Answered step by step

Verified Expert Solution

Question

1 Approved Answer

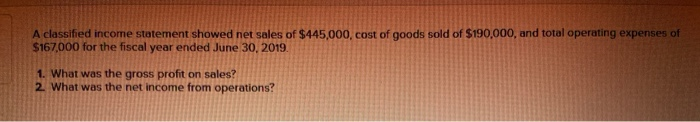

A classified income statement showed net sales of $445,000, cost of goods sold of $190,000, and total operating expenses of $167,000 for the fiscal year

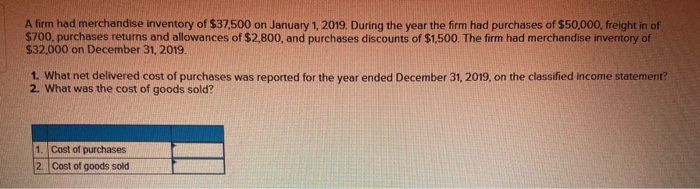

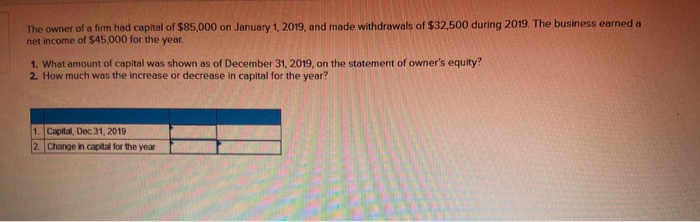

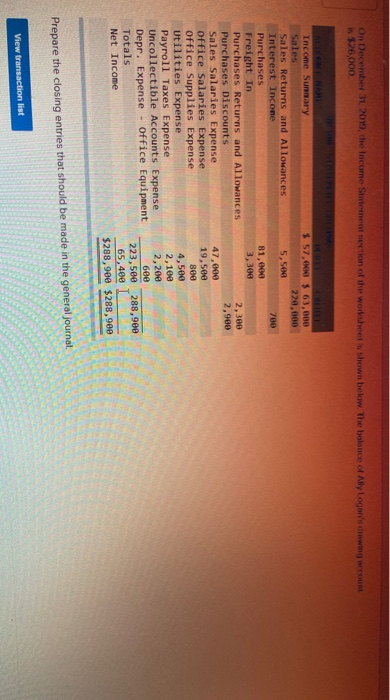

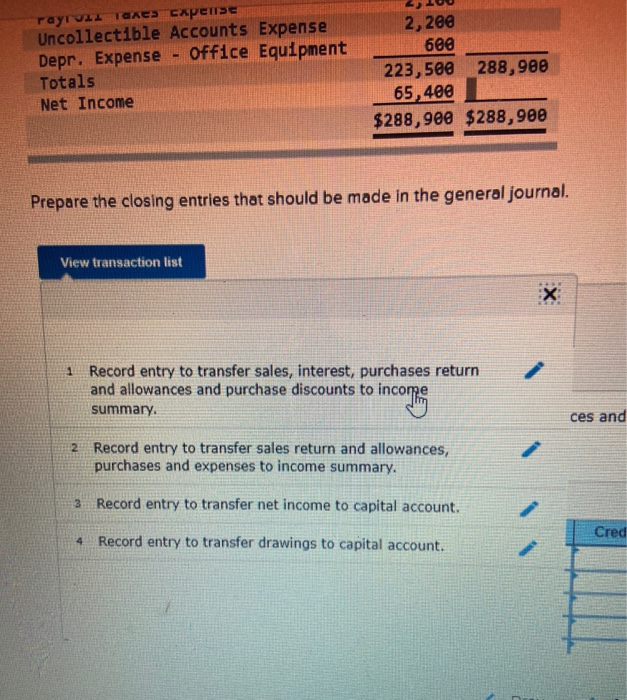

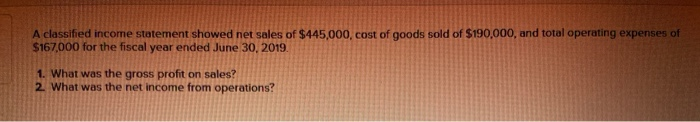

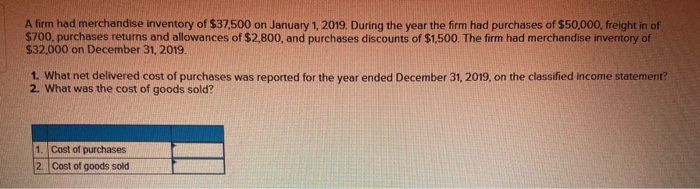

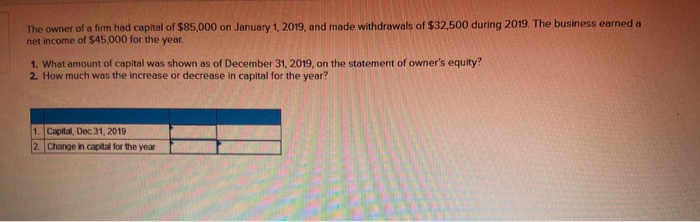

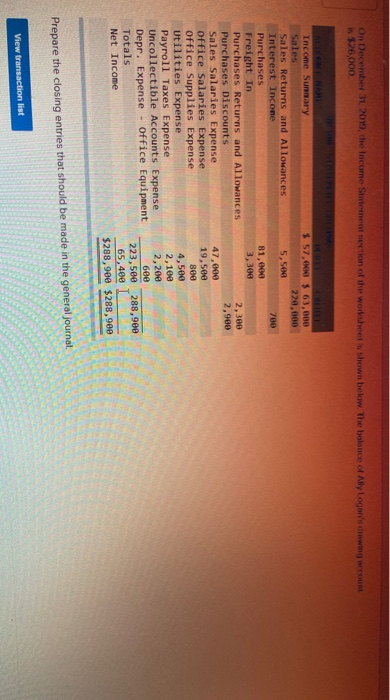

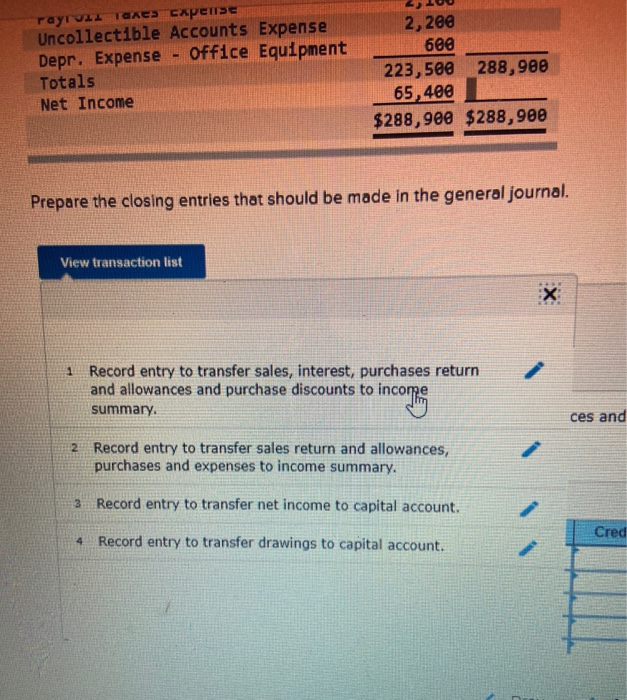

A classified income statement showed net sales of $445,000, cost of goods sold of $190,000, and total operating expenses of $167,000 for the fiscal year ended June 30, 2019 1. What was the gross profit on sales? 2. What was the net income from operations? A firm had merchandise inventory of $37.500 on January 1, 2019. During the year the firm had purchases of $50,000, freight in of $700. purchases returns and allowances of $2,800, and purchases discounts of $1,500. The firm had merchandise inventory of $32,000 on December 31, 2019. 1 What net delivered cost of purchases was reported for the year ended December 31, 2019, on the classified income statement 2. What was the cost of goods sold? 1. Cost of purchases 2. Cost of goods sold The owner of a firm had capital of $85,000 on January 1, 2019, and made withdrawals of $32,500 during 2019. The business earned a net income of $45,000 for the year. 1. What amount of capital was shown as of December 31, 2019. on the statement of owner's equity? 2. How much was the increase or decrease in capital for the year? 1. Capital, Dec 31, 2019 2 Change in capital for the year On December 31, 2019, the income Statement section of the worksheet is shown below the balance of Ally Logan'towing IN 26,000 count Income Summary 57, 63,000 220.000 5,500 700 81,00 3,300 2,300 2,900 Sales Returns and Allowances Interest Incone Purchases Freight In Purchases Returns and Allowances Purchases Discounts Sales Salaries Expense Office Salaries Expense Office Supplies Expense Utilities Expense Payroll Taxes Expense Uncollectible Accounts Expense Depr. Expense - Office Equipment Totals Net Income 47,60e 19,500 800 4,500 2,1ee 2,200 600 223,580 288,900 65,480 $288,900 $288,9ee Prepare the closing entries that should be made in the general journal View transaction list 2) 100 rayruit Taxes cxpense Uncollectible Accounts Expense Depr. Expense - Office Equipment Totals Net Income 2,200 6e@ 223,500 288,900 65,40 $288,900 $288,900 Prepare the closing entries that should be made in the general journal. View transaction list 1 Record entry to transfer sales, interest, purchases return and allowances and purchase discounts to income summary. ces and 2 Record entry to transfer sales return and allowances, purchases and expenses to income summary. 3 Record entry to transfer net income to capital account. 4 Record entry to transfer drawings to capital account. Cred

A classified income statement showed net sales of $445,000, cost of goods sold of $190,000, and total operating expenses of $167,000 for the fiscal year ended June 30, 2019 1. What was the gross profit on sales? 2. What was the net income from operations? A firm had merchandise inventory of $37.500 on January 1, 2019. During the year the firm had purchases of $50,000, freight in of $700. purchases returns and allowances of $2,800, and purchases discounts of $1,500. The firm had merchandise inventory of $32,000 on December 31, 2019. 1 What net delivered cost of purchases was reported for the year ended December 31, 2019, on the classified income statement 2. What was the cost of goods sold? 1. Cost of purchases 2. Cost of goods sold The owner of a firm had capital of $85,000 on January 1, 2019, and made withdrawals of $32,500 during 2019. The business earned a net income of $45,000 for the year. 1. What amount of capital was shown as of December 31, 2019. on the statement of owner's equity? 2. How much was the increase or decrease in capital for the year? 1. Capital, Dec 31, 2019 2 Change in capital for the year On December 31, 2019, the income Statement section of the worksheet is shown below the balance of Ally Logan'towing IN 26,000 count Income Summary 57, 63,000 220.000 5,500 700 81,00 3,300 2,300 2,900 Sales Returns and Allowances Interest Incone Purchases Freight In Purchases Returns and Allowances Purchases Discounts Sales Salaries Expense Office Salaries Expense Office Supplies Expense Utilities Expense Payroll Taxes Expense Uncollectible Accounts Expense Depr. Expense - Office Equipment Totals Net Income 47,60e 19,500 800 4,500 2,1ee 2,200 600 223,580 288,900 65,480 $288,900 $288,9ee Prepare the closing entries that should be made in the general journal View transaction list 2) 100 rayruit Taxes cxpense Uncollectible Accounts Expense Depr. Expense - Office Equipment Totals Net Income 2,200 6e@ 223,500 288,900 65,40 $288,900 $288,900 Prepare the closing entries that should be made in the general journal. View transaction list 1 Record entry to transfer sales, interest, purchases return and allowances and purchase discounts to income summary. ces and 2 Record entry to transfer sales return and allowances, purchases and expenses to income summary. 3 Record entry to transfer net income to capital account. 4 Record entry to transfer drawings to capital account. Cred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started