Question

A Case Study of Paying Extra Principal on a Mortgage Great Idea or Height of Foolishness? Before you begin: Review the loan basics in unit

A Case Study of Paying Extra Principal on a Mortgage

Great Idea or Height of Foolishness?

Before you begin: Review the loan basics in unit 4D of your textbook regarding the payment formula and the roles that interest and principal play in an amortization. Then carefully read the following pieces of advice written by two different nationally syndicated financial columnists (Sharon Epperson and Bruce Williams) regarding paying extra principal on a mortgage:

- Sharon Epperson from Money Smart of USAWeekend.com

Pay mortgage early?

Q: My husband and I are 49 and 48 and are paying extra on our mortgage to have it paid off by the time we're 56. My friend says that will hurt us on our taxes; my husband says its better to save the money in interest now than to worry about a mortgage tax deduction later. What's your take? S.R. Sheboygan, Wis.

A: You married a smart man. Paying off your mortgage early will save thousands of dollars, and you'll get a reliable rate of return on your investment (you save the interest you would have paid on your mortgage). Yes, you'll lose the mortgage interest tax deduction when that happens. But if you're in the 25% tax bracket, for example, you'd only get back a quarter for each $1 in interest you pay --not such a big break. If you're debt-free and maxing out your 401(k) and IRAs, which offer tax breaks, paying up early isn't a bad idea.

Source: http://www.usaweekend.com/08_issues/080511/080511thinksmart-mortgage-broadwaytickets.html (Posted May 11, 2008).

- Bruce Williams from Smart Money

DEAR BRUCE: I have a friend who says that you often advise that it is not wise to pay off a mortgage in advance. Could you tell me in one paragraph why this is a bad idea? It seems to me that being debt-free is a goal worth working toward. L.H. Syracuse, N.Y.

DEAR L.H.: In a nutshell, the cheapest money that you can borrow is against a first mortgage on your primary residence. Generally speaking, its in a sub-7 percent range today. It is not too difficult to earn substantially more than that in the marketplace, so why pay off the loan early and settle for an effective return of below 7 percent? You could invest this money elsewhere at a far better return. In addition, if you itemize the interest that you are paying on the home loan, it becomes a deductible item. To me, its a no-brainer. For younger people to pay off a mortgage early is, in my opinion, the height

of foolishness. When you get into your 60s and the idea of having your home paid for out distances the need for return, I have no objection.

Source: Should 35-year-old save for down payment or retirement? Post Register, July 19, 2001.

Download Spreadsheet: Download or ask your instructor for the file Activity 5 A Case Study of Paying Extra Principal on a Mortgage Student Financial Toolboxes which provides you a collection of mini financial calculators anda worksheet on the role of the negative.

Procedure:

In our brief case study, we assume the Thomas and Jefferson families have identical mortgages (30-year term, fixed-rate 6% APR, and a loan amount of $175,000). The Thomas family will not pay extra but the Jeffersons will. Follow the steps below prior to your analysis.

- Using the Payment mini calculator of the Financial Toolboxes spreadsheet, calculate the mortgage payment (the same for both families).

- Assume that the Thomass will make only the required mortgage payment. The Jeffersons, however, would like to pay off their loan early. They decide to make the equivalent of an extra payment each year by adding an extra 1/12 of the payment to the required amount.

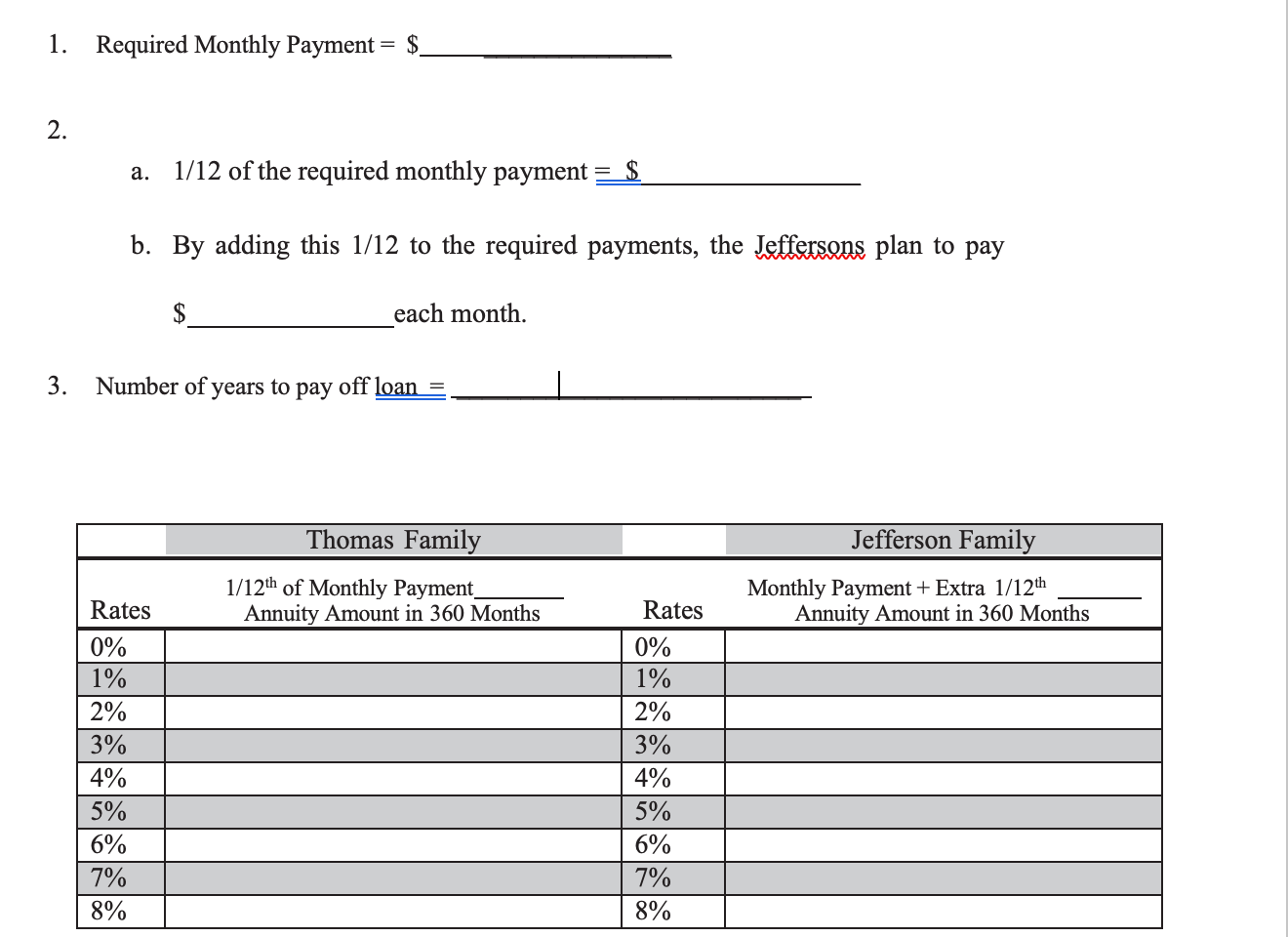

Calculate the following to find what they plan to pay each month:

- 1/12 of the required monthly payment

- Jeffersons monthly payment found by adding this 1/12 to the required payments

- The Thomass will take the full 30 years to pay off their loan, since they are making only the required payments. The Jeffersons extra payment amount, on the other hand, will allow them to pay off their loan more rapidly. Use the Years mini financial calculator of the Financial Toolbox spreadsheet to calculate the approximate number of years (nearest 10th) it would take the Jeffersons to pay off theirloan.

Analysis: For the Thomas Family: assume that they could afford to make the same extra payment as the Jeffersons, but instead they decide to put that money (#2a. from Procedures above) into a savings plan called an annuity. Use the Future Value mini financial calculator of the Financial Toolbox spreadsheet to calculate how much they will have in their savings plan at the end of 30 years at the various interest rates. Write your answers (to the nearest dollar) in the appropriate cells of the table on the student worksheet.

For the Jefferson Family: assume that they save nothing until their loan is paid off, but then after their debt is paid, they start putting their full monthly payment and 1/12 (#2b. from Procedures above) into a savings plan. The time they invest is equal to 30 years minus the number of years needed to pay off the loan (#3 from Procedures above). Use the Future Value mini financial calculator to calculate how much they will have in their savings plan at the various interest rates. Write your answers (to the nearest dollar) in the appropriate cells of the table on the student worksheet.

| Thomas Family | Jefferson Family | ||

| 1/12th of Monthly Payment Monthly Payment + Extra 1/12th Rates Annuity Amount in 30 Years Rates Annuity Amount in 30 Years | |||

| 0% |

| 0% |

|

| 1% |

| 1% |

|

| 2% |

| 2% |

|

| 3% |

| 3% |

|

| 4% |

| 4% |

|

| 5% |

| 5% |

|

| 6% |

| 6% |

|

| 7% |

| 7% |

|

| 8% |

| 8% |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started