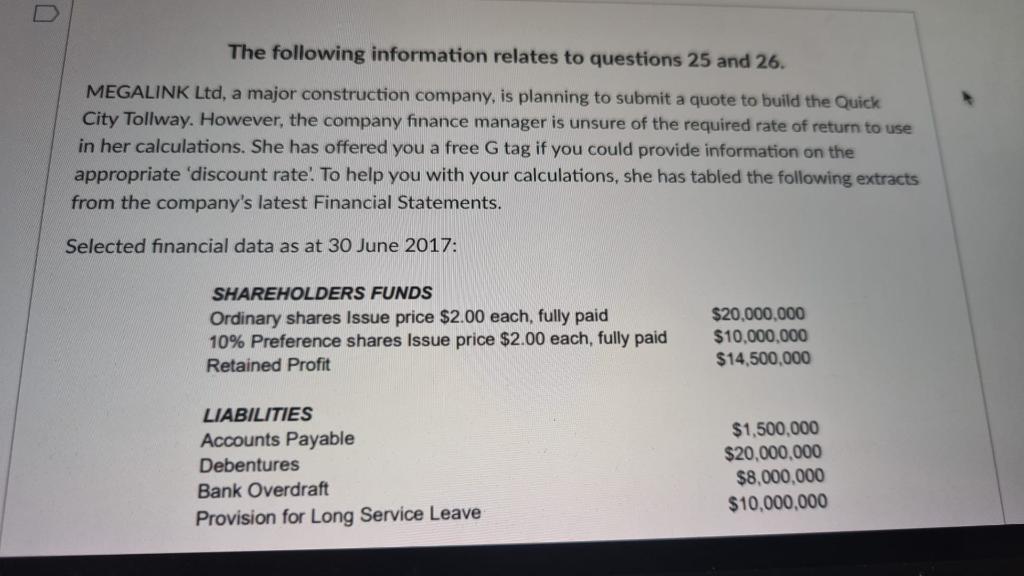

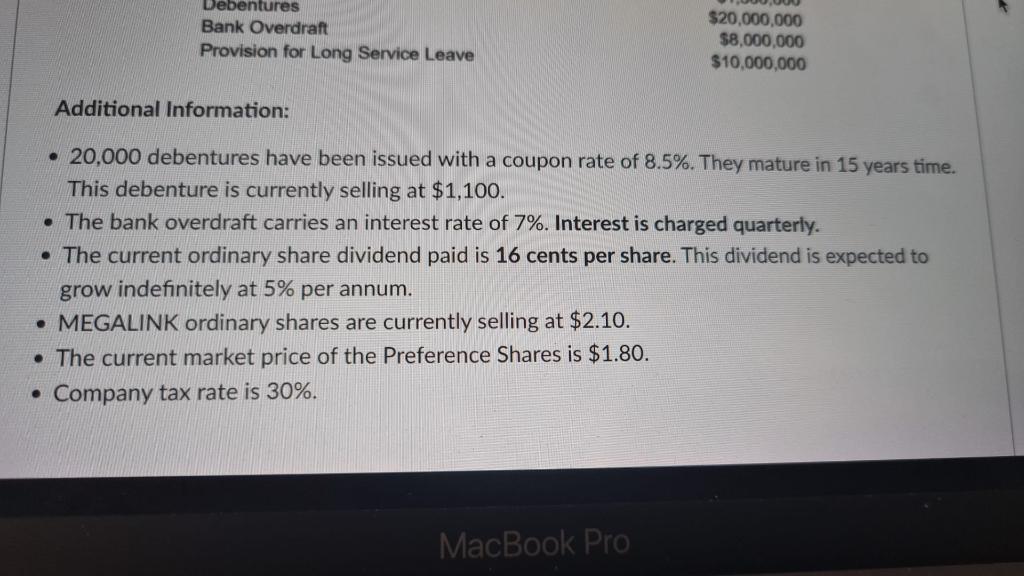

The following information relates to questions 25 and 26. MEGALINK Ltd, a major construction company, is planning to submit a quote to build the Quick City Tollway. However, the company finance manager is unsure of the required rate of return to use in her calculations. She has offered you a free G tag if you could provide information on the appropriate 'discount rate'. To help you with your calculations, she has tabled the following extracts from the company's latest Financial Statements. Selected financial data as at 30 June 2017 : Additional Information: - 20,000 debentures have been issued with a coupon rate of 8.5%. They mature in 15 years time. This debenture is currently selling at $1,100. - The bank overdraft carries an interest rate of 7%. Interest is charged quarterly. - The current ordinary share dividend paid is 16 cents per share. This dividend is expected to grow indefinitely at 5% per annum. - MEGALINK ordinary shares are currently selling at $2.10. - The current market price of the Preference Shares is $1.80. - Company tax rate is 30\%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started