A city government adds streetlights within its boundaries at a total cost of $294,000. These lights should burn for at least 12 years but can last significantly longer if maintained properly. The city develops a system to monitor these lights with the goal that 97 percent will be working at any one time. During the year, the city spends $50,700 to clean and repair the lights so that they are working according to the specified conditions. The city also spends another $80,000 to construct lights for several new streets.

-

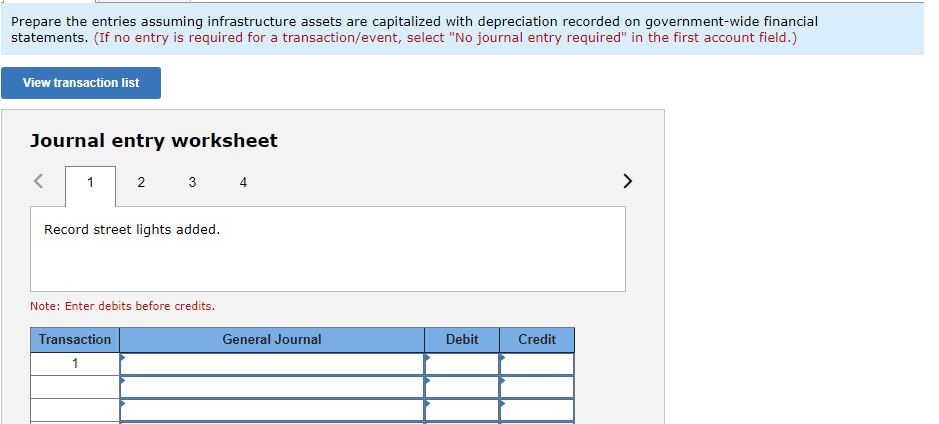

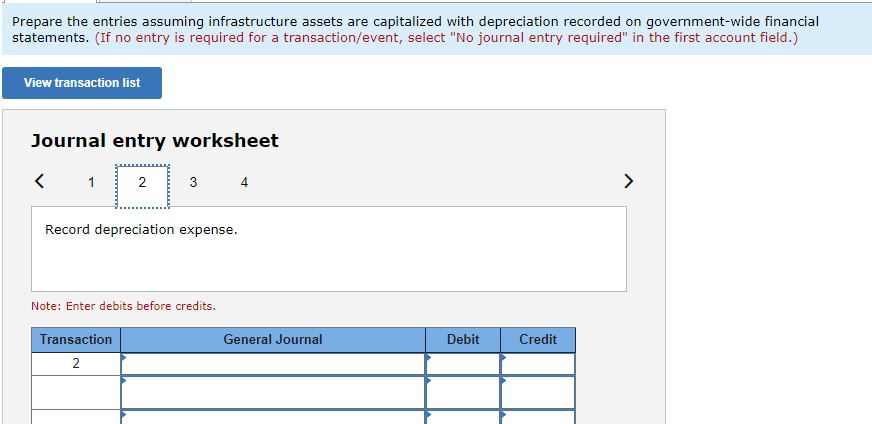

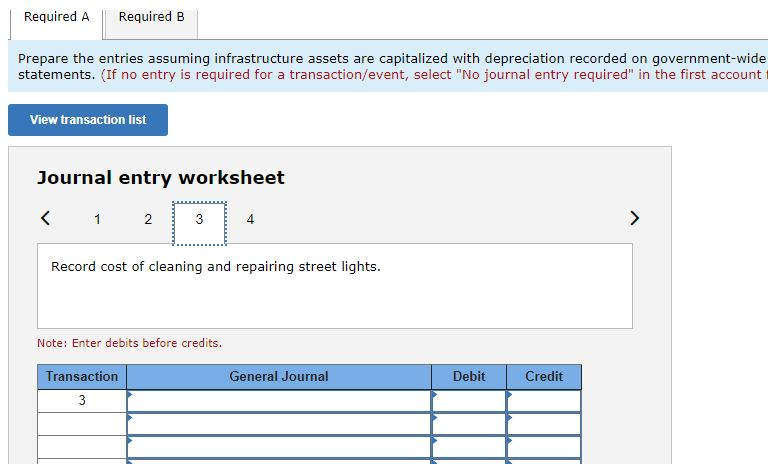

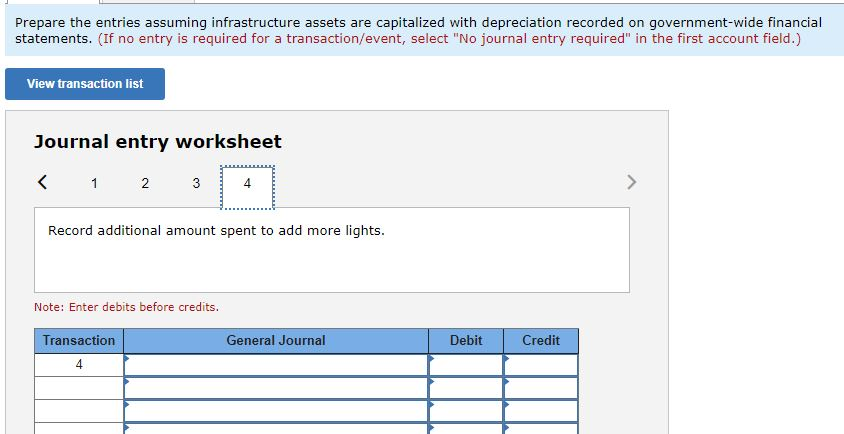

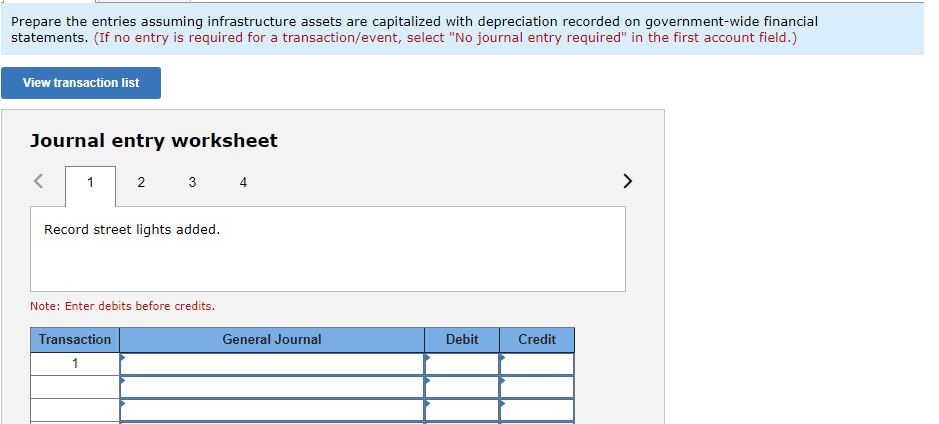

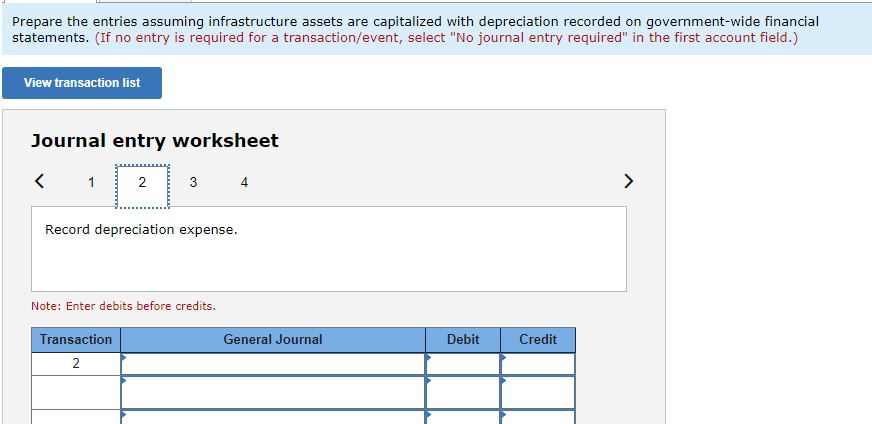

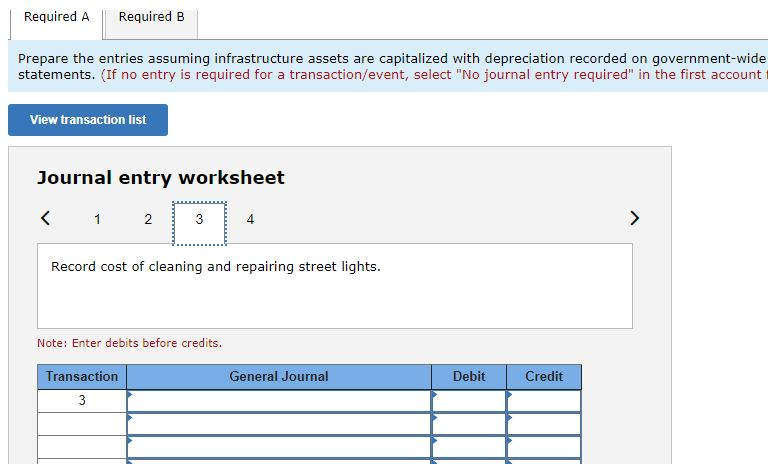

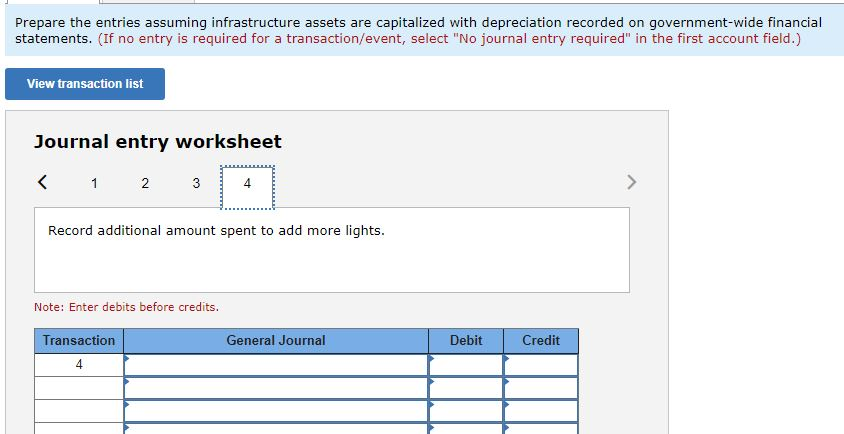

Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements.

-

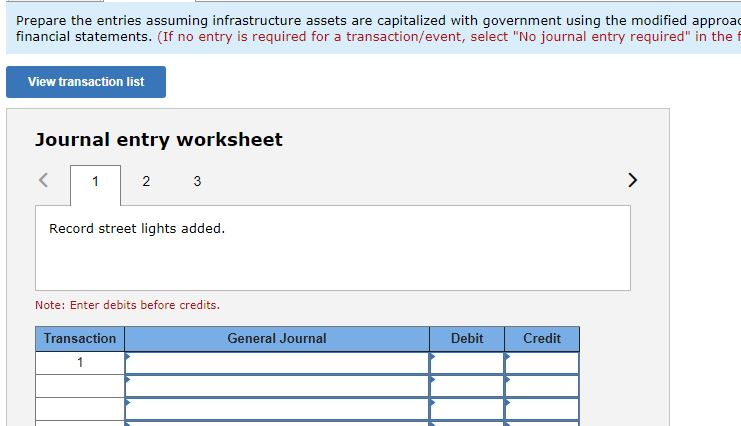

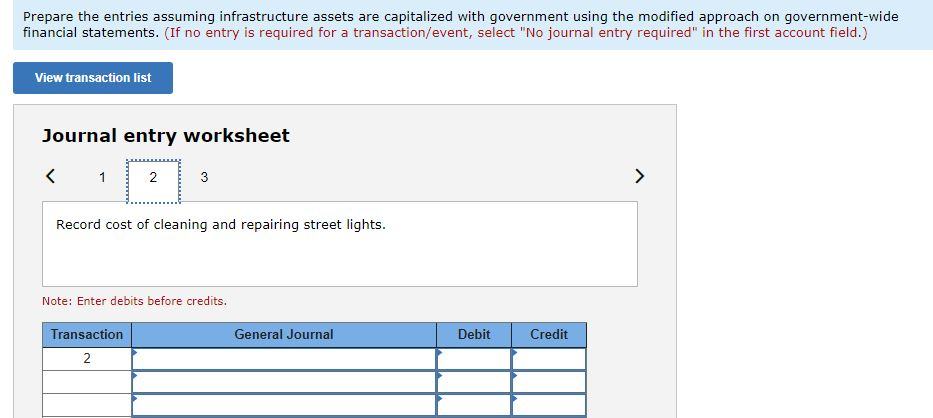

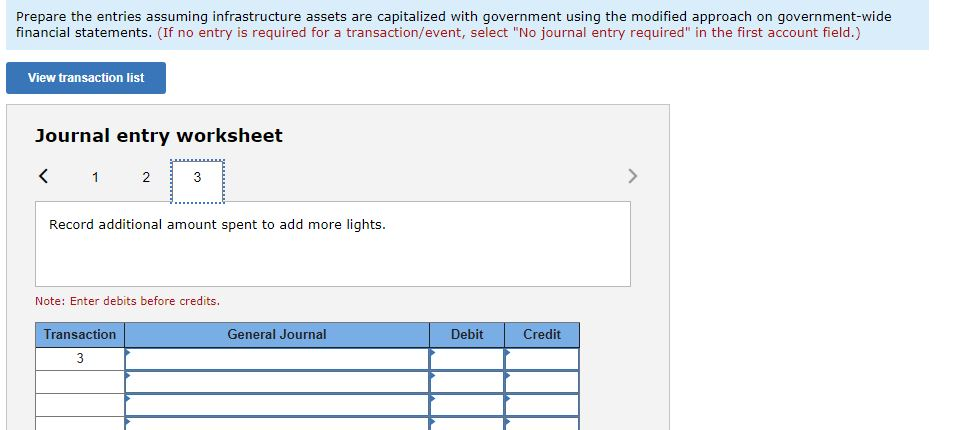

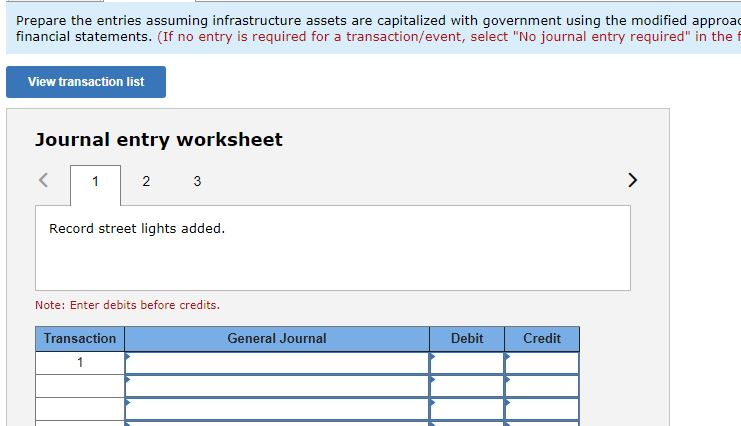

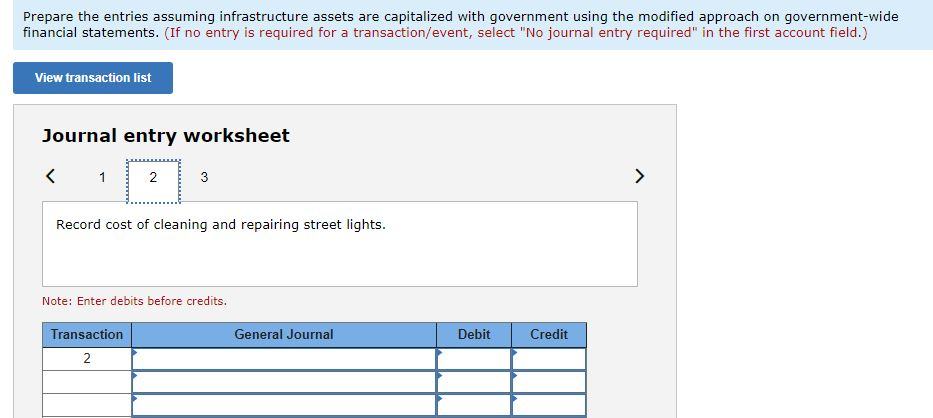

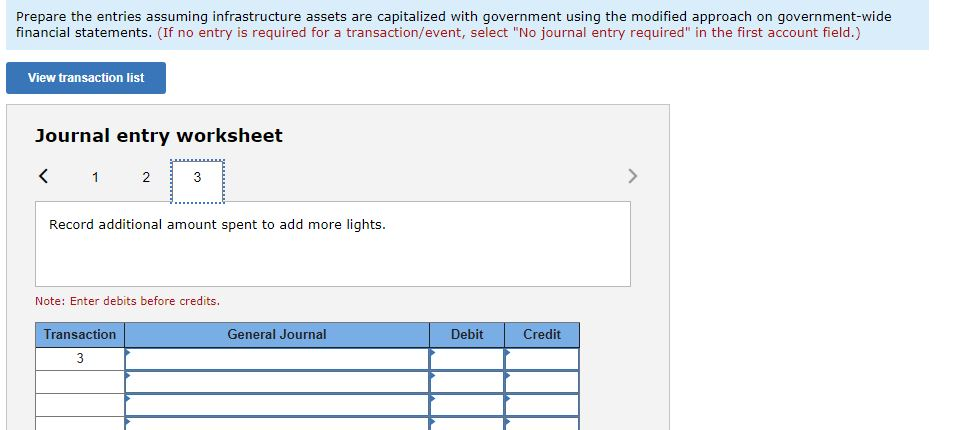

Prepare the entries assuming infrastructure assets are capitalized with government using the modified approach on government-wide financial statements.

Prepare the entries assuming infrastructure assets are capitalized with government using the modified approa financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the f View transaction list Journal entry worksheet 1 2 3 > Record street lights added. Note: Enter debits before credits. Transaction General Journal Debit Credit Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet N Record street lights added. Note: Enter debits before credits. Transaction General Journal Debit Credit Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 3 4 > N Record depreciation expense. Note: Enter debits before credits. General Journal Debit Credit Transaction 2 Required A Required B Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account View transaction list Journal entry worksheet Record cost of cleaning and repairing street lights. Note: Enter debits before credits. Transaction General Journal Debit Credit 3 Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record cost of cleaning and repairing street lights. Note: Enter debits before credits. General Journal Debit Credit Transaction 2 Prepare the entries assuming infrastructure assets are capitalized with government using the modified approach on government-wide financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet