Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A China based company named ITC exports one lot of products to the U.S., domestic procuring price at the port of shipment amounts to

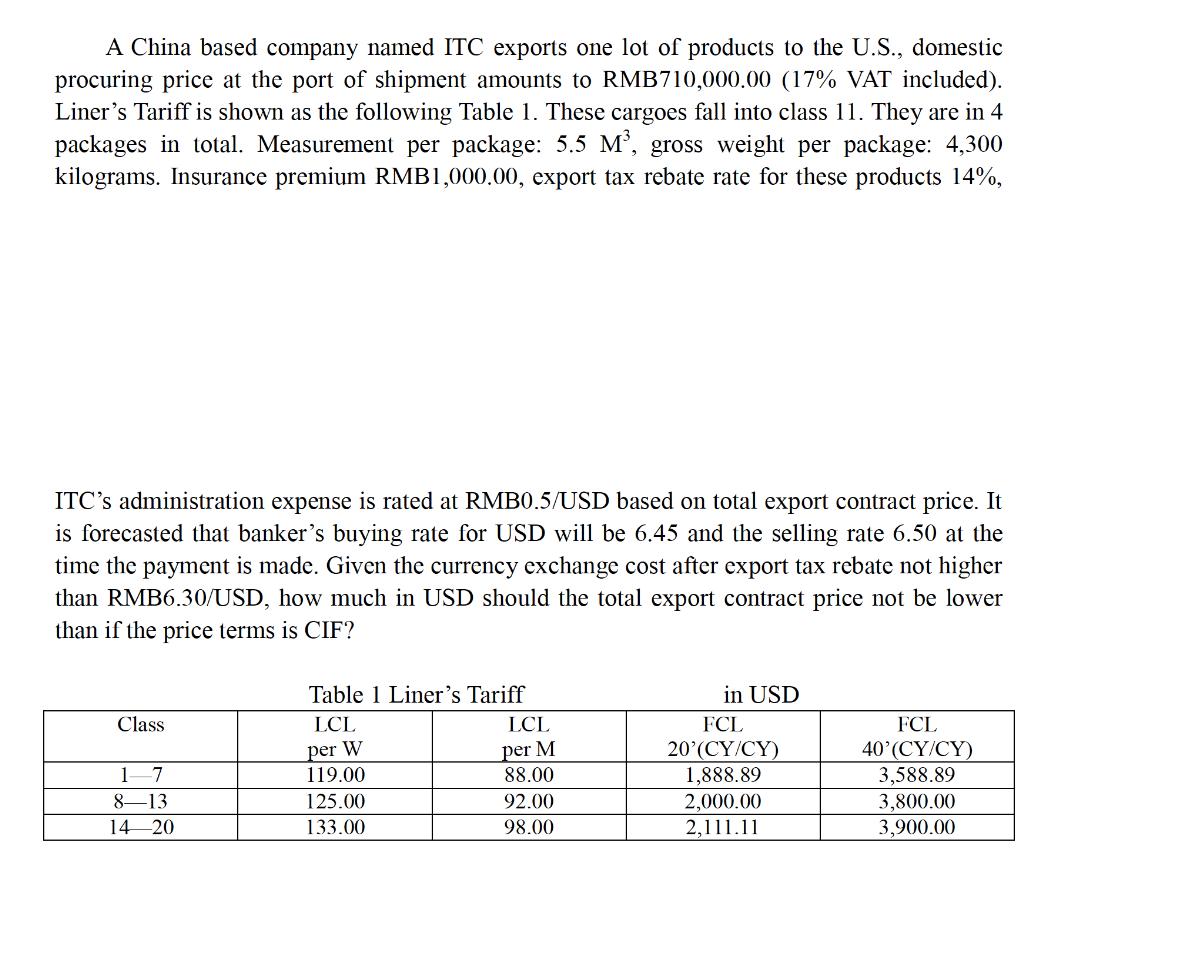

A China based company named ITC exports one lot of products to the U.S., domestic procuring price at the port of shipment amounts to RMB710,000.00 (17% VAT included). Liner's Tariff is shown as the following Table 1. These cargoes fall into class 11. They are in 4 packages in total. Measurement per package: 5.5 M, gross weight per package: 4,300 kilograms. Insurance premium RMB1,000,00, export tax rebate rate for these products 14%, ITC's administration expense is rated at RMB0.5/USD based on total export contract price. It is forecasted that banker's buying rate for USD will be 6.45 and the selling rate 6.50 at the time the payment is made. Given the currency exchange cost after export tax rebate not higher than RMB6.30/USD, how much in USD should the total export contract price not be lower than if the price terms is CIF? Class 1-7 8-13 14 20 Table 1 Liner's Tariff LCL per W 119.00 125.00 133.00 LCL per M 88.00 92.00 98.00 in USD FCL 20'(CY/CY) 1,888.89 2,000.00 2,111.11 FCL 40'(CY/CY) 3,588.89 3,800.00 3,900.00

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Given Shipment 700000 RMB Insurance Premium E Export tax rebate 14 ITC administration expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started