Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a case brief is needed for the case Inter-Tel Technologies v. Linn Station on pages 648-49 of the text. Separate out and label each of

a case brief is needed for the case Inter-Tel Technologies v. Linn Station on pages 648-49 of the text. Separate out and label each of the seven parts of the case brief and then correctly identify the portions of the Inter-Tel case that fit into each individual case brief section.

Procedural Fact

Facts relevant to the legal issue

Rule

Issue

Reasoning and policy that support Holding

Holding

Disposition

After the case brief, in the same document, please give your opinion on whether you agree or disagree with the court's decision and why

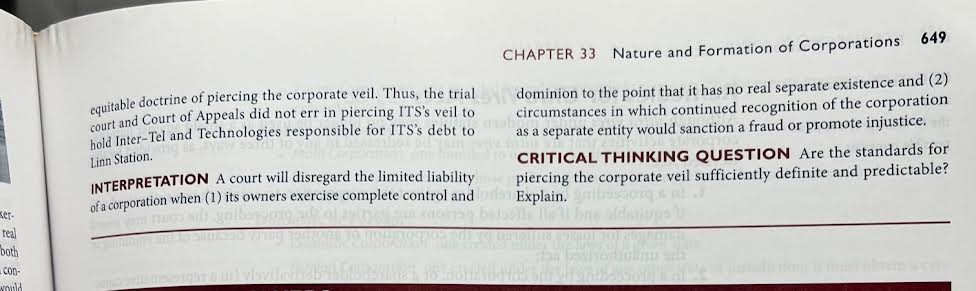

PART VII Business Associations FACTS Integrated Telecom Services Corp. (ITS) was acquired by and becane a wholly owned subsidiary of Inter-Tel Technologies, Inc. (Technologies), which is fura is a wholly-owned subsidiary of Inter-Tel, Inc. (Inter-Tel). Inter-Tel designs, nasufactures, sells, and services telecommanications systems through its subsidiaries and affiliates. Technologies is the retail division of Inter-Tel. ITS was the company's first retal branch in Ken. tucky, selling Inter-Tel's telecommunications products from an office balding it leased from Lian Station Properties, 1.LC thinn Station). After IIS was acequired by Technologies, 1TS was not permit. ted to maintain a bank account, hold any finds, or pay any bills. All of ITS s regional offices were transformed from independent dealers of communications equipment into direct szles \"branches\" of Inter-Tel. ITS employees became employees of Inter-Tel and were paid by Inter-Tel. When a customer purchased a telecommunications system from ITS, the payment went directly into a depository account controlled by Inter-Tel. Inter-Tel pasd all the vendors who provided ITS with goods and services. All of ITS's inventory was prowided by another Inter Tel subsidiary Inter-Tel paid ITS's rent for the Linn Station Road property from the time Technologies acquired ITS until ITS abandoned the premises in 2002. Inter-Tel and Technologies were the named insareds listed on the property damage insurance for ITSs premises on linn Station Road. ITS did not hold an annual board of directors or shareholders meeting from 1999 through 2002 . Nor did Technologies hold an annual board of directors or shareholders meeting from 1998 through 2002. During the four-year period from 1999 through 2002, ITS and Technologies had identical boards of directors and the President and CEO of Inter-Tel served on the boards of ITS, Technologies, and later-Tel. Although all inter-Tel business conducted is Kentucky since 2001 was performed by ITS in its own name, inter-Tel. Technologies, and another Inter-Tel subsidiary filed sales and use tax returns with Kentucky in 2001, 2002, and 2003 On June 19, 2002, Iina Station filed suit against ITS, seeking damages for failure to repair and maintain the ptemises and for unpaid rent. ITS failed to respond, and on August 12, 2002, a default judgrnent was entered against ITS for \\( \\$ 332,900 \\) plus interest. After repeated, unsuccessful attempts to satisfy the judgment against ITS, on June 20, 2003, Linn Station sued ITS, Technol ogies, and Inter-Tel to pierce the corporate veil and establish Inter-Tel and Technologies' liability for the judgment against ITS. The trial court granted summary judgment to Linn Station, and the Court of Appeals affirmed. Technologies and Inter-Tel appealed. DECISION The decision of the Court of Appeals is affirmed, and the case is remanded to the trial court for entry of judgment against Inter-Tel and Technologies. OPINION Piercing the corpozate veil is an equitable doctrine invoked by courts to allow a creditor recourse against the shareholders of a corporation. In short, the limited liability, which is the hallmark of a corporation, is disregarded and the debt of the pierced entity becomes enforceable against those who have then. (1) the element of demination and (2) elecamstances in whis tow tinued recognition of the corporation \\( 2 s \\) a separate tatity wos. corporate veil doctrine in the context of an inerealroly com mon scenariox a creditor's attempt to eolilect on detse incuried by, wholly-owned subsidiary where the subsidlary has been deptined of all income and rendered asset-less by the in this case also grandparent) corporation The following factors are considered in applying the abler tyo test: (1) inadequate capital ization, (2) failure to issue stock, (3) fig). ure to observe corparate formalities, (4) sonpaymens of dividesh (5) insolvency of the debtor corporation, (6) nonfunctioning of the other officers or directors, (7) absence of corponate tecords, (t) commingliag of funds, (9) diversion of assets from the corpocision by or to a stockholder of other person or entity to the detrionerm creditors. (10) failure to maintain arm's-length relationships amper related entities, and (11) whether the corporation is a mete force for the operation of the dominant stockholders. The alter ego test language employed by mast jutisdictista expressly refers to \"promoting injustice\" and, indeed, prerciap, should not be limited to instances where all the elements of 260 . mon-law fraud claim can be established. The injustice, bowever, must be something beyond the mere inability to collect a debt fore the corporation. The trial court and Court of Appeals were correct in condud. ing the undisputed facts of this case justified piercing ITSs cae. porate veil. IT'S lost all semblance of separate corporate existente and through the joint acts of Technologies and Inter-Tel was fetdered income-tess and asset-less. Their diversion of MS's copperste income and transfer of ITS's corporate assets for their own bencit. provides the extra \"Injustice, something more than simply a ced. itor's inability to collect is debt from ITS. The alter ego test is this satisfied. Technologies was \100 owned and controlled by Inter-iet and the two corporations acted completely in concet in dominat ing ITS and extracting any thing of value from ITS. It is entitely appropriate to look at the larger picture of the conduct of InterTel and Technologies as opposed to only the individual actions of the parent entity. To do otherwise would render the equita. ble piercing doctrine hopelessly inadequate, if not meaningles in some cases, based on the sheer number of business entities involved. ITS had grossly inadequate capital for day-to-day operation because it had no funds at all, literally nothing of its own. Inte 'Tel paid the cmployees' salaries and other expenses of ITS. 1 had no assets of its own. ITS simply had no independent finan existence. Both Technologies and Inter-Tel used the Linn tion lease premises and any other assets previously held by solely for the benefit of Inter-Tel, not for ITS's benefit. Fin the formal legal requirements of ITS were not observed. case is clearly within the boundaries of proper application CHAPTER 33 Nature and Formation of Corporations 649 equitable doctrine of piercing the corporate veil. Thus, the trial court and Court of Appeals did not err in piercing ITS's veil to hold Inter-Tel and Technologies responsible for ITS's debt to Linn Station. INTERPRETATION A court will disregard the limited liability of a corporation when (1) its owners exercise complete control and dominion to the point that it has no real separate existence and (2) circumstances in which continued recognition of the corporation as a separate entity would sanction a fraud or promote injustice. CRITICAL THINKING QUESTION Are the standards for piercing the corporate veil sufficiently definite and predictable? Explain

PART VII Business Associations FACTS Integrated Telecom Services Corp. (ITS) was acquired by and becane a wholly owned subsidiary of Inter-Tel Technologies, Inc. (Technologies), which is fura is a wholly-owned subsidiary of Inter-Tel, Inc. (Inter-Tel). Inter-Tel designs, nasufactures, sells, and services telecommanications systems through its subsidiaries and affiliates. Technologies is the retail division of Inter-Tel. ITS was the company's first retal branch in Ken. tucky, selling Inter-Tel's telecommunications products from an office balding it leased from Lian Station Properties, 1.LC thinn Station). After IIS was acequired by Technologies, 1TS was not permit. ted to maintain a bank account, hold any finds, or pay any bills. All of ITS s regional offices were transformed from independent dealers of communications equipment into direct szles \"branches\" of Inter-Tel. ITS employees became employees of Inter-Tel and were paid by Inter-Tel. When a customer purchased a telecommunications system from ITS, the payment went directly into a depository account controlled by Inter-Tel. Inter-Tel pasd all the vendors who provided ITS with goods and services. All of ITS's inventory was prowided by another Inter Tel subsidiary Inter-Tel paid ITS's rent for the Linn Station Road property from the time Technologies acquired ITS until ITS abandoned the premises in 2002. Inter-Tel and Technologies were the named insareds listed on the property damage insurance for ITSs premises on linn Station Road. ITS did not hold an annual board of directors or shareholders meeting from 1999 through 2002 . Nor did Technologies hold an annual board of directors or shareholders meeting from 1998 through 2002. During the four-year period from 1999 through 2002, ITS and Technologies had identical boards of directors and the President and CEO of Inter-Tel served on the boards of ITS, Technologies, and later-Tel. Although all inter-Tel business conducted is Kentucky since 2001 was performed by ITS in its own name, inter-Tel. Technologies, and another Inter-Tel subsidiary filed sales and use tax returns with Kentucky in 2001, 2002, and 2003 On June 19, 2002, Iina Station filed suit against ITS, seeking damages for failure to repair and maintain the ptemises and for unpaid rent. ITS failed to respond, and on August 12, 2002, a default judgrnent was entered against ITS for \\( \\$ 332,900 \\) plus interest. After repeated, unsuccessful attempts to satisfy the judgment against ITS, on June 20, 2003, Linn Station sued ITS, Technol ogies, and Inter-Tel to pierce the corporate veil and establish Inter-Tel and Technologies' liability for the judgment against ITS. The trial court granted summary judgment to Linn Station, and the Court of Appeals affirmed. Technologies and Inter-Tel appealed. DECISION The decision of the Court of Appeals is affirmed, and the case is remanded to the trial court for entry of judgment against Inter-Tel and Technologies. OPINION Piercing the corpozate veil is an equitable doctrine invoked by courts to allow a creditor recourse against the shareholders of a corporation. In short, the limited liability, which is the hallmark of a corporation, is disregarded and the debt of the pierced entity becomes enforceable against those who have then. (1) the element of demination and (2) elecamstances in whis tow tinued recognition of the corporation \\( 2 s \\) a separate tatity wos. corporate veil doctrine in the context of an inerealroly com mon scenariox a creditor's attempt to eolilect on detse incuried by, wholly-owned subsidiary where the subsidlary has been deptined of all income and rendered asset-less by the in this case also grandparent) corporation The following factors are considered in applying the abler tyo test: (1) inadequate capital ization, (2) failure to issue stock, (3) fig). ure to observe corparate formalities, (4) sonpaymens of dividesh (5) insolvency of the debtor corporation, (6) nonfunctioning of the other officers or directors, (7) absence of corponate tecords, (t) commingliag of funds, (9) diversion of assets from the corpocision by or to a stockholder of other person or entity to the detrionerm creditors. (10) failure to maintain arm's-length relationships amper related entities, and (11) whether the corporation is a mete force for the operation of the dominant stockholders. The alter ego test language employed by mast jutisdictista expressly refers to \"promoting injustice\" and, indeed, prerciap, should not be limited to instances where all the elements of 260 . mon-law fraud claim can be established. The injustice, bowever, must be something beyond the mere inability to collect a debt fore the corporation. The trial court and Court of Appeals were correct in condud. ing the undisputed facts of this case justified piercing ITSs cae. porate veil. IT'S lost all semblance of separate corporate existente and through the joint acts of Technologies and Inter-Tel was fetdered income-tess and asset-less. Their diversion of MS's copperste income and transfer of ITS's corporate assets for their own bencit. provides the extra \"Injustice, something more than simply a ced. itor's inability to collect is debt from ITS. The alter ego test is this satisfied. Technologies was \100 owned and controlled by Inter-iet and the two corporations acted completely in concet in dominat ing ITS and extracting any thing of value from ITS. It is entitely appropriate to look at the larger picture of the conduct of InterTel and Technologies as opposed to only the individual actions of the parent entity. To do otherwise would render the equita. ble piercing doctrine hopelessly inadequate, if not meaningles in some cases, based on the sheer number of business entities involved. ITS had grossly inadequate capital for day-to-day operation because it had no funds at all, literally nothing of its own. Inte 'Tel paid the cmployees' salaries and other expenses of ITS. 1 had no assets of its own. ITS simply had no independent finan existence. Both Technologies and Inter-Tel used the Linn tion lease premises and any other assets previously held by solely for the benefit of Inter-Tel, not for ITS's benefit. Fin the formal legal requirements of ITS were not observed. case is clearly within the boundaries of proper application CHAPTER 33 Nature and Formation of Corporations 649 equitable doctrine of piercing the corporate veil. Thus, the trial court and Court of Appeals did not err in piercing ITS's veil to hold Inter-Tel and Technologies responsible for ITS's debt to Linn Station. INTERPRETATION A court will disregard the limited liability of a corporation when (1) its owners exercise complete control and dominion to the point that it has no real separate existence and (2) circumstances in which continued recognition of the corporation as a separate entity would sanction a fraud or promote injustice. CRITICAL THINKING QUESTION Are the standards for piercing the corporate veil sufficiently definite and predictable? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started