Question

A Chinese import company is supposed to pay 10 million US dollars to an American firm in six months. It wants to hedge the risk

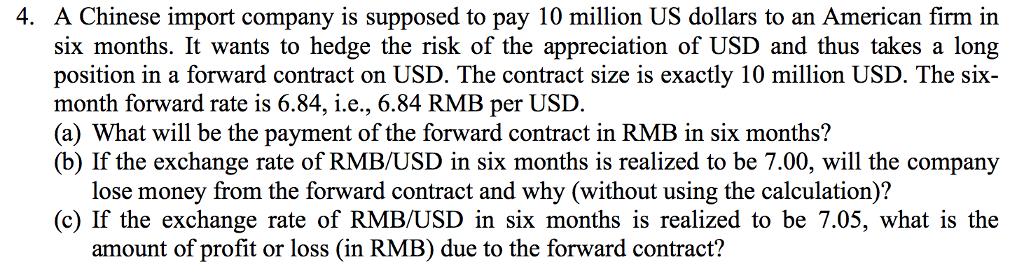

A Chinese import company is supposed to pay 10 million US dollars to an American firm in six months. It wants to hedge the risk of the appreciation of USD and thus takes a long position in a forward contract on USD. The contract size is exactly 10 million USD. The six-month forward rate is 6.84, i.e., 6.84 RMB per USD.

(a) What will be the payment of the forward contract in RMB in six months?

(b) If the exchange rate of RMB/USD in six months is realized to be 7.00, will the company lose money from the forward contract and why (without using the calculation)?

(c) If the exchange rate of RMB/USD in six months is realized to be 7.05, what is the amount of profit or loss (in RMB) due to the forward contract?

4. A Chinese import company is supposed to pay 10 million US dollars to an American firm in six months. It wants to hedge the risk of the appreciation of USD and thus takes a long position in a forward contract on USD. The contract size is exactly 10 million USD. The six- month forward rate is 6.84, i.e., 6.84 RMB per USD. (a) What will be the payment of the forward contract in RMB in six months? (b) If the exchange rate of RMB/USD in six months is realized to be 7.00, will the company lose money from the forward contract and why (without using the calculation)? (c) If the exchange rate of RMB/USD in six months is realized to be 7.05, what is the amount of profit or loss (in RMB) due to the forward contract

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started