Question

A car costs $30,000 without a down payment. Several banks are willing to lend you the $30,000 through a 72-month auto loan at the annual

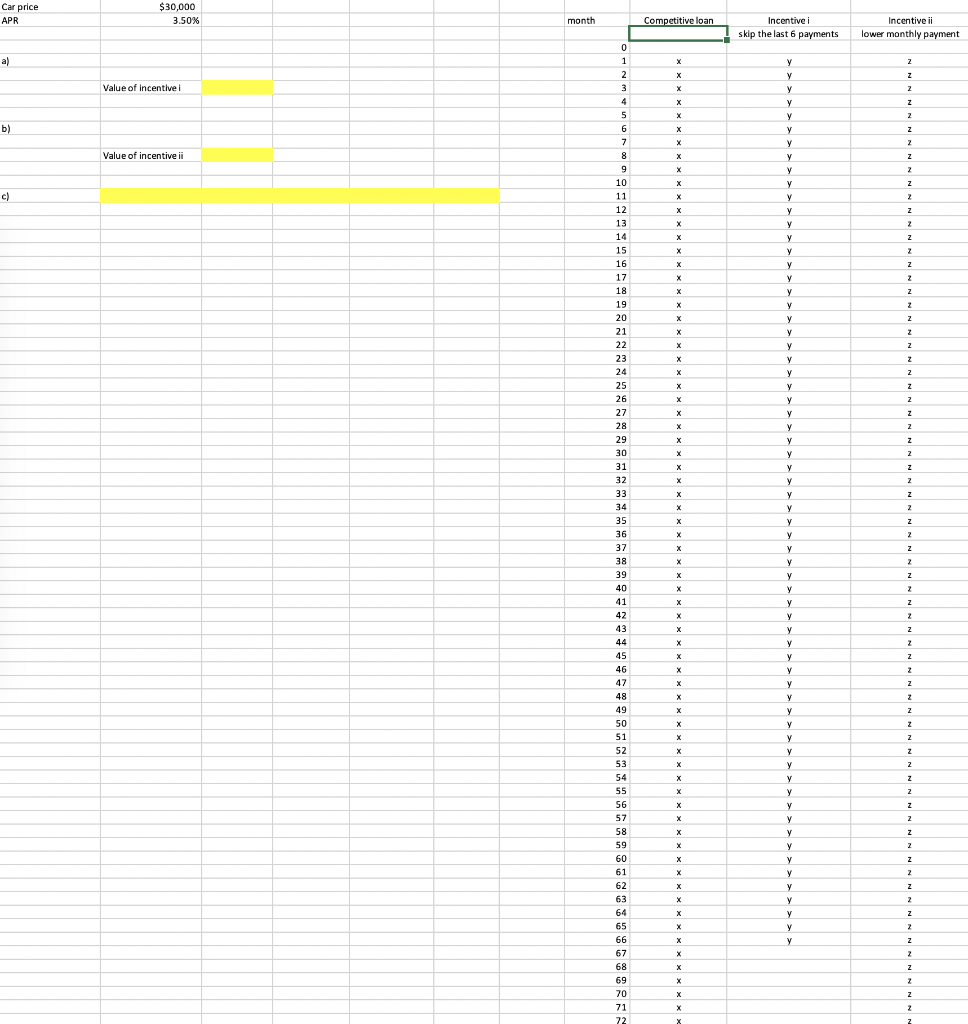

A car costs $30,000 without a down payment. Several banks are willing to lend you the $30,000 through a 72-month auto loan at the annual percentage rate (APR) of 3.5%. This 3.5% APR is the competitive nominal interest rate in the market. The loan requires monthly payments that begin one month after purchase, and the payments are constant in the next 72 months (6 years). Ignore any tax effects.

Given the current slowdown in the auto market, the dealer allows you to choose one of the following two incentives:

-

i) You can borrow from any bank. The dealer covers the last 6 monthly payments for you. In other words you are only responsible for the payments in the first 5.5 years.

-

ii) You can borrow from its partner bank through a 72-month auto loan, at a 50$ discount on each of your monthly payment. In other words, the dealer pays 50$ for you every month.

Expand your cell to show 4 decimal places (e.g., $12.4567).

-

What is the present value (in dollars today) of the payments under incentive i?

-

What is the present value (in dollars today) of the payments under incentive ii?

-

What incentive offer should you choose? Why?

Hint:

-

You should use the competitive market interest rate to discount any cash flow stream.

-

The Excel template contains the payment schedule of each option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started