Answered step by step

Verified Expert Solution

Question

1 Approved Answer

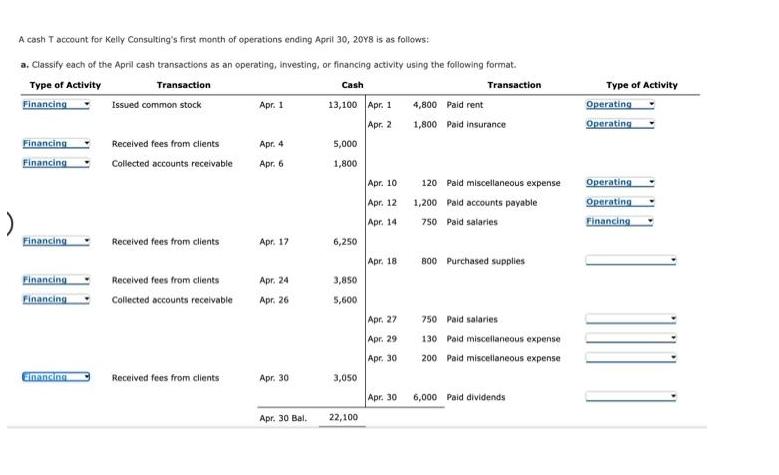

A cash T account for Kelly Consulting's first month of operations ending April 30, 2018 is as follows: a. Classify each of the April

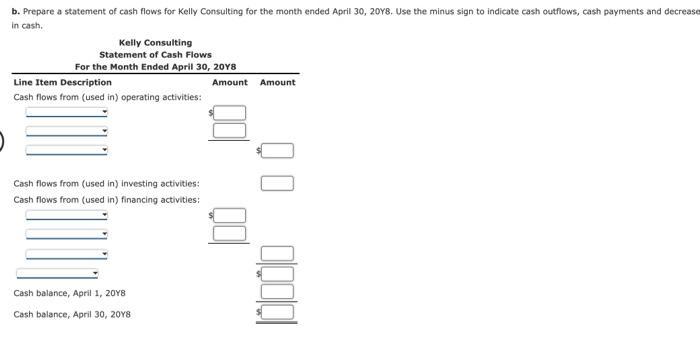

A cash T account for Kelly Consulting's first month of operations ending April 30, 2018 is as follows: a. Classify each of the April cash transactions as an operating, investing, or financing activity using the following format. Type of Activity Transaction Cash Financing Issued common stock Financing Financing Financing Financing Financing Einancing Received fees from clients Collected accounts receivable Received fees from clients Received fees from clients Collected accounts receivable Received fees from clients Apr. 1 Apr. 4 Apr. 6 Apr. 17 Apr. 24 Apr. 26 Apr. 30 Apr. 30 Bal. 13,100 Apr. 1 Apr. 2 5,000 1,800 6,250 3,850 5,600 3,050 22,100 Apr. 10 Apr. 12 Apr. 14 Apr. 18 Apr. 27 Apr. 29 Apr. 30 Apr. 30 Transaction 4,800 Paid rent 1,800 Paid insurance 120 Paid miscellaneous expense 1,200 Paid accounts payable 750 Paid salaries 800 Purchased supplies 750 Paid salaries 130 Paid miscellaneous expense 200 Paid miscellaneous expense 6,000 Paid dividends Type of Activity Operating Operating Operating Operating Financing b. Prepare a statement of cash flows for Kelly Consulting for the month ended April 30, 2018. Use the minus sign to indicate cash outflows, cash payments and decrease in cash. Kelly Consulting Statement of Cash Flows For the Month Ended April 30, 2018 Line Item Description Amount Cash flows from (used in) operating activities: Cash flows from (used in) investing activities: Cash flows from (used in) financing activities: Cash balance, April 1, 2018 Cash balance, April 30, 2018 Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Cash received from clients 5000 1800 6250 38505600 3050 25550 2 Cash paid to suppliers and operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started