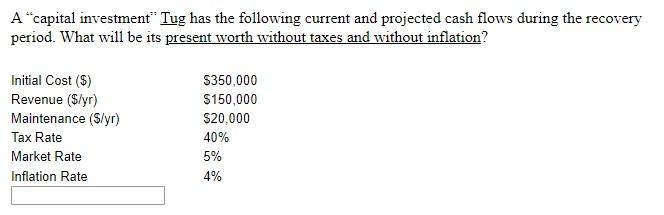

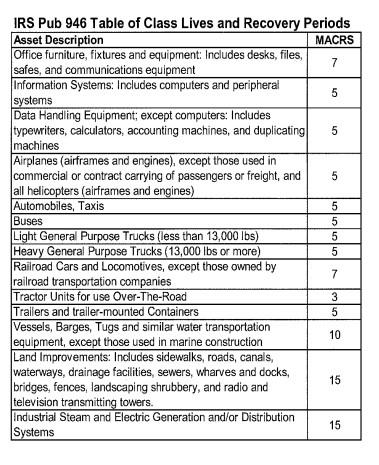

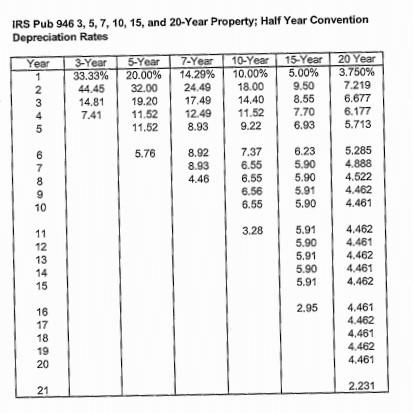

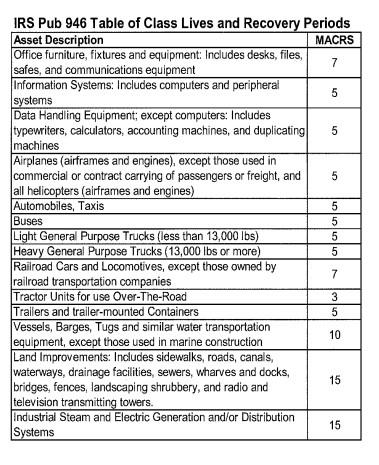

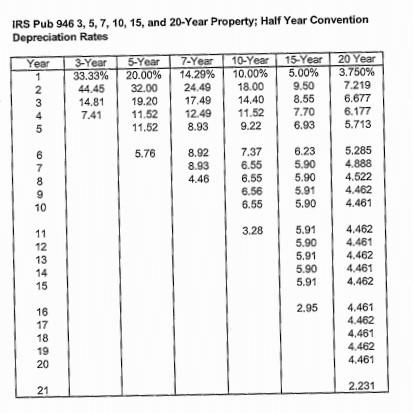

A "capital investment Tug has the following current and projected cash flows during the recovery period. What will be its present worth without taxes and without inflation? Initial Cost ($) Revenue ($/yr) Maintenance (s/yr) Tax Rate Market Rate Inflation Rate $350,000 $150,000 $20,000 40% 5% 4% 5 5 IRS Pub 946 Table of Class Lives and Recovery Periods Asset Description MACRS Office furniture, fixtures and equipment: Includes desks, files, 7 safes, and communications equipment Information Systems Includes computers and peripheral 5 systems Data Handling Equipment; except computers: Includes typewriters, calculators, accounting machines, and duplicating 5 machines Airplanes (airframes and engines), except those used in commercial or contract carrying of passengers or freight, and all helicopters (airframes and engines) Automobiles, Taxis 5 Buses Light General Purpose Trucks (less than 13,000 lbs) Heavy General Purpose Trucks (13,000 lbs or more) 5 Railroad Cars and Locomotives, except those owned by 7 railroad transportation companies Tractor Units for use Over-The-Road 3 Trailers and trailer-mounted Containers 5 Vessels, Barges, Tugs and similar water transportation 10 equipment, except those used in marine construction Land Improvements: Includes sidewalks, roads, canals, waterways, drainage facilities, sewers, wharves and docks, 15 bridges, fences, landscaping shrubbery, and radio and television transmitting towers. Industrial Steam and Electric Generation and/or Distribution 15 Systems non un ch | IRS Pub 946 3, 5, 7, 10, 15, and 20-Year Property; Half Year Convention Depreciation Rates Year WN - 3-Year 33.33% 44.45 14,81 7.41 5-Year 20.00% 32.00 19.20 11,52 11.52 7-Year 14.29% 24.49 17.49 12.49 8.93 10-Year 10.00% 18.00 14.40 11.52 9.22 15-Year 20 Year 5.00% 3.750% 9.50 7.219 8.55 6.677 7.70 6.177 6.93 5.713 4 5 5.76 6 7 8 9 10 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.285 4.888 4.522 4.462 4.461 5.90 3.28 11 12 13 14 15 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 2.95 16 17 18 19 20 4.461 4.462 4,461 4.462 4.461 21 2.231