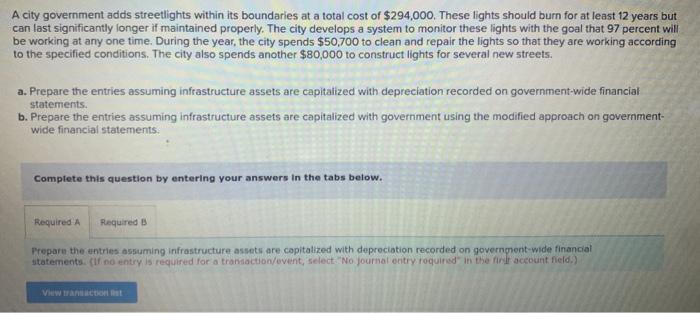

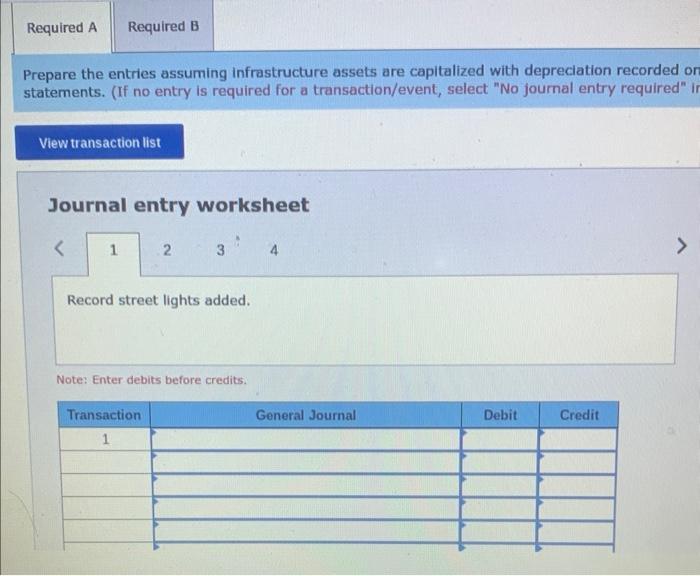

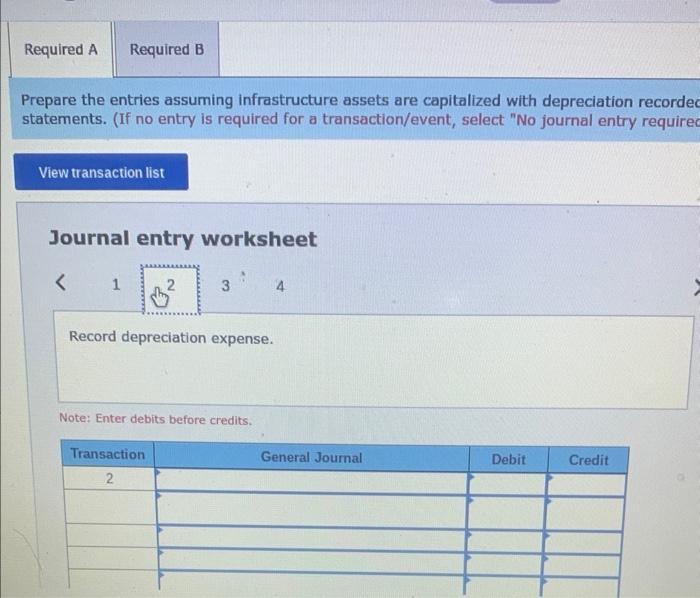

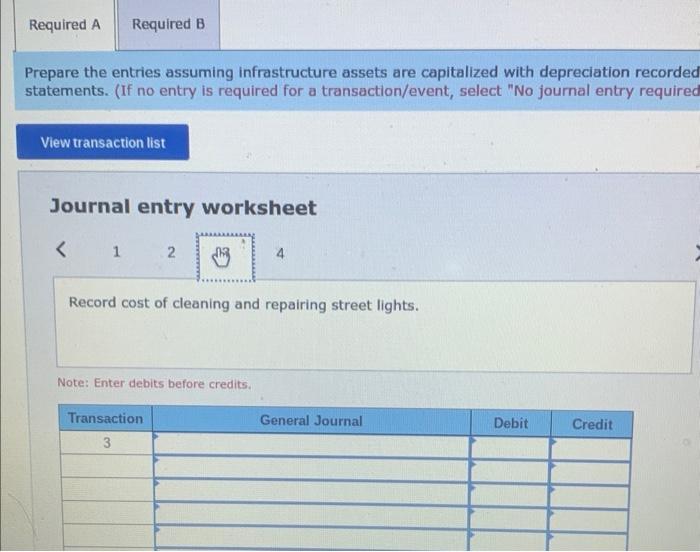

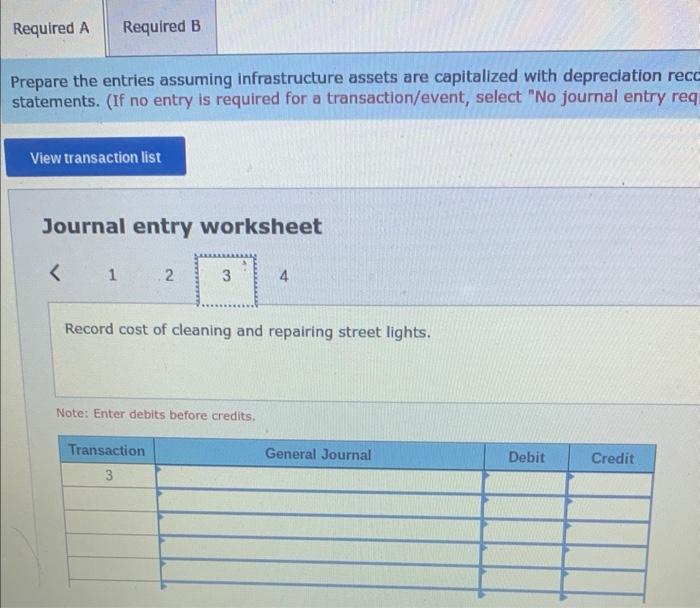

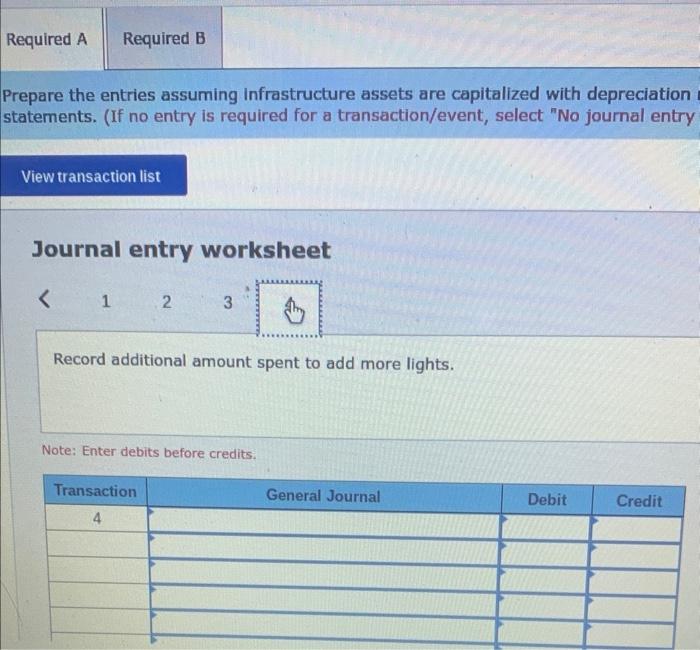

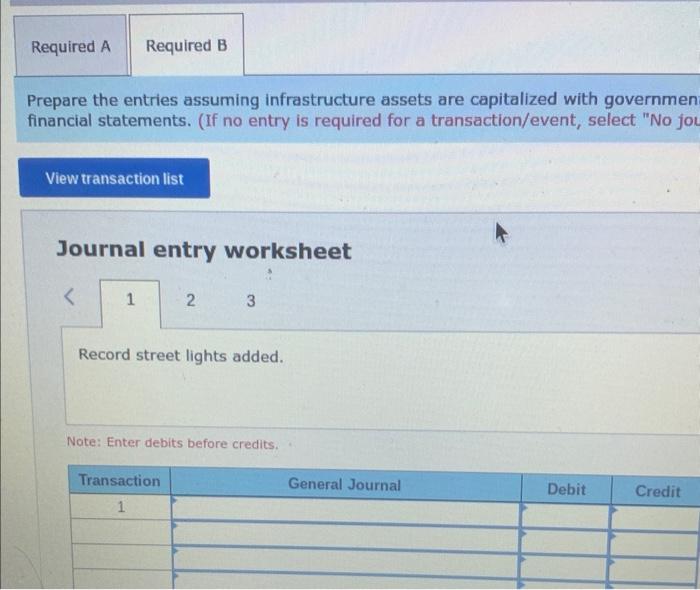

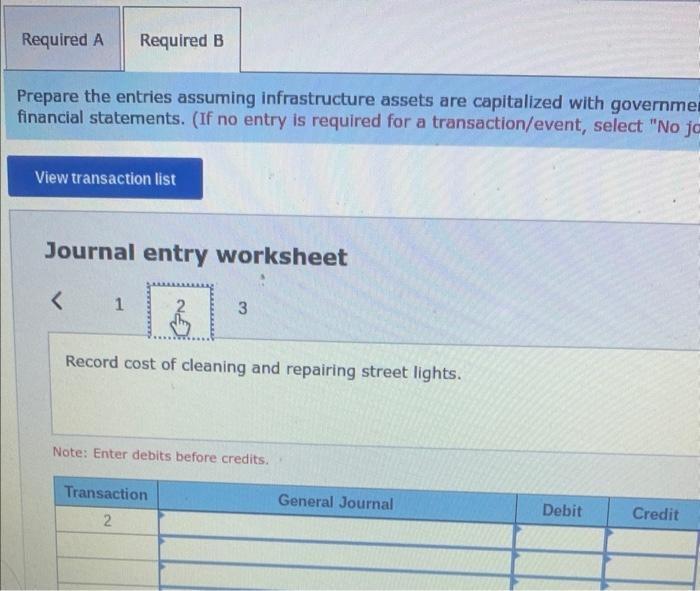

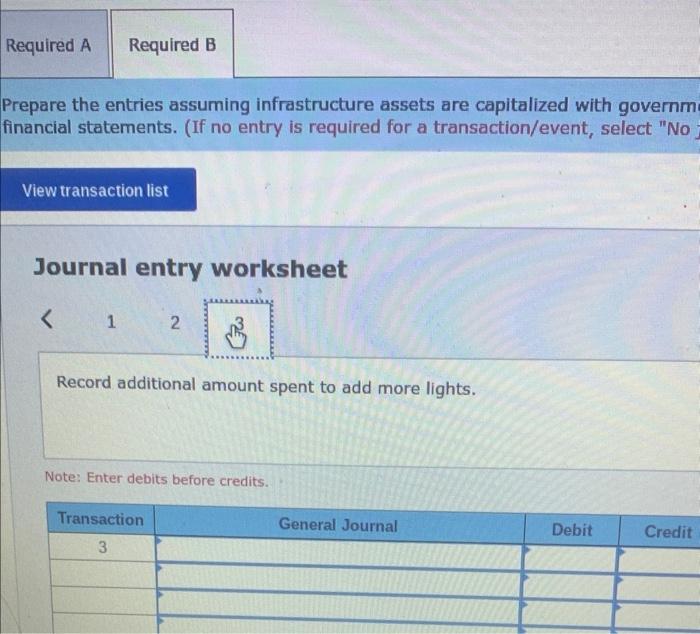

A city government adds streetlights within its boundaries at a total cost of $294,000. These lights should burn for at least 12 years but can last significantly longer if maintained properly. The city develops a system to monitor these lights with the goal that 97 percent will be working at any one time. During the year, the city spends $50,700 to clean and repair the lights so that they are working according to the specified conditions. The city also spends another $80,000 to construct lights for several new streets. a. Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements. b. Prepare the entries assuming infrastructure assets are capitalized with government using the modified approach on governmentwide financial statements: Complete this question by entering your answers in the tabs below. Prepare the entries assuming infrastructure assets are copitalized with depreciation recorded on government-wide financial statemente. (If no entry is required for a transaction/event, select "No journal entry roquirisd in the firir aceount field.) Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded or statements. (If no entry is required for a transaction/event, select "No journal entry required" I Journal entry worksheet 23:4 Note: Enter debits before credits. Prepare the entries assuming infrastructure assets are capitalized with depreciation recordec statements. (If no entry is required for a transaction/event, select "No journal entry require Journal entry worksheet 4 Note: Enter debits before credits. Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded statements. (If no entry is required for a transaction/event, select "No journal entry required Journal entry worksheet Record cost of cleaning and repairing street lights. Note: Enter debits before credits. Prepare the entries assuming infrastructure assets are capitalized with depreciation recc statements. (If no entry is required for a transaction/event, select "No journal entry req Journal entry worksheet 1 Record cost of cleaning and repairing street lights. Note: Enter debits before credits, repare the entries assuming infrastructure assets are capitalized with depreciation itatements. (If no entry is required for a transaction/event, select "No journal entry Journal entry worksheet 12 Record additional amount spent to add more lights. Note: Enter debits before credits. Prepare the entries assuming infrastructure assets are capitalized with governmen financial statements. (If no entry is required for a transaction/event, select "No job Journal entry worksheet Record street lights added. Note: Enter debits before credits. Prepare the entries assuming infrastructure assets are capitalized with governme financial statements. (If no entry is required for a transaction/event, select "No j Journal entry worksheet Record cost of cleaning and repairing street lights. Note: Enter debits before credits. Prepare the entries assuming infrastructure assets are capitalized with governm financial statements. (If no entry is required for a transaction/event, select "No Journal entry worksheet Record additional amount spent to add more lights. Note: Enter debits before credits