Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PERCH FALLS MINRO HOCKEY ASSOCIATION FUND Operating Capital Endowment Cash Inflows: Government grant for operating Costs $162 Government grant for hockey arena $350 Corporate donations

![]()

PERCH FALLS MINRO HOCKEY ASSOCIATION | |||||||

FUND | |||||||

Operating | Capital | Endowment | |||||

Cash Inflows: | |||||||

Government grant for operating Costs | $162 | ||||||

Government grant for hockey arena | $350 | ||||||

Corporate donations for hockey arena | 250 | ||||||

Registration fees | 50 | ||||||

Contribution for tournaments | $95.0 | ||||||

Rental of hockey arena | 160 | ||||||

Interest Received | 5.7 | ||||||

372 | 600 | 100.7 | |||||

Cash Outflows: | |||||||

Operating expenses | 356 | ||||||

Construction of hockey arena | 600 | ||||||

Purchase of corporate bonds | 95.0 | ||||||

Travel costs for tournament | 5.7 | ||||||

356 | 600 | 100.70 | |||||

Cash, end of year | $16 | $0 | $0.0 | ||||

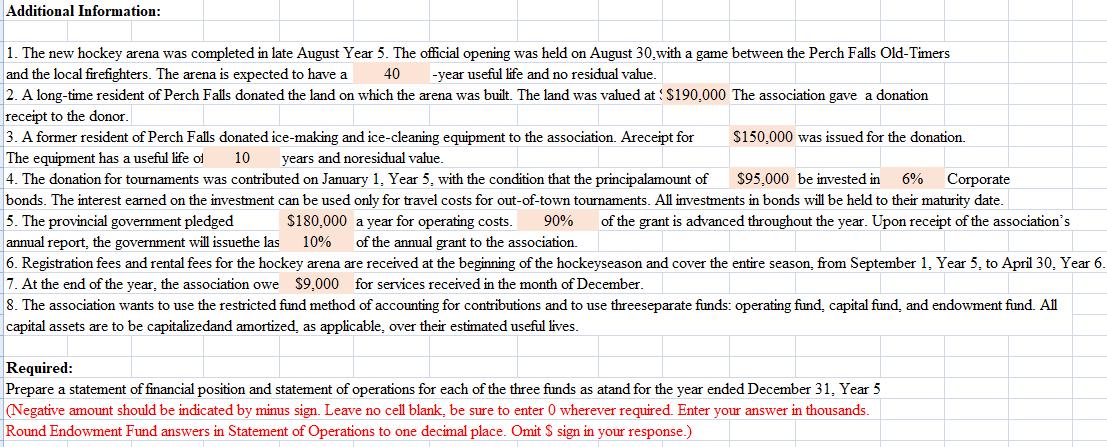

The Perch Falls Minor Hockey Association was established in Perch Falls in January, Year 5. Its mandate is to promote recreational hockey in the small community of Perch Falls. With the support of the provincial government, local business people, and many individuals, the association raised sufficient funds to build an indoor hockey arena, and it also established an endowment fund for paying travel costs to tournaments on an annual basis. The following schedule summarizes the cash flows for the year ended December 31, Year 5. Additional Information: 1. The new hockey arena was completed in late August Year 5. The official opening was held on August 30, with a game between the Perch Falls Old-Timers and the local firefighters. The arena is expected to have a 40 -year useful life and no residual value. 2. A long-time resident of Perch Falls donated the land on which the arena was built. The land was valued at $190,000 The association gave a donation receipt to the donor. 3. A former resident of Perch Falls donated ice-making and ice-cleaning equipment to the association. Areceipt for The equipment has a useful life of 10 years and noresidual value. $95,000 be invested in 6% Corporate 4. The donation for tournaments was contributed on January 1, Year 5, with the condition that the principalamount of bonds. The interest earned on the investment can be used only for travel costs for out-of-town tournaments. All investments in bonds will be held to their maturity date. 5. The provincial government pledged $180,000 a year for operating costs. 90% of the grant is advanced throughout the year. Upon receipt of the association s annual report, the government will issuethe las 10% of the annual grant to the association. 6. Registration fees and rental fees for the hockey arena are received at the beginning of the hockeyseason and cover the entire season, from September 1, Year 5, to April 30, Year 6. 7. At the end of the year, the association owe $9,000 for services received in the month of December. 8. The association wants to use the restricted fund method of accounting for contributions and to use threeseparate funds: operating fund, capital fund, and endowment fund. All capital assets are to be capitalizedand amortized, as applicable, over their estimated useful lives. $150,000 was issued for the donation. Required: Prepare a statement of financial position and statement of operations for each of the three funds as atand for the year ended December 31, Year 5 (Negative amount should be indicated by minus sign. Leave no cell blank, be sure to enter 0 wherever required. Enter your answer in thousands. Round Endowment Fund answers in Statement of Operations to one decimal place. Omit S sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Perch Falls Minor Hockey Association Statement of Operations Operating Capital Endowment Fund ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

626242be88e7f_100922.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started