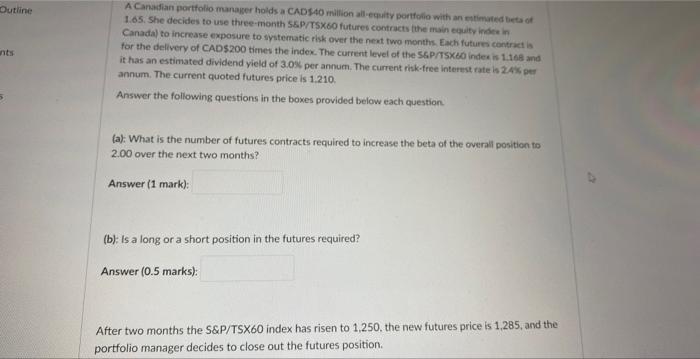

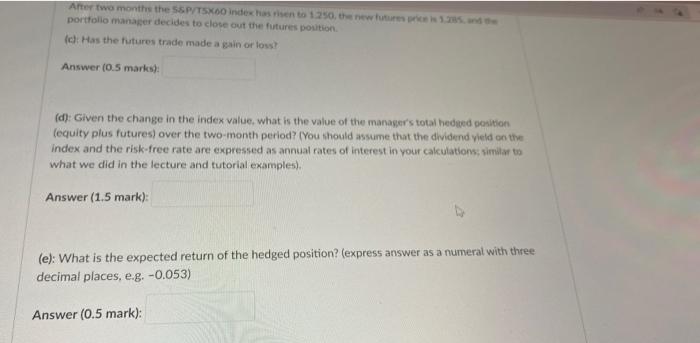

A Cansifian portfolio manager hoids a CAD\$4O wilion all equity pertfolio with an nelmated beta of 1.65. She decides to use three-month 5SP. TSX60 futures contracts fore main eauity lides in Canadal to increase exposare to systematic risk over the newt fwo months. Each futures contrict is for the delivery of CADS200 times the indek. The current level of the S5P/1SXQ0 indee in 1.16B and it has an estimated dividend yield of 3.05 per annum. The current risk-free interest rate is 2.44 pen annum. The current quoted futures price is 1.210. Answer the following questions in the boxes provided below each question. (a): What is the number of futures contracts required to increase the beta of the overail position to 2.00 over the next two months? Answer (1 mark): (b): Is a long or a short position in the futures required? Answer (0.5 marks): After two months the S\&P/TSX60 index has risen to 1,250, the new futures price is 1,285 , and the portfolio manager decides to close out the futures position. Dortfolio manaker decides to close out the futures poultion. fch: Has the futures trade made a gain of loss? Answer (0.5 marks): (d): Given the change in the index value, what is the value of the manaser's total hedged oosition (equity plus futures) over the two-month period? (You thould assume that the dividend yield on the index and the risk-free rate are expressed as annual rates of interest in your calculations; simbar 6 m what we did in the lecture and tutorial examples). Answer (1.5 mark): (e): What is the expected return of the hedged position? (express answer as a numeral with three decimal places, e.g. 0.053 ) Answer (0.5 mark): A Cansifian portfolio manager hoids a CAD\$4O wilion all equity pertfolio with an nelmated beta of 1.65. She decides to use three-month 5SP. TSX60 futures contracts fore main eauity lides in Canadal to increase exposare to systematic risk over the newt fwo months. Each futures contrict is for the delivery of CADS200 times the indek. The current level of the S5P/1SXQ0 indee in 1.16B and it has an estimated dividend yield of 3.05 per annum. The current risk-free interest rate is 2.44 pen annum. The current quoted futures price is 1.210. Answer the following questions in the boxes provided below each question. (a): What is the number of futures contracts required to increase the beta of the overail position to 2.00 over the next two months? Answer (1 mark): (b): Is a long or a short position in the futures required? Answer (0.5 marks): After two months the S\&P/TSX60 index has risen to 1,250, the new futures price is 1,285 , and the portfolio manager decides to close out the futures position. Dortfolio manaker decides to close out the futures poultion. fch: Has the futures trade made a gain of loss? Answer (0.5 marks): (d): Given the change in the index value, what is the value of the manaser's total hedged oosition (equity plus futures) over the two-month period? (You thould assume that the dividend yield on the index and the risk-free rate are expressed as annual rates of interest in your calculations; simbar 6 m what we did in the lecture and tutorial examples). Answer (1.5 mark): (e): What is the expected return of the hedged position? (express answer as a numeral with three decimal places, e.g. 0.053 ) Answer (0.5 mark)