On January 1, Year 4, Goodkey Co. acquired all of the common shares of Jingya. The condensed

Question:

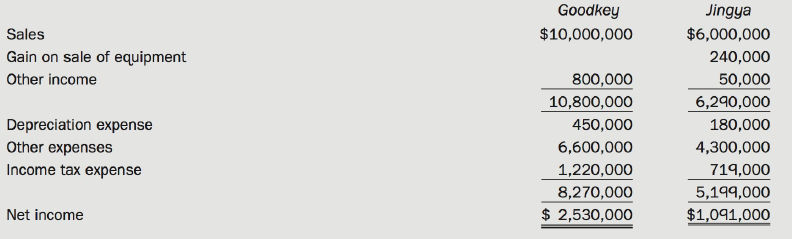

On January 1, Year 4, Goodkey Co. acquired all of the common shares of Jingya. The condensed income statements for the two companies for January Year 5, were as follows:

The following transactions occurred in January, Year 5, and are properly reflected in the income statements above:

• On January 1, Year 5, Jingya sold equipment to Goodkey for $1,000,000 and reported a gain of $240,000. On this date, the equipment had a remaining useful life of four years.

• On January 31, Year 5, Jingya paid a dividend of $600,000.

Goodkey uses the cost method to account for its investment in Jingya. Both companies pay income tax at the rate of 40%.

Required:

(a) Prepare a consolidated income statement for January Year 5.

(b) Now assume that Goodkey uses the equity method to account for its investment in Jingya. What accounts would change on the three income statements (Goodkey, Jingya, and consolidated) in January Year 5, and what would be the account balances?

(c) Now assume that Goodkey only owns 80% of the common shares of Jingya and uses the cost method to account for its investment in Jingya. What accounts would change (as compared to part (a)) on the three income statements (Goodkey, Jingya, and consolidated) in January Year 5, and what would be the account balances?

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell