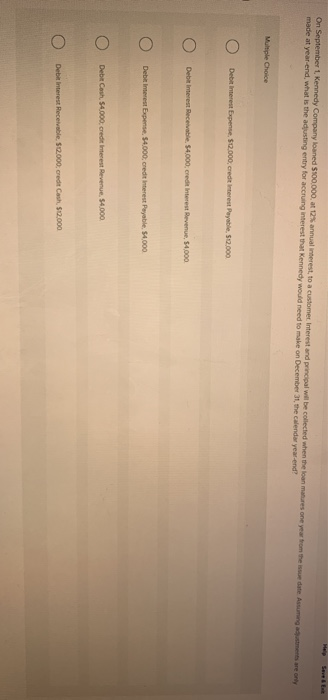

a check correctly written and paid by the bank for $9.36 is incorrectly recorded in the company's books for $963, how should this error be treated on the bank reconciliation Multiple Choice U Subtract 27 from the bank's balance Add $27 to the bank's balance Subtract 527 from the book belance Oo oo Add 527 to the book balance O Subtract $27 from the bank's balance and add $45 to the book's balance During the month of July Clanton Industries issued a check in the amount of $923 to supplier on account the check did not clear the bank during my in preparing the bank reconciation the company thoud Multiple Choice 0 Add the check out the balance Deduct the check amount to the book balance of cash 0 0 Add the check amount to the book balance of cash 0 Deduct the check amount from the bank balance 0 Make a joumal entry in the company records for anno The credit purchase of a new ovenfor $4.700 was posted to Kitchen Equipment as a $4.700 debit and to Accounts Payable as a $4700 debt what effect would have on the table Multiple Choice o The total of the Credit column of the trial balonce wil exceed the total of the Debt column by 54700 o The total of the Debt column of the balance wil exceed the total of the Cred column by $9.400 o The total of the Credit column of the trial balance will exceed the total of the Debit column by $9.400. o The total of the Debt column of the vil balance will exceed the total of the Credit column by $4700 o The total of the Debt column of the trial balance will be total of the Credit column A company's Office Supplies account shows a beginning balance of $600 and an ending balance of 500 period? ce supplies expense for the year is 500, what amount office was purchased during the Murple Choice o 7 o o 529oo o 2. o Ossoo o O saoo. On September 1 Kennedy Company loaned $100.000 a 12 annual interest to a customer Interest and principal will be collected when the loan made at year-end, what is the adjusting entry for accrung interest that Kennedy would need to make on December the calendar year-end s one year from the date A g o ry Multiple Choice O Debit interest Expense $12.000, credit interest Payable, 50.000 O Debet interest Receivable $4,000, credit interest Revenue 54.000 Debit interest Expense. $4.000. credit interest Payable, $4.000 O Debt Cosh. 54.000.credit Interest Revenue. 54.000 . O Debit interest Receivable. $12.000, credit Cash $10,000