Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Canadian company has an account payable for a new machinery that is due in six months for a total of 3 Million USD.

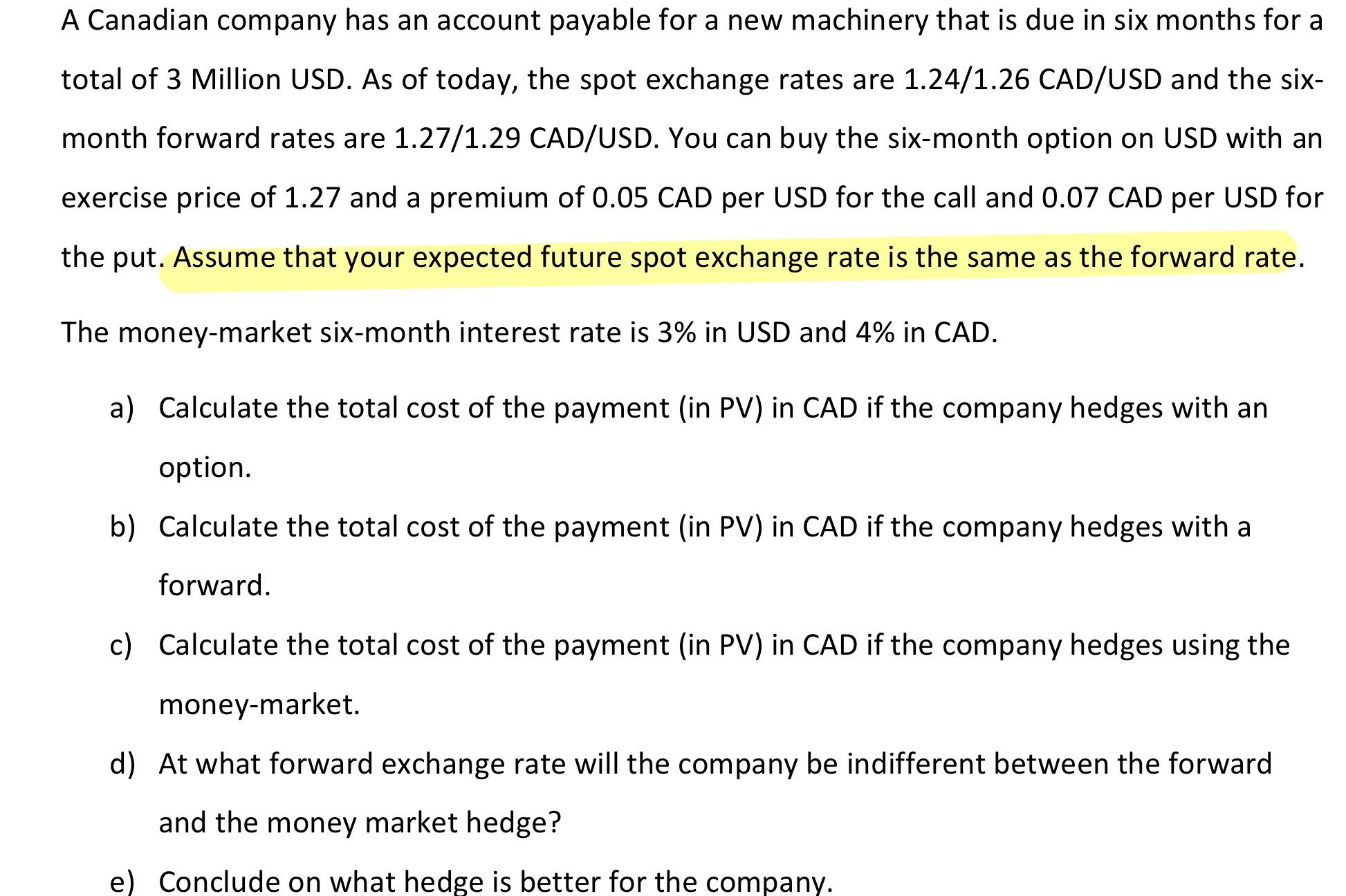

A Canadian company has an account payable for a new machinery that is due in six months for a total of 3 Million USD. As of today, the spot exchange rates are 1.24/1.26 CAD/USD and the six- month forward rates are 1.27/1.29 CAD/USD. You can buy the six-month option on USD with an exercise price of 1.27 and a premium of 0.05 CAD per USD for the call and 0.07 CAD per USD for the put. Assume that your expected future spot exchange rate is the same as the forward rate. The money-market six-month interest rate is 3% in USD and 4% in CAD. a) Calculate the total cost of the payment (in PV) in CAD if the company hedges with an option. b) Calculate the total cost of the payment (in PV) in CAD if the company hedges with a forward. c) Calculate the total cost of the payment (in PV) in CAD if the company hedges using the money-market. d) At what forward exchange rate will the company be indifferent between the forward and the money market hedge? e) Conclude on what hedge is better for the company.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started