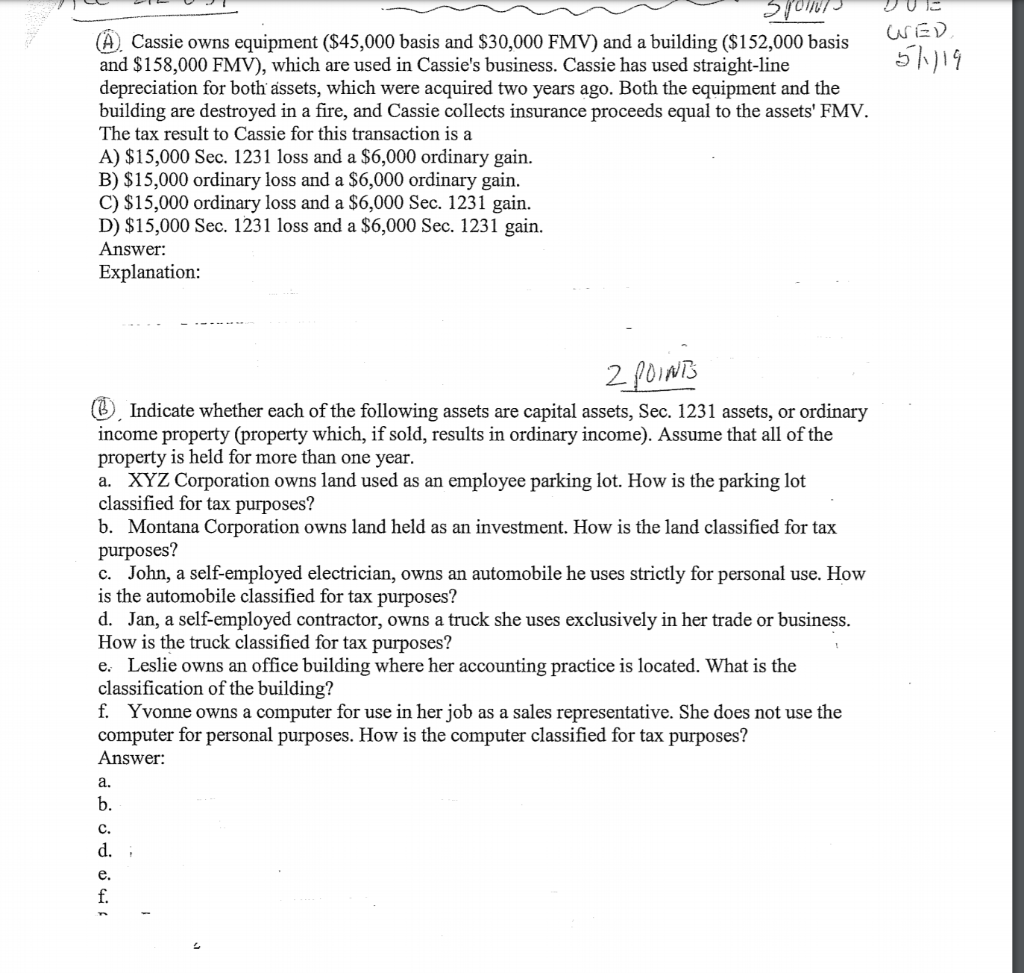

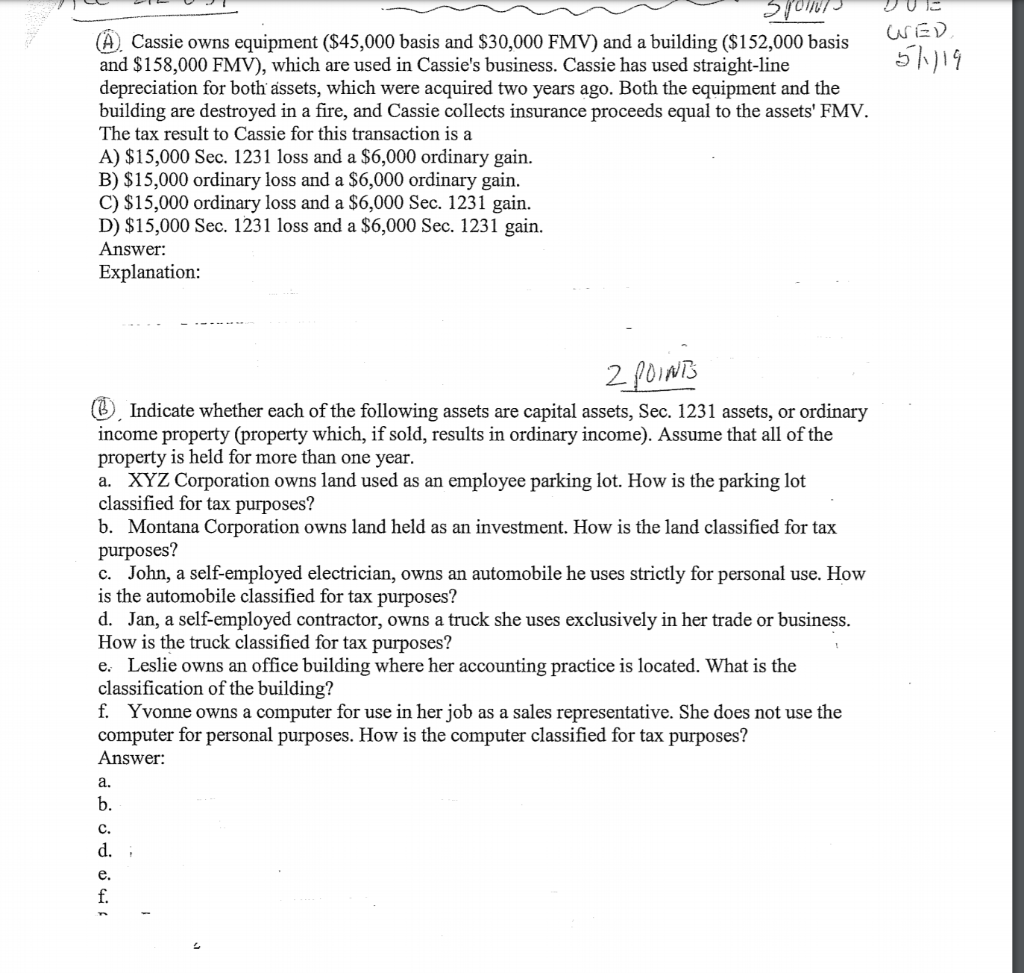

(A Cassie owns equipment ($45,000 basis and S30,000 FMV) and a building (S152,000 basis and $158,000 FMV), which are used in Cassie's business. Cassie has used straight-line depreciation for both assets, which were acquired two years ago. Both the equipment and the building are destroyed in a fire, and Cassie collects insurance proceeds equal to the assets' FMV The tax result to Cassie for this transaction is a A) $15,000 Sec. 1231 loss and a $6,000 ordinary gain. B) $15,000 ordinary loss and a $6,000 ordinary gain C) $15,000 ordinary loss and a $6,000 Sec. 1231 gain. D) $15,000 Sec. 1231 loss and a S6,000 Sec. 1231 gain. Answer: Explanation (B), Indicate whether each of the following assets are capital assets, Sec. 1231 assets, or ordinary income property (property which, if sold, results in ordinary income). Assume that all of the property is held for more than one year XYZ Corporation owns land used as an employee parking lot. How is the parking lot classified for tax purposes? b. Montana Corporation owns land held as an investment. How is the land classified for tax purposes? c. John, a self-employed electrician, owns an automobile he uses strictly for personal use. How is the automobile classified for tax purposes? d. Jan, a self-employed contractor, owns a truck she uses exclusively in her trade or business How is the truck classified for tax purposes? e. Leslie owns an office building where her accounting practice is located. What is the classification of the building? f. Yvonne owns a computer for use in her job as a sales representative. She does not use the computer for personal purposes. How is the computer classified for tax purposes? Answer: a. C. e. f. (A Cassie owns equipment ($45,000 basis and S30,000 FMV) and a building (S152,000 basis and $158,000 FMV), which are used in Cassie's business. Cassie has used straight-line depreciation for both assets, which were acquired two years ago. Both the equipment and the building are destroyed in a fire, and Cassie collects insurance proceeds equal to the assets' FMV The tax result to Cassie for this transaction is a A) $15,000 Sec. 1231 loss and a $6,000 ordinary gain. B) $15,000 ordinary loss and a $6,000 ordinary gain C) $15,000 ordinary loss and a $6,000 Sec. 1231 gain. D) $15,000 Sec. 1231 loss and a S6,000 Sec. 1231 gain. Answer: Explanation (B), Indicate whether each of the following assets are capital assets, Sec. 1231 assets, or ordinary income property (property which, if sold, results in ordinary income). Assume that all of the property is held for more than one year XYZ Corporation owns land used as an employee parking lot. How is the parking lot classified for tax purposes? b. Montana Corporation owns land held as an investment. How is the land classified for tax purposes? c. John, a self-employed electrician, owns an automobile he uses strictly for personal use. How is the automobile classified for tax purposes? d. Jan, a self-employed contractor, owns a truck she uses exclusively in her trade or business How is the truck classified for tax purposes? e. Leslie owns an office building where her accounting practice is located. What is the classification of the building? f. Yvonne owns a computer for use in her job as a sales representative. She does not use the computer for personal purposes. How is the computer classified for tax purposes? Answer: a. C. e. f