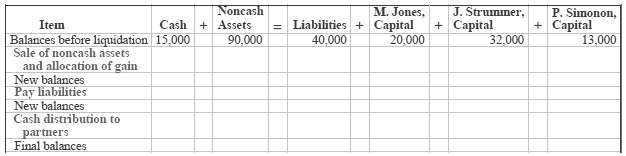

The partners of Clash Company have decided to liquidate their business. Noncash assets were sold for $125,000.

Question:

The partners of Clash Company have decided to liquidate their business. Noncash assets were sold for $125,000. The income ratios of the partners M. Jones, J. Strummer, and P. Simonon are 3:2:3, respectively. Complete the following schedule of cash payments for ClashCompany

Transcribed Image Text:

M. Jones. J. Strummer, P. Simonon, Noncash + Assets 90,000 = Liabilities + Capital 40,000 + Capital Cash + Capital Item 20.000 Balances before liquidation 15,000 Sale of noncash assets 13,000 32,000 and allocation of gain New balances Pay liabilities New balances Cash distribution to partners Final balances

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

Item Cash Noncash Assets Liabilities M Jones Capita...View the full answer

Answered By

Bijitha Balan

MY name is bijitha balan .I was finished msc PC science.My ug subject is PC application.

later I Have worked ina visitor instructor as Govt higher auxiliary school.Then after I could worked in chegg freelancing.so absolute six years work involvement with my educating field.

0.00

0 Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Accounting questions

-

The partners of LR Company have decided to liquidate their business. Noncash assets were sold for $125,000. The income ratios of the partners Cisneros, Gunselman, and Forren are 3:2:3, respectively....

-

Partners Maness and Joiner have decided to liquidate their business. The ledger shows the following account balances: Maness and Joiner share profits and losses in an 8:2 ratio. During the first...

-

Partners Maness and Joiner have decided to liquidate their business. The ledger shows the following account balances: Maness and Joiner share profits and losses in an 8:2 ratio. During the first...

-

Requirement 1. Journalize the partners' initial contributions. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the...

-

On January 1, 2018, Morissette Inc. purchased $900,000 of 6-year, 2% bonds for $850,916 to yield a market interest rate of 3%. Interest is received semi-annually on July 1 and January 1. Morissette's...

-

Write a method called dominant that accepts three integers as parameters and returns true if any one of the three integers is larger than the sum of the other two integers. The integers might be...

-

9-6. Qu criterios se utilizan para decidir cules segmentos se eligen como objetivo?

-

Lilly Painting Company is considering whether to purchase a new spray paint machine that costs $4,000. The machine is expected to save labor, increasing net income by $600 per year. The effective...

-

Calculate the cash dividends required to be paid for each of the following preferred stock issues: Required: a. The semiannual dividend on 8% cumulative preferred $70 par value, 14,000 shares...

-

You are also considering a second business opportunity: Supplying fish, fresh from the bottom of the Charles River, to Harvard Dining Services, for the next three years in return for an up-front...

-

Villa America Company reported net income of $85,000. The partnership agreement provides for salaries of $25,000 to S.Wiborg and $18,000 to G. Murphy. They divide the remainder 40% to Wiborg and 60%...

-

Granger Company wishes to liquidate the firm by distributing the companys cash to the three partners. Prior to the distribution of cash, the companys balances are: Cash $66,000; Niles, Capital (Cr.)...

-

We Scream For Ice Cream sells ice cream in three flavors: Chocolate, Strawberry, and Vanilla. It sold 28,000 gallons last year, but it is still losing money. For every five gallons of ice cream sold,...

-

Activity 1.4: When Less Becomes More For this activity, refer to the images shown. This is an activity which was performed for you if you do not have available two identical mirrors at home. But if...

-

! Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced...

-

During the early part of winter, one morning, two hunters decided to go quail hunting on a property where the owner had given them permission to hunt. A nearby forest ranger saw the hunters and...

-

Required information [The following information applies to the questions displayed below.] Trini Company set the following standard costs per unit for its single product. Direct materials (30 pounds...

-

A horticulturist knows that the weights of honeybees that have previously visited her orchard are normally distributed with a mean of 0.87 grams, and a population standard deviation of 0.15 grams....

-

Accounting for the Transition in Goodwill Treatment Porch Company acquired the net assets of Stairs Company on January 1, 2000, for $600,000. The management of Porch recently adopted a vertical...

-

A bar of a steel alloy that exhibits the stress-strain behavior shown in Figure 6.22 is subjected to a tensile load; the specimen is 375 mm (14.8 in.) long and has a square cross section 5.5 mm (0.22...

-

Use the indicated substitution to evaluate the integral. dx (x-4)3/2 Sa x = 2 sec 0

-

Discuss the potential advantages and disadvantages that countries outside the United States should consider before adopting regulations, such as those in the Sarbanes-Oxley Act, that increase...

-

The financial statements of Zetar plc are presented in Appendix C. The companys complete annual report, including the notes to its financial statements, is available at www.zetarplc.com. Instructions...

-

(a) What is the primary objective of financial reporting? (b) Identify the characteristics of useful accounting information.

-

TB SA Qu. 13-74 (Static) What must Abdu invest today to... What must Abdu invest today to receive an annuity of $9,000 for four years semiannually at an 8% annual rate? All withdrawals will be made...

-

The tolal landed coet with the order gaantly sire of 6,000 unts is 4 (Enter your response roundod to the nearest dolar)

-

Boyne Inc. had beginning inventory of $12,000 at cost and $20,000 at retail. Net purchases were $120,000 at cost and $170,000 at retail. Net markups were $10,000, net markdowns were $7,000, and sales...

Study smarter with the SolutionInn App