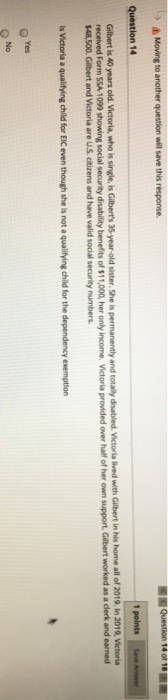

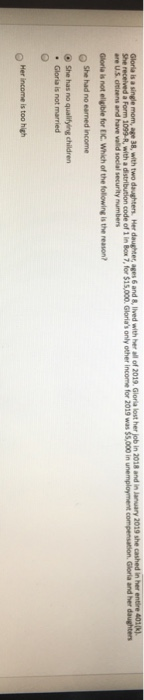

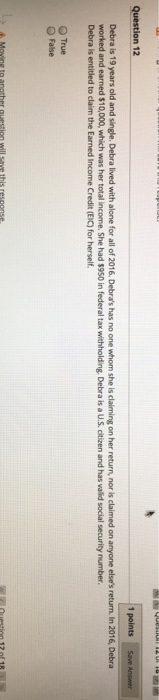

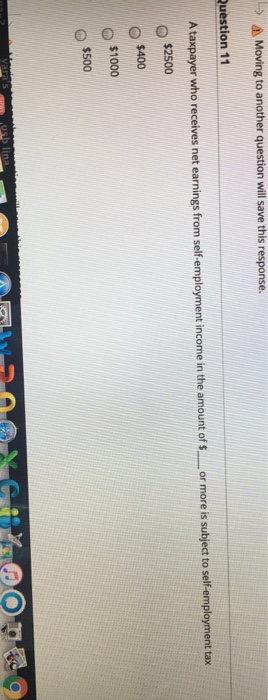

>> A Click Submit to complete this assessment. uestion 18 To qualify for earned income credit, a child must be claimed as a dependent on the taxpayers tax return O True O False A Click Submit to complete this assessment. OLOILOLOWTOOXCEE MacBook Pro Question 17 You may be eligible for Earned Income Credit if you have no children True False A Moving to another question will save this response. Question 16 What is the maximum age to qualify for EIC without a child A Moving to another question will save this response. ana-2 yara's usb lina. Mullig wu another question will save this response. Question 15 To qualify for Earned Income Credit you must have a valid social security number True False - A Moving to another question will save this response. Dal -2 yara's 2 usb lina OLGODOVO@W700 Question 14 of 10 Moving to another question will save this response. Question 14 1 points Save Awwer Gilbert is 40 years old. Victoria, who is single, is Gilbert's 35-year-old sister. She is permanently and totally disabled. Victoria lived with Gilbert in his home all of 2019. In 2019, Victoria received Form SSA-1099 showing social security disability benefits of $11,000,her only income. Victoria provided over half of her own support. Gilbert worked as a dark and earned $48,500, Gilbert and Victoria are U.S. citizens and have valid social security numbers. Is Victoria a qualifying child for EIC even though she is not a qualifying child for the dependency exemption oo Gloria is a single mom age 38, with two daughter. Her daughter, ages 6 and lived with her all of 2019. Gloria lost her job in 2018 and in January 2019 she cashed in her entire 401 She received a Form 1099-R, with a distribution code of 1 in Box 7 for $15,000. Gloria's only other income for 2019 was $5,000 in unemployment compensation. Gloria and her daughters are US cities and have vaid social security numbers Gloria is not eligible for IC. Which of the following is the reason? She had no earned income She has no qualifying children . Gloria is not married Mer income is too high Question 12 1 points Save Answer Debra is 19 years old and single. Debra lived with alone for all of 2016. Debra's has no one whom she is claiming on her return, nor is claimed on anyone else's return. In 2016, Debra worked and earned $10,000, which was her total income. She had $950 in federal tax withholding. Debra is a U.S. citizen and has valid social security number. Debra is entitled to claim the Earned Income Credit (EIC) for herself. True False Maying to another Question will this response question 17 of 18 A Moving to another question will save this response. Question 11 A taxpayer who receives net earnings from self-employment income in the amount of $_or more is subject to self-employment tax $2500 $400 $1000 $500 SALOMOO