Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Checks outstanding totaled $10,860. b. A deposit of $8,850, representing receipts of November 30 , had been made too late to appear on the

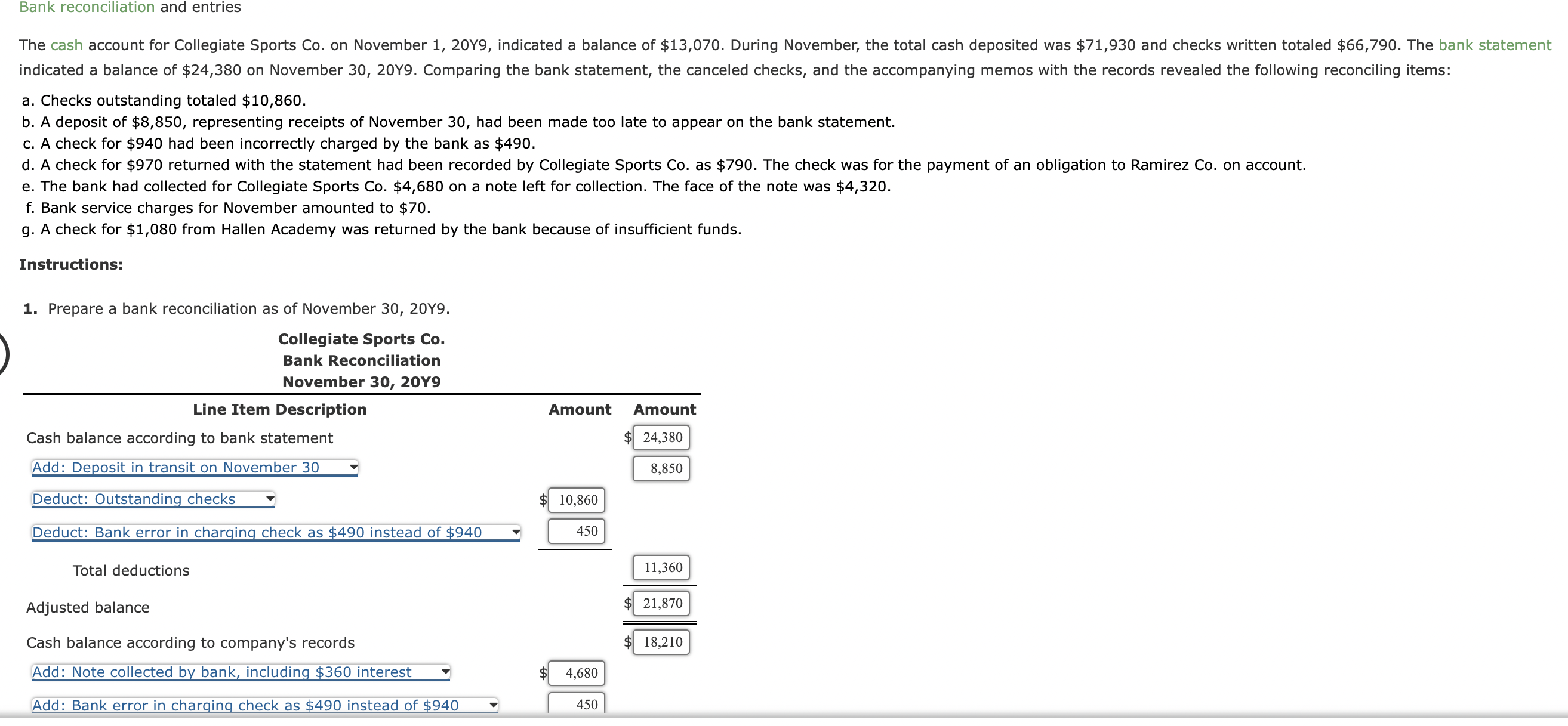

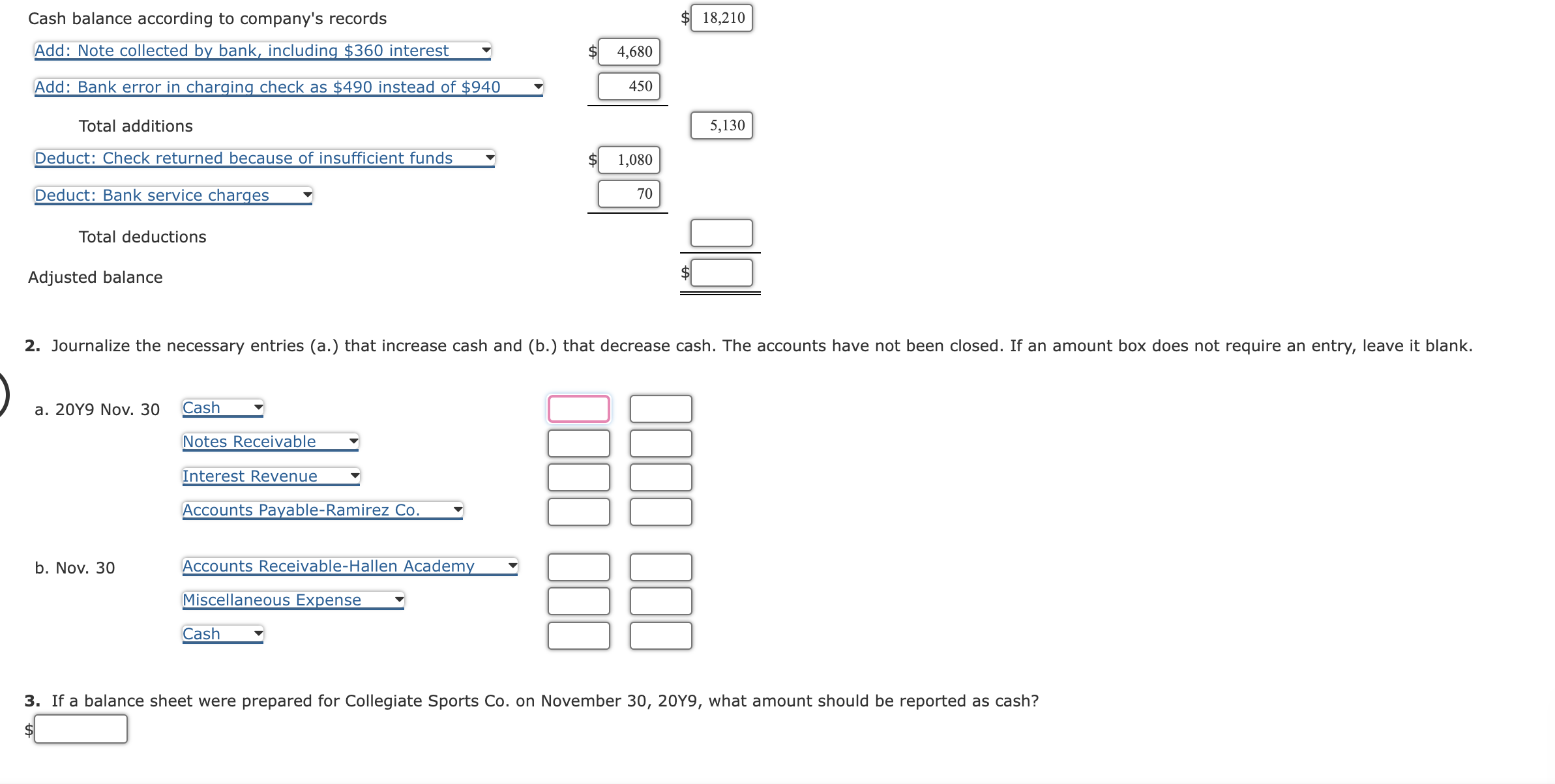

a. Checks outstanding totaled $10,860. b. A deposit of $8,850, representing receipts of November 30 , had been made too late to appear on the bank statement. c. A check for $940 had been incorrectly charged by the bank as $490. d. A check for $970 returned with the statement had been recorded by Collegiate Sports Co. as $790. The check was for the payment of an obligation to Ramirez Co. on account. e. The bank had collected for Collegiate Sports Co. $4,680 on a note left for collection. The face of the note was $4,320. f. Bank service charges for November amounted to $70. g. A check for $1,080 from Hallen Academy was returned by the bank because of insufficient funds. Instructions: 1. Prepare a bank reconciliation as of November 30,20Y9. 3. If a balance sheet were prepared for Collegiate Sports Co. on November 30,20Y9, what amount should be reported as cash

a. Checks outstanding totaled $10,860. b. A deposit of $8,850, representing receipts of November 30 , had been made too late to appear on the bank statement. c. A check for $940 had been incorrectly charged by the bank as $490. d. A check for $970 returned with the statement had been recorded by Collegiate Sports Co. as $790. The check was for the payment of an obligation to Ramirez Co. on account. e. The bank had collected for Collegiate Sports Co. $4,680 on a note left for collection. The face of the note was $4,320. f. Bank service charges for November amounted to $70. g. A check for $1,080 from Hallen Academy was returned by the bank because of insufficient funds. Instructions: 1. Prepare a bank reconciliation as of November 30,20Y9. 3. If a balance sheet were prepared for Collegiate Sports Co. on November 30,20Y9, what amount should be reported as cash Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started