Question

A Case Study On Monday, September 13, 2020 Mr. Michael Gordon, Vice President of operations, asked the Controller William Cooper, the Sales Manager Charles Myers,

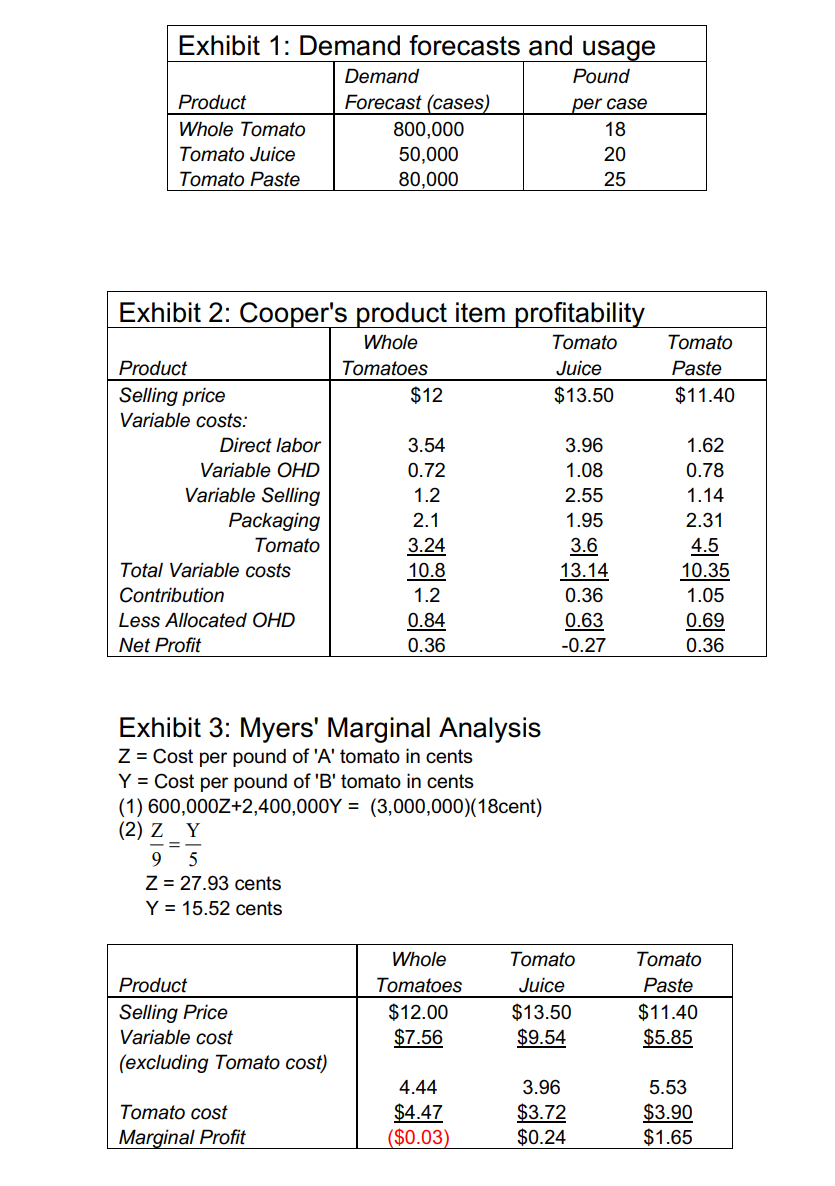

A Case Study On Monday, September 13, 2020 Mr. Michael Gordon, Vice President of operations, asked the Controller William Cooper, the Sales Manager Charles Myers, and Dan Tucker the Production Manager to meet with him to discuss the amount of tomato products to pack that season. The tomato crop, which had been purchased at planting, was beginning to arrive at the cannery, and packing operations would have to be started by the following Monday. Red Brand Canners (RBC) was a medium-size company that canned and distributed a variety of fruit and vegetable products under private brands in the western states. Cooper and Myers were the first to arrive in Mr. Gordons office. The production manager came in a few minutes later and apologized for being late. He had to pick up produce inspections latest quality estimate of the incoming tomatoes. It was estimated about 20% of the crop was grade A quality and the remaining portion of the 3 million pound crop was grade B. Gordon asked Myers about the demand for tomato products for the coming year. Myers replied that they could sell all of the whole canned tomatoes they could produce, but he expected though a limited demand for tomato juice and tomato paste. He then passed around the latest demand forecasts, which is shown in Exhibit 1. He reminded the group that the selling price has been set in light of the long-term marketing strategy of the company, and potential sales have been forecasted at these prices. Bill Cooper, after looking at Myers estimates of demand said that it looked like the company should do quite well on the tomato crop this year. With the new accounting system that had been set up, he has been able to compute the contribution for each product, and according to his analysis the incremental profit on the whole tomatoes was greater than for any other tomato products. In May, after RBC had signed contracts agreeing to purchase the growers production at an average delivered price of $0.18 per pound, Cooper had computed the tomato products contributions (see Exhibit 2). Dan Tucker brought to Coopers attention that although there was ample production capacity, it was impossible to produce all whole tomatoes because too small portion of the tomato crop was A quality. RBC used a numerical scaling to record the quality of both raw produce and prepared products. This scale ran from 0 to 10, with the higher number representing better quality. Rating tomatoes according to this scale, grade A tomatoes averaged 9 points per pound and grade B tomatoes averaged 5 points per pound. Tucker noted that the average input quality for canned whole tomatoes was 8 points, and for juice 6 points per pound. Paste could be made entirely from grade B tomatoes. This meant that whole tomato production was limited to 800,000 pounds. Gordon stated that this was not a real limitation. He had been recently solicited to purchase 80,000 pounds of grade A tomatoes at $0.085 per pound and at that time he turned down the offer. He felt, however, that the tomatoes were still available. Myers, who had been doing some calculations, said that although he agreed that the company should do quite well this year it would not be by canning whole tomatoes. It seemed to him that the tomato cost should be allocated based on quantity and quality, rather than by quantity only as Cooper had done. Therefore, he re-computed the marginal profit on this basis (Exhibit 3). From his result, RBC should use 2,000,000 pounds of the grade B tomatoes for paste, and the remaining 400,000 pounds of grade B along with all of the 600,000 pounds of grade A tomatoes for juice.

Assignments Answer the following general questions: 1. Why does Tucker state that the whole tomato production is limited to 800,000 pounds? (i.e. where does the number 800,000 come from?) 2. What is wrong with Coopers suggestion to use the entire crop for whole tomatoes? 3. How does Myers reach the conclusion that the company should use 2,000,000 pounds of grade B tomatoes for paste and the rest of the grade B and grade A tomatoes to produce juice? What is wrong with Myers reasoning? 4. Myers calculated the tomato cost for Whole Tomato cans to be $4.47 per can (see Exhibit 3). Explain how? This figure is a bit rounded (from 4.469). Set up a Linear Optimization (LO) model and solve it with Solver: 5. Without including the possibility of the additional purchases suggested by Gordon, formulate as an LO the problem of determining the optimal canning policy. Use the appropriate parameters from one of the exhibits shown below. 6. Answer the following questions about the optimal solution: a. How much of each tomato grade will be used for the production of each product? b. How much of each product is produced? c. What is the actual average quality per pound of the whole tomato and the juice? d. What is the net profit obtained after netting out the cost of the crop? Model Modifications: 7. How should your model be modified to include the possibility of the additional purchases suggested by Gordon? Find at which cost per pound it becomes optimal to purchase additional amount of grade A tomatoes. Assume the additional amount available is 80,000 pound. Solve the new model and state the optimal solution. 8. Suppose unused tomatoes could be sold at 18 cents per pound. Change your formulation and resolve.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started