A central concern of any lender is whether a potential or actual borrower is likely to repay the loan. To the extent that investors may

A central concern of any lender is whether a potential or actual borrower is likely to repay the loan. To the extent that investors may face information asymmetry problems, the role ofCredit Rating Agencies (CRAs)is to give judgements about the credit quality of bonds which are issued by corporations.

Enron went bankrupt in November 2001. In the wake of the Enron bankruptcy, however, the media and government noticed that the three major rating agencies (e.g.,Moody's, S&P, and Fitch)had maintained "investment grade" ratings on Enron's bonds until five days before that company declared bankruptcy.

Required:

a.Discuss why the sluggishness in adjusting credit ratings persists.

b.Before Enron went bankrupt, the company issued a three year bond with a coupon rate of 15% and $1000 par value. Assume investor's required rate of return was 13%, calculate the price of the bond.

c.Calculate the Duration of a bond with $1000 par value and 7% coupon rate, three years remaining to maturity and yield to maturity is 9%.

2.The intellectual dominance of the efficient-market revolution has been challenged by economists who stress psychological and behavioural elements of stock-price determination and by econometricians who argue that stock returns are, to a considerable extent, predictable.

Continued...

Required:

a.Examine the critics of the efficient market hypothesis and the relationship between predictability and efficiency.

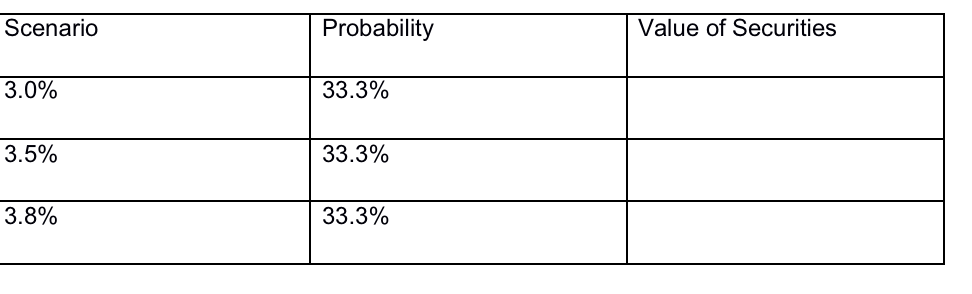

b.Assume the RBG Bank has money market securities with par value of $100 million that will mature in nine months. The bank will urgently need a substantial amount of funds in three months, it wants to know how much cash it will receive from selling these securities three months from now. Assume that it expects the required rate of return on these securities to be 3%, or 3.5%, or 3.8% with a 33.3% chance for each of these three scenarios. What are the value of securities under each of these scenarios?

Scenario 3.0% 3.5% 3.8% Probability 33.3% 33.3% 33.3% Value of Securities

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a The sluggishness in adjusting credit ratings can persist due to various reasons 1 Conflict of interest Credit rating agencies may have conflicts of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started