Hanna Corporation owns 80% of the outstanding voting stock of Fellow Inc. At the date of acquisition,

Question:

Hanna Corporation owns 80% of the outstanding voting stock of Fellow Inc. At the date of acquisition, Fellow's retained earnings were $2,100,000. On December 31, Year 2, Hanna Inc. sold equipment to Fellow at its fair value of $2,000,000 and recorded a gain of $500,000. The equipment had a remaining useful life of five years on the date of the intercompany transaction. This equipment was still held within the consolidated entity at the end of Year 4.

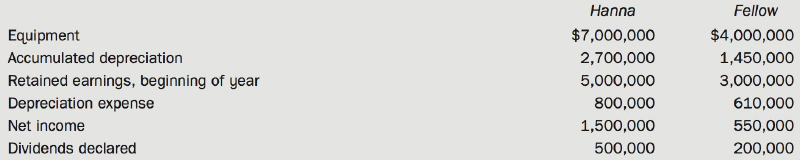

At the end of Year 4, selected figures from the two companies' financial statements were as follows:

Hanna uses the cost method to account for its investment in Fellow. Both companies pay income tax at the rate of 40%.

Required:

(a) Calculate the amount to be reported on the Year 4 consolidated financial statements for the accounts/items listed above.

(b) Now, assume that the Year 2 intercompany sale was upstream, that is, Fellow sold to Hanna. Calculate the amount to be reported on the Year 4 consolidated financial statements for the accounts/items listed above.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell