Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a). Christine is an MBA student at University of Nairobi and also in charge of sales for Ladies Centre Enterprises, a business that sells Christmas

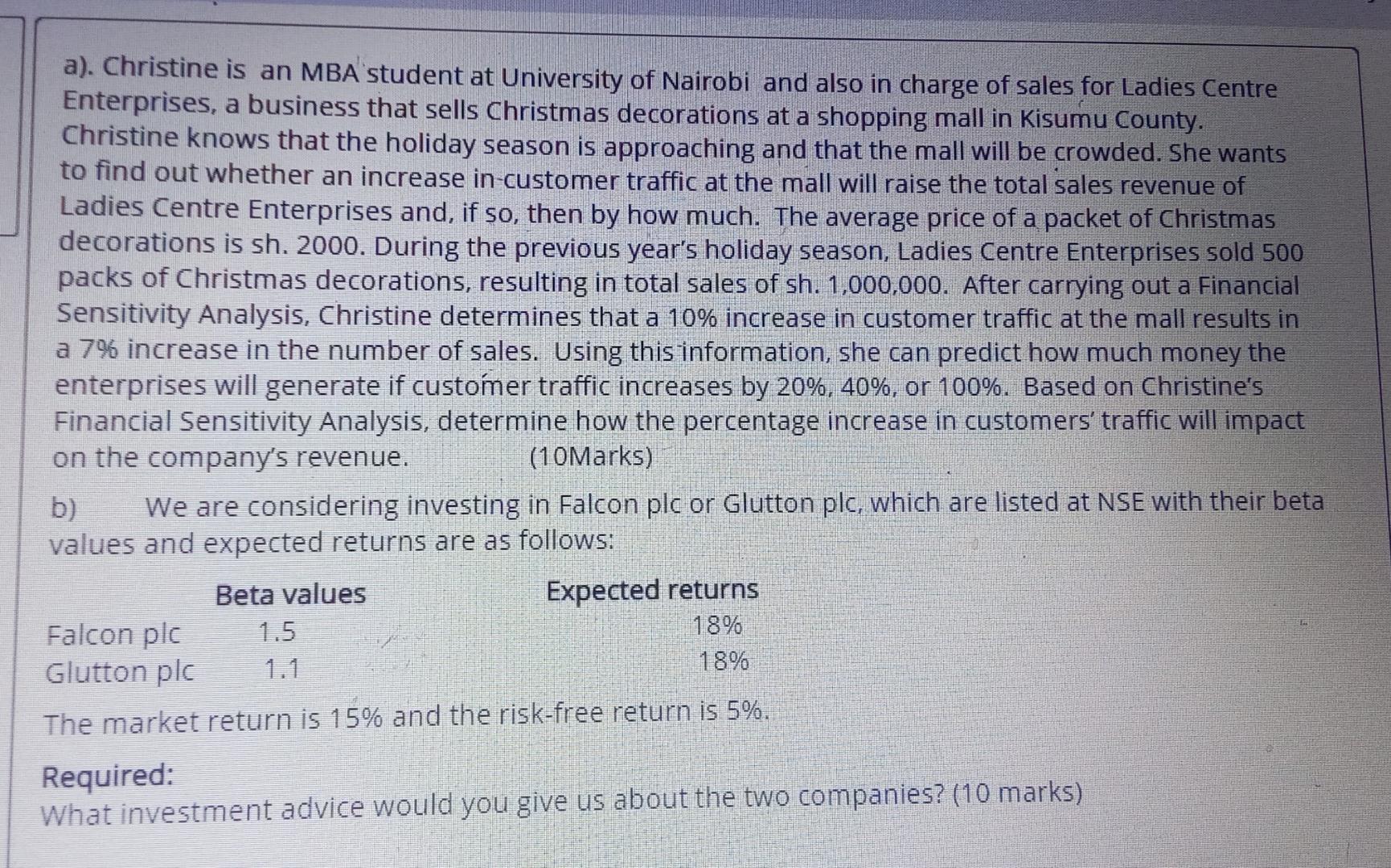

a). Christine is an MBA student at University of Nairobi and also in charge of sales for Ladies Centre Enterprises, a business that sells Christmas decorations at a shopping mall in Kisumu County. Christine knows that the holiday season is approaching and that the mall will be crowded. She wants to find out whether an increase in customer traffic at the mall will raise the total sales revenue of Ladies Centre Enterprises and, if so, then by how much. The average price of a packet of Christmas decorations is sh. 2000. During the previous year's holiday season, Ladies Centre Enterprises sold 500 packs of Christmas decorations, resulting in total sales of sh. 1,000,000. After carrying out a Financial Sensitivity Analysis, Christine determines that a 10% increase in customer traffic at the mall results in a 7% increase in the number of sales. Using this information, she can predict how much money the enterprises will generate if customer traffic increases by 20%, 40%, or 100%. Based on Christine's Financial Sensitivity Analysis, determine how the percentage increase in customers' traffic will impact on the company's revenue. (10Marks) b) We are considering investing in Falcon plc or Glutton plc, which are listed at NSE with their beta values and expected returns are as follows: Beta values Expected returns Falcon plc 1.5 18% 18% Glutton plc The market return is 15% and the risk-free return is 5%. Required: What investment advice would you give us about the two companies? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started