Answered step by step

Verified Expert Solution

Question

1 Approved Answer

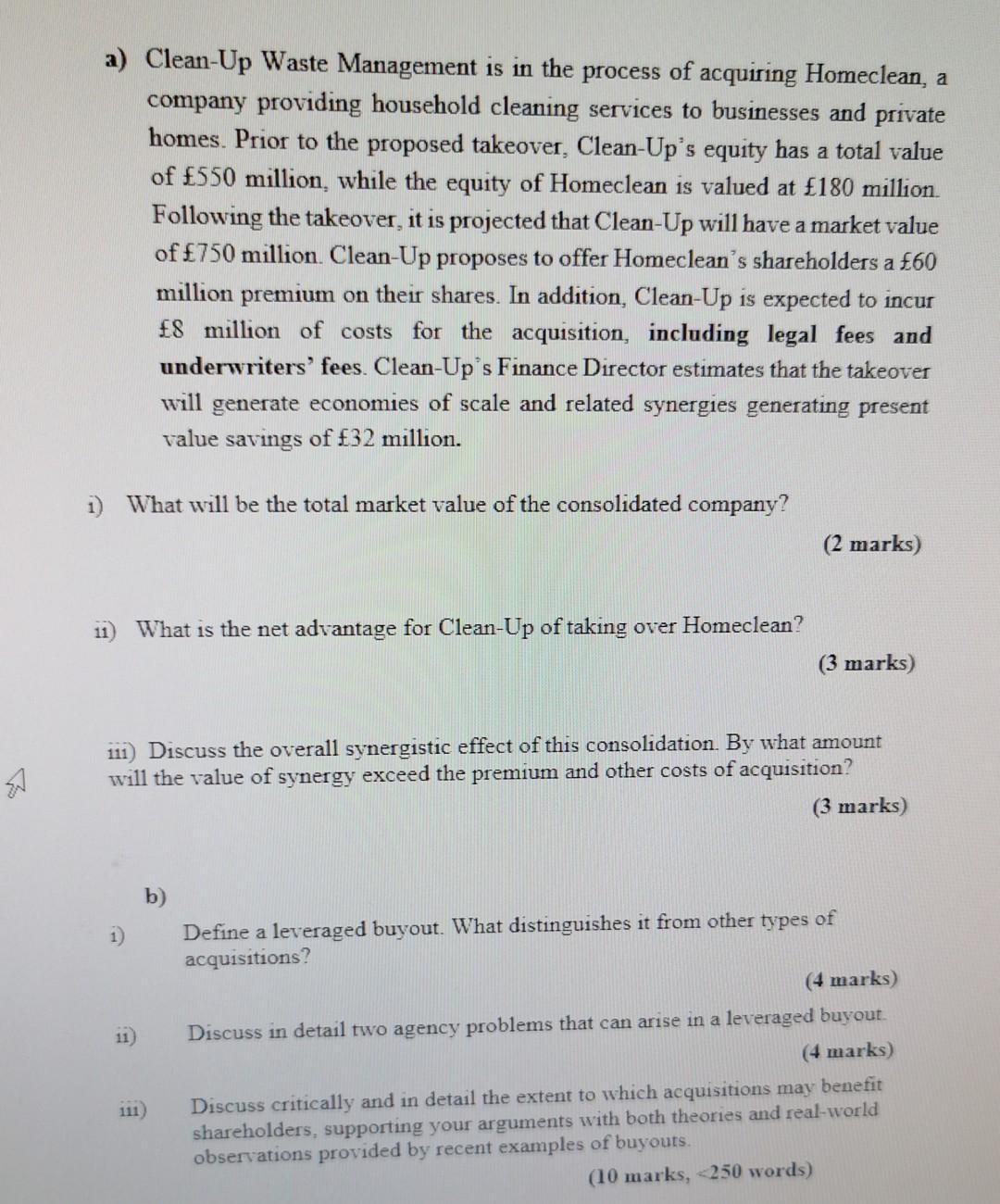

a) Clean-Up Waste Management is in the process of acquiring Homeclean, a company providing household cleaning services to businesses and private homes. Prior to the

a) Clean-Up Waste Management is in the process of acquiring Homeclean, a company providing household cleaning services to businesses and private homes. Prior to the proposed takeover, Clean-Up's equity has a total value of 550 million, while the equity of Homeclean is valued at 180 million Following the takeover, it is projected that Clean-Up will have a market value of 750 million. Clean-Up proposes to offer Homeclean's shareholders a 60 million premium on their shares. In addition, Clean-Up is expected to incur 8 million of costs for the acquisition, including legal fees and underwriters' fees. Clean-Up's Finance Director estimates that the takeover will generate economies of scale and related synergies generating present value savings of 32 million. 1) What will be the total market value of the consolidated company? (2 marks) 11 What is the net advantage for Clean-Up of taking over Homeclean? (3 marks) A 111) Discuss the overall synergistic effect of this consolidation. By what amount will the value of synergy exceed the premium and other costs of acquisition? (3 marks) b) 1) Define a leveraged buyout. What distinguishes it from other types of acquisitions? (4 marks) Discuss in detail two agency problems that can arise in a leveraged buyout. (4 marks) Discuss critically and in detail the extent to which acquisitions may benefit shareholders, supporting your arguments with both theories and real-world observations provided by recent examples of buyouts. (10 marks, 250 words) 111 a) Clean-Up Waste Management is in the process of acquiring Homeclean, a company providing household cleaning services to businesses and private homes. Prior to the proposed takeover, Clean-Up's equity has a total value of 550 million, while the equity of Homeclean is valued at 180 million Following the takeover, it is projected that Clean-Up will have a market value of 750 million. Clean-Up proposes to offer Homeclean's shareholders a 60 million premium on their shares. In addition, Clean-Up is expected to incur 8 million of costs for the acquisition, including legal fees and underwriters' fees. Clean-Up's Finance Director estimates that the takeover will generate economies of scale and related synergies generating present value savings of 32 million. 1) What will be the total market value of the consolidated company? (2 marks) 11 What is the net advantage for Clean-Up of taking over Homeclean? (3 marks) A 111) Discuss the overall synergistic effect of this consolidation. By what amount will the value of synergy exceed the premium and other costs of acquisition? (3 marks) b) 1) Define a leveraged buyout. What distinguishes it from other types of acquisitions? (4 marks) Discuss in detail two agency problems that can arise in a leveraged buyout. (4 marks) Discuss critically and in detail the extent to which acquisitions may benefit shareholders, supporting your arguments with both theories and real-world observations provided by recent examples of buyouts. (10 marks, 250 words) 111

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started