Answered step by step

Verified Expert Solution

Question

1 Approved Answer

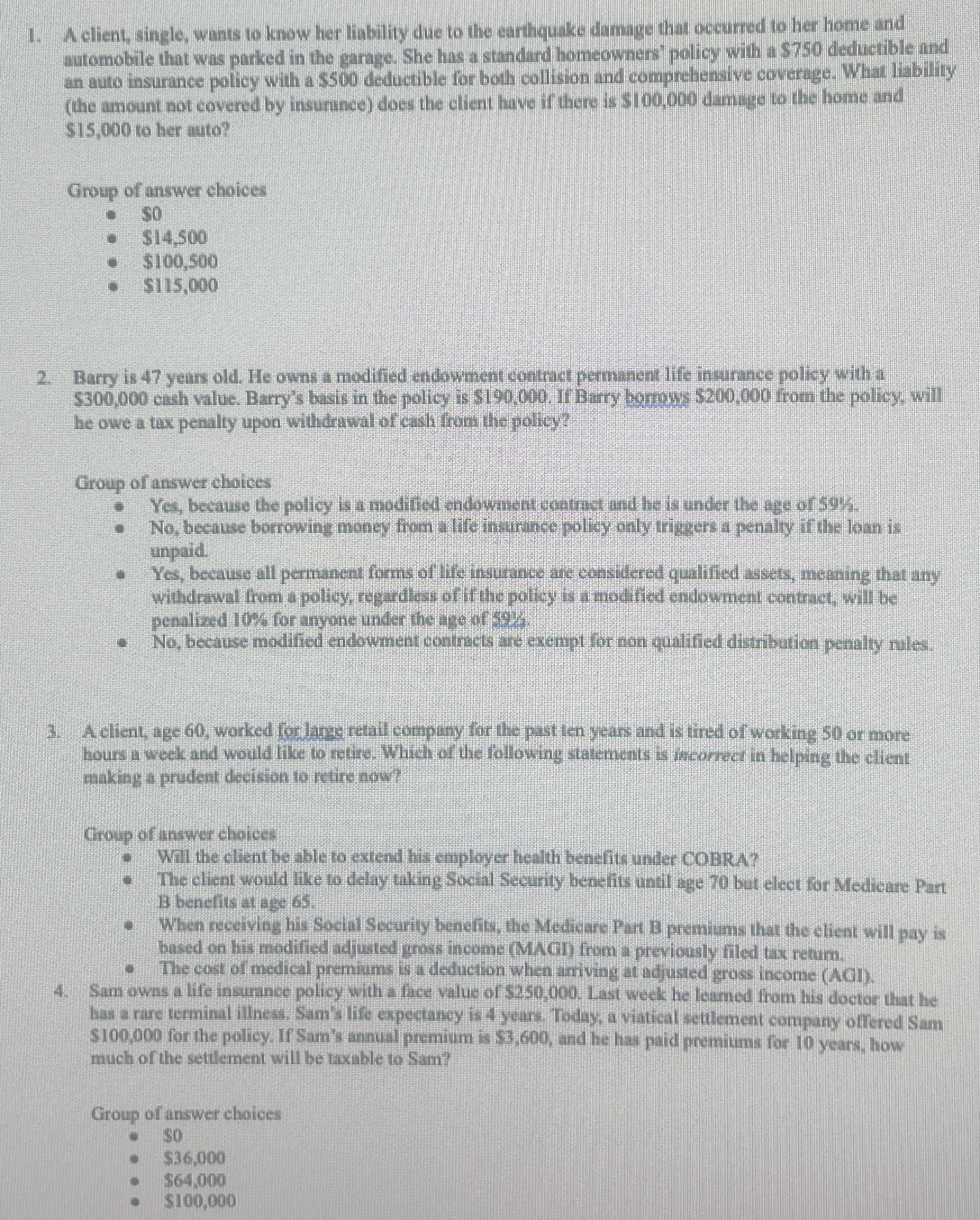

A client, single, wants to know her lisbility due to the carthquake damage that oceurred to her home and aufomokile that was parked in the

A client, single, wants to know her lisbility due to the carthquake damage that oceurred to her home and aufomokile that was parked in the garage She hac a standard homeowners' policy with a $ deductible and an auto insurance policy wilh a $ deductible for both oollision and comprehensive coveruge. What liability the amount not covered by insurnnce does the client have if there is $ damuge to the home and $ to her auto?

Group of answer choices

$

$

$

$

Barry is years old. He owns a modified endowment contract permment life insurance policy with a $ eash value. Barry's basis in the policy is $ Ir Barry bormos $ from the policy, will he owe a tax penally upon withdrawal of ceili frum the pollicy?

Group of answer cholices

Yes, because the policy is a modilict mondownent entint and he is under the age of

No because bortowing money from life in urinee policy only triggers a penalty if the loan is unputid.

Yes, because all permanent forms of life insurante we consiliered qualified assets, meaning that any withdrwal from a policy, regerdles of ti the poltey as a nodified endowment contract, will be penilized e for anyone under the wic uf wow.

No betause modified endowment coninets are exermpt for non qualified distribution peralty niles.

A client, age worked for laree retail compiny for the past ten years and is tind of working or more hours a week and would like to retire. Which of the folloving statements is weorrect in helping the client making a prudent decikton to retire now?

Croup of answer choices

Wil the client be able to extend his cmployer helt th benefits under COBRA?

The ctical would rite to delay takane Sochal Secirity benefs until age bat elect for Medicare Part B bencits at lage s

When receiviog his Sodat Securily benerit, the Medicare Pert B premiums that the elient will pay is bosed on lis modified adjusted gress income MACI from a previously fled tux retum.

The cost of medical preniums is a deduction when ariving at sadusted gross income AGI

Sam owns a life insurance policy with a face value of $ lest week he leamed trom his doctor that he has a rare terminal illnes: Samm life expectancy is years. Today, a viatical wetlement company offered Sam $ for the policy. If Sam's annual premium is $ and he has paid premiums for years, how much of the settement will be taxable to Sam?

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started