Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A close corporation is a legal entity, which implies that it is not liable to pay for obligations and can acquire assets in its own

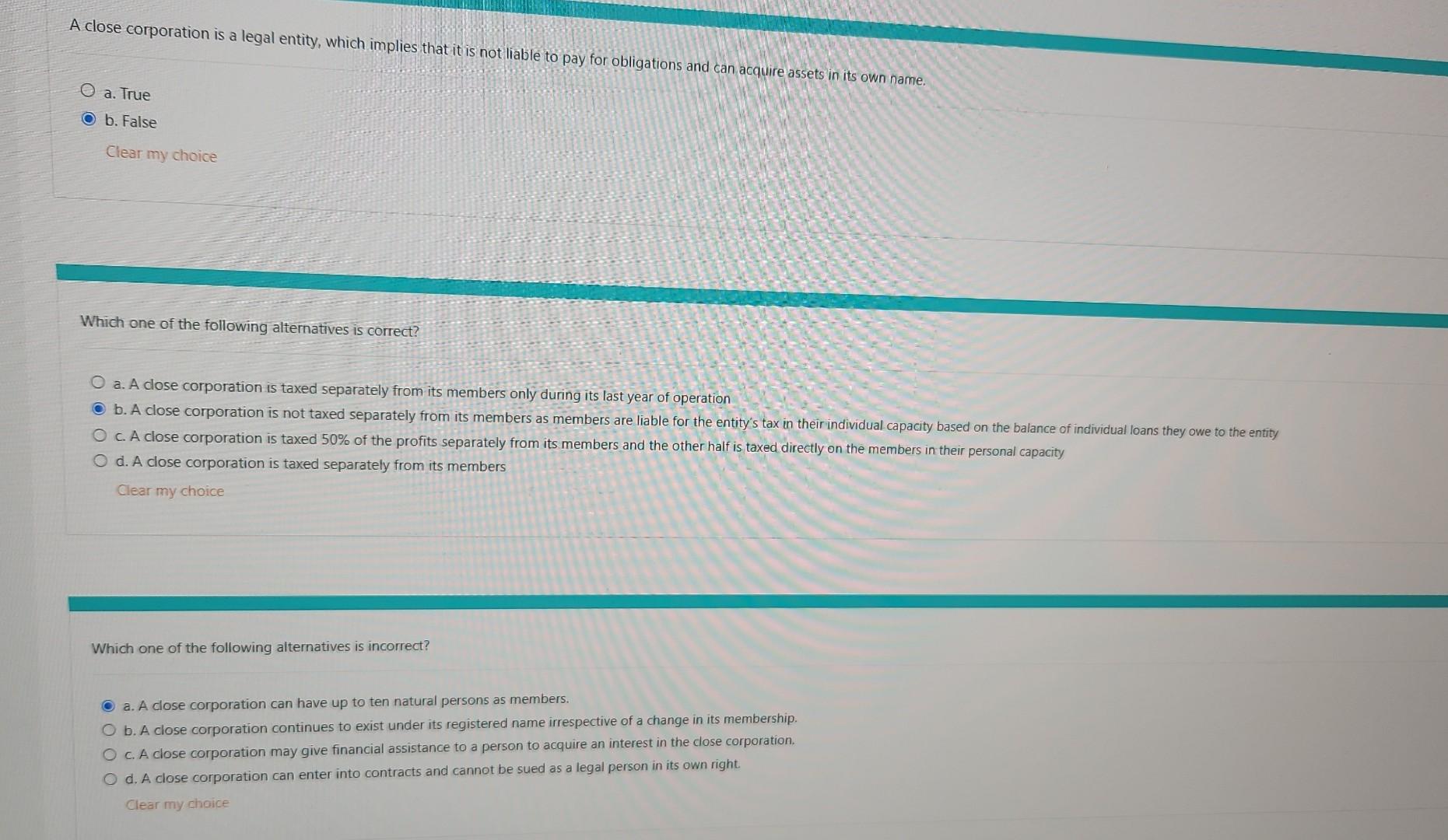

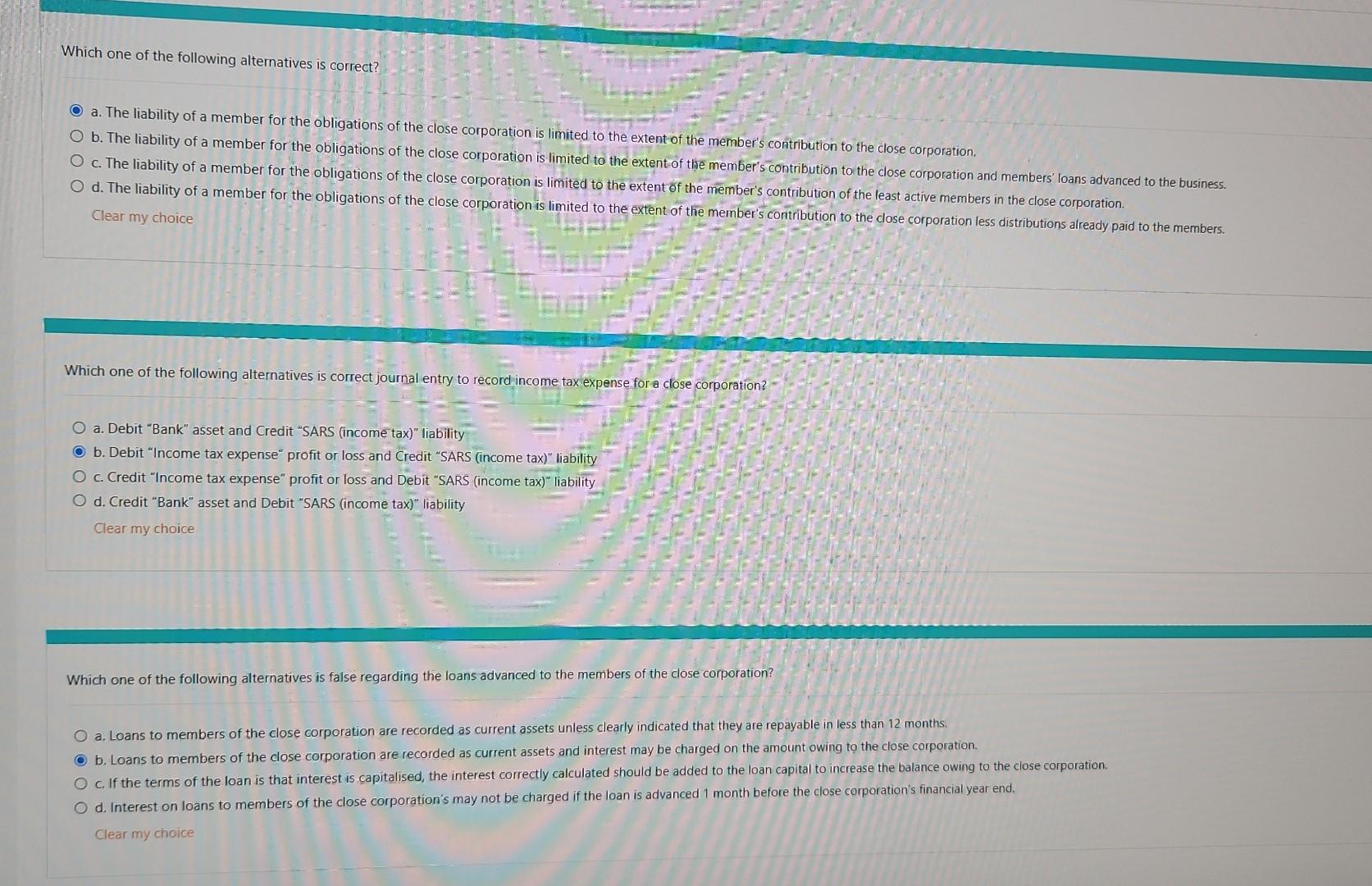

A close corporation is a legal entity, which implies that it is not liable to pay for obligations and can acquire assets in its own name. a. True b. False Clear my choice Which one of the following alternatives is correct? a. A close corporation is taxed separately from its members only during its last year of operation b. A close corporation is not taxed separately from its members as members are liable for the entity's tax in their individual capacity based on the balance of individual loans they owe to the entity c. A close corporation is taxed 50% of the profits separately from its members and the other half is taxed directly on the members in their personal capacity d. A close corporation is taxed separately from its members Clear my choice Which one of the following alternatives is incorrect? a. A close corporation can have up to ten natural persons as members. b. A close corporation continues to exist under its registered name irrespective of a change in its membership. c. A close corporation may give financial assistance to a person to acquire an interest in the close corporation. d. A close corporation can enter into contracts and cannot be sued as a legal person in its own right. Clear my choice Which one of the following alternatives is correct? a. The liability of a member for the obligations of the close corporation is limited to the extent of the member's contribution to the close corporation. b. The liability of a member for the obligations of the close corporation is limited to the extent of the member's contribution to the close corporation and members' loans advanced to the business. c. The liability of a member for the obligations of the close corporation is limited to the extent of the member's contribution of the least active members in the close corporation. d. The liability of a member for the obligations of the close corporation is limited to the extent of the member's contribution to the close corporation less distributions already paid to the members. Clear my choice Which one of the following alternatives is correct journal entry to record income tax expense for a close corporation? a. Debit "Bank" asset and Credit "SARS (income tax)" liability b. Debit "Income tax expense" profit or loss and Credit "SARS (income tax)" liability c. Credit "Income tax expense" profit or loss and Debit "SARS (income tax)" liability d. Credit "Bank" asset and Debit "SARS (income tax)" liability Clear my choice Which one of the following alternatives is false regarding the loans advanced to the members of the close corporation? a. Loans to members of the close corporation are recorded as current assets unless clearly indicated that they are repayable in less than 12 months. b. Loans to members of the close corporation are recorded as current assets and interest may be charged on the amount owing to the close corporation. c. If the terms of the loan is that interest is capitalised, the interest correctly calculated should be added to the loan capital to increase the balance owing to the close corporation. d. Interest on loans to members of the close corporation's may not be charged if the loan is advanced 1 month before the close corporation's financial year end. Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started