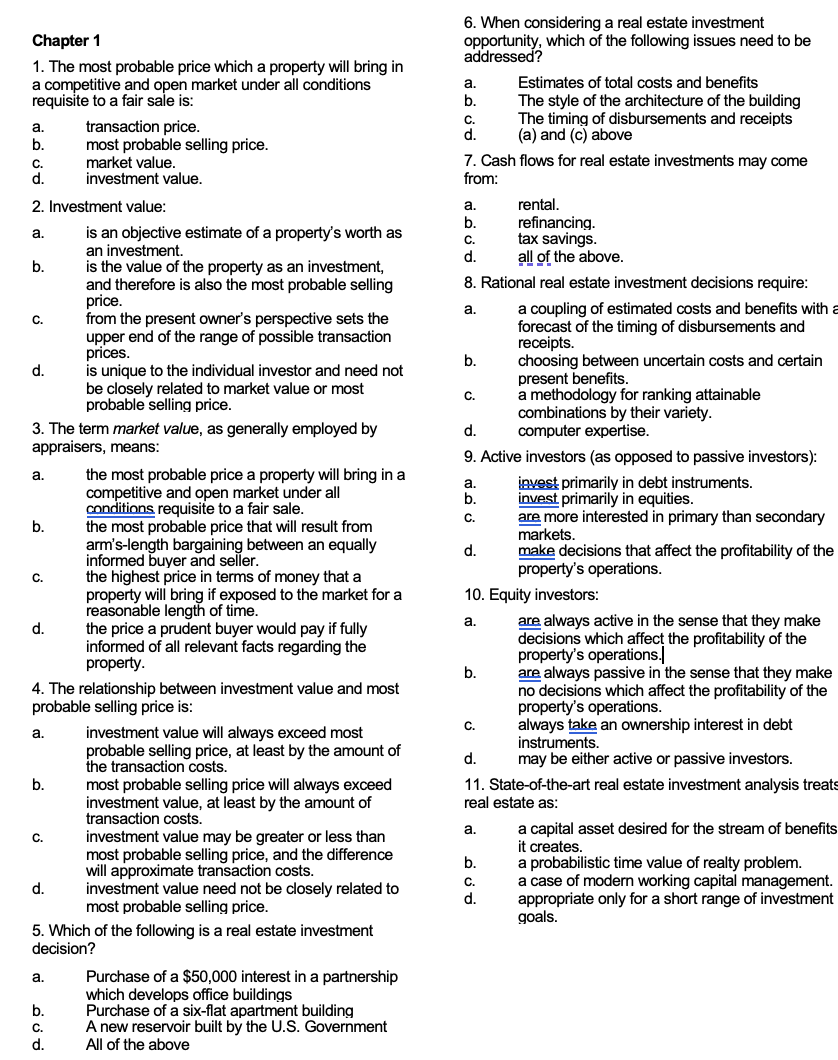

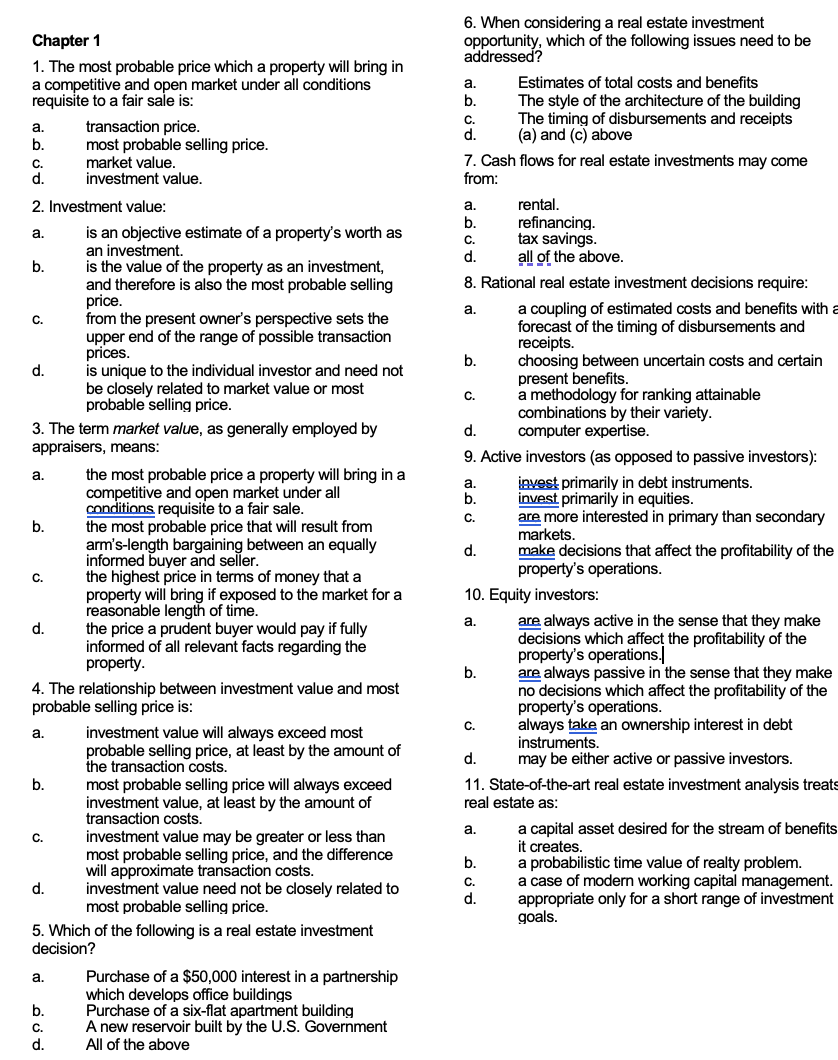

a. Chapter 1 1. The most probable price which a property will bring in a competitive and open market under all conditions requisite to a fair sale is: transaction price. b. most probable selling price. C. market value. d investment value. 2. Investment value: is an objective estimate of a property's worth as an investment. b. is the value of the property as an investment, and therefore is also the most probable selling price. C. from the present owner's perspective sets the upper end of the range of possible transaction a. doo prices. o 6. When considering a real estate investment opportunity, which of the following issues need to be addressed? a. Estimates of total costs and benefits b. The style of the architecture of the building The timing of disbursements and receipts d. (a) and (c) above 7. Cash flows for real estate investments may come from: rental. refinancing. tax savings. . all of the above. 8. Rational real estate investment decisions require: a. a coupling of estimated costs and benefits with a forecast of the timing of disbursements and receipts. b. choosing between uncertain costs and certain present benefits. C. a methodology for ranking attainable combinations by their variety. d. computer expertise. 9. Active investors (as opposed to passive investors): a. invest primarily in debt instruments. b. invest primarily in equities. C. are more interested in primary than secondary markets. make decisions that affect the profitability of the property's operations. 10. Equity investors: a. are always active in the sense that they make decisions which affect the profitability of the property's operations. b. are always passive in the sense that they make no decisions which affect the profitability of the property's operations. c. always take an ownership interest in debt instruments. d. may be either active or passive investors. 11. State-of-the-art real estate investment analysis treats real estate as: a. a capital asset desired for the stream of benefits it creates. b. a probabilistic time value of realty problem. C. a case of modern working capital management. d. appropriate only for a short range of investment goals. d. d. is unique to the individual investor and need not be closely related to market value or most probable selling price. 3. The term market value, as generally employed by appraisers, means: a. the most probable price a property will bring in a competitive and open market under all conditions requisite to a fair sale. b. the most probable price that will result from arm's-length bargaining between an equally informed buyer and seller. the highest price in terms of money that a property will bring if exposed to the market for a reasonable length of time. d. the price a prudent buyer would pay if fully informed of all relevant facts regarding the property. 4. The relationship between investment value and most probable selling price is: a. investment value will always exceed most probable selling price, at least by the amount of the transaction costs. b. most probable selling price will always exceed investment value, at least by the amount of transaction costs. investment value may be greater or less than most probable selling price, and the difference will approximate transaction costs. d. investment value need not be closely related to most probable selling price. 5. Which of the following is a real estate investment decision? a. Purchase of a $50,000 interest in a partnership which develops office buildings b. Purchase of a six-flat apartment building C. A new reservoir built by the U.S. Government d. All of the above C. C