Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A certain company sells its only product for $12 per unit. The variable cost to produce the product are $7 per unit and it costs

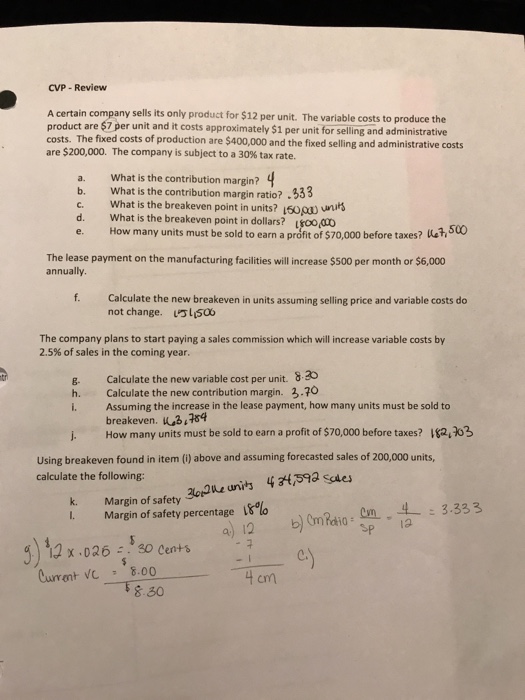

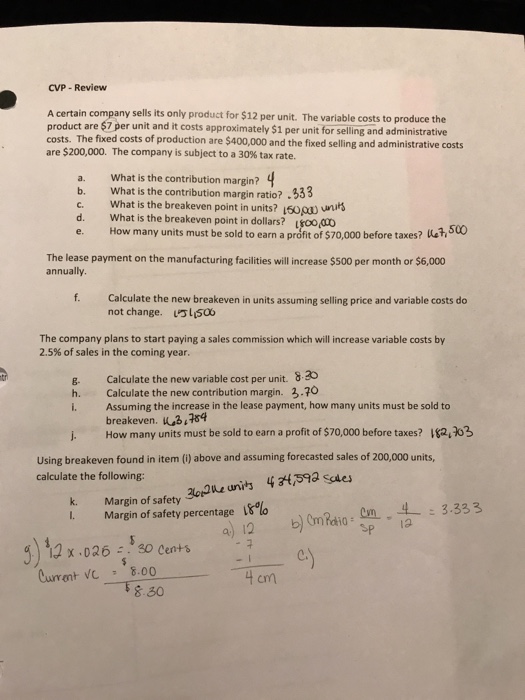

A certain company sells its only product for $12 per unit. The variable cost to produce the product are $7 per unit and it costs approximately $1 per unit for selling and administrative costs. The fixed costs of the production are $400,000 and the fixed selling and administrative costs are $200,000. The company is subject to a 30% tax rate.

CVP - Review sells its only product for $12 per unit. The variable costs to produce the A certain company product are $7 per unit and it costs approximately $1 per unit for selling and administrative costs. The fixed costs of production are $400,000 and the fixed selling and administrative costs are $200,000. The company is subject to a 30% tax rate. What is the contribution margin? what is the contribution margin ratio a. b, ? .533 c. What is the breakeven point in units? 10w d. What is the breakeven point in dollars? usoo e. How many units must be sold to earn a profit of $70,000 befoes500 The lease payment on the manufacturing facilities will increase $500 per month or $6,000 annually. f. Calculate the new breakeven in units assuming selling price and variable costs do not change. s5 The company plans to start paying a sales commission which will increase variable costs by 2.5% of sales in the coming year. B. Calculate the new variable cost per unit. 82 h. Calculate the new contribution margin. 3.70 i. Assuming the increase in the lease payment, how many units must be sold to breakeven. 3,74 j How many units must be sold to earn a profit of $70,000 before taxes? 1g2,203 Using breakeven found in item (i) above and assuming forecasted sales of 200,000 units calculate the following: k. argin of safety 3o2e units 4 59 k% Margin of safety percentage 2x 026 30 cents Curront vc 8.00 cm 8.30 How do I get these numbers?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started