Answered step by step

Verified Expert Solution

Question

1 Approved Answer

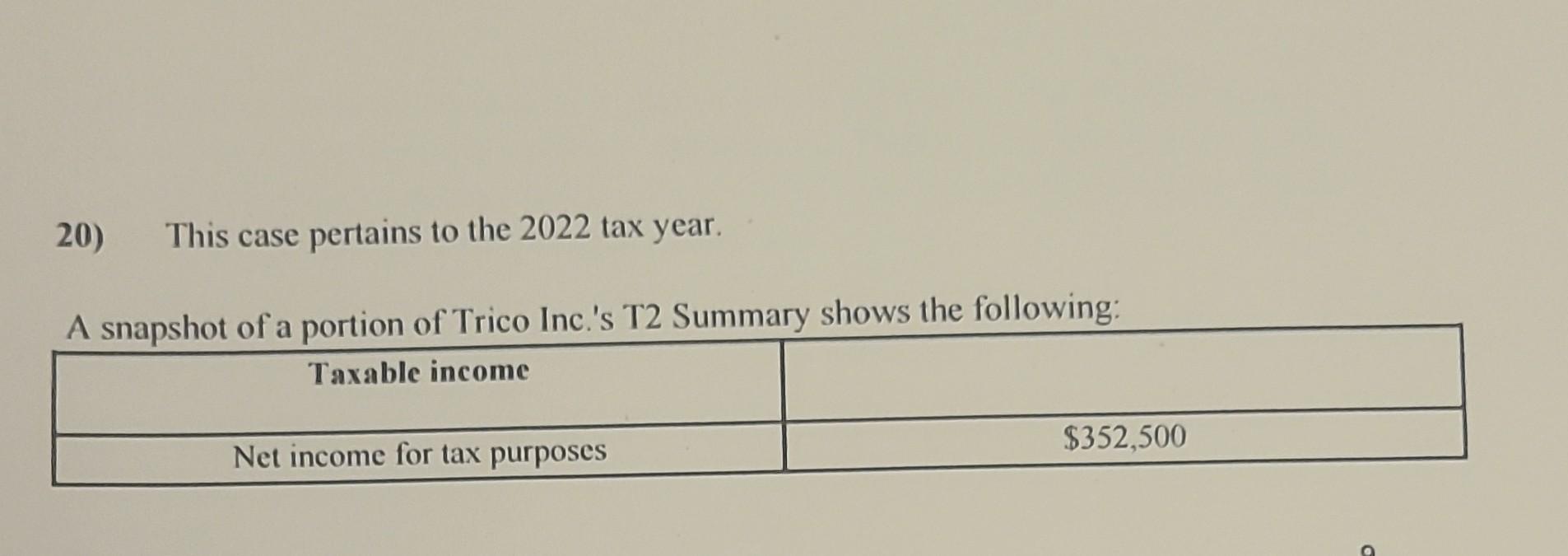

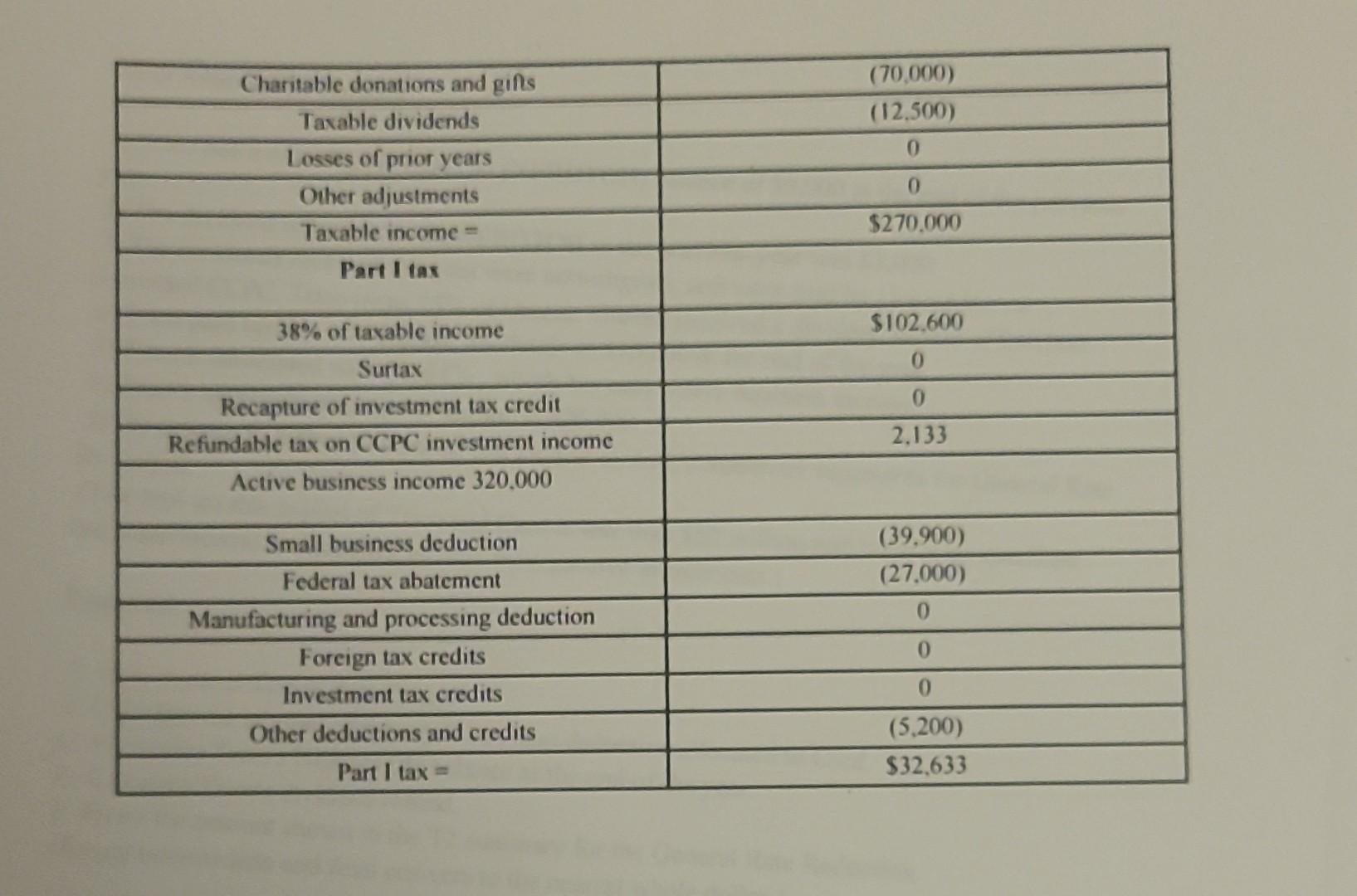

A cnanchat of a nortion of Trico Inc.'s T2 Summary shows the following: begin{tabular}{|c|c|} hline Charitable donations and gifs & (70,000) hline Taxable dividends

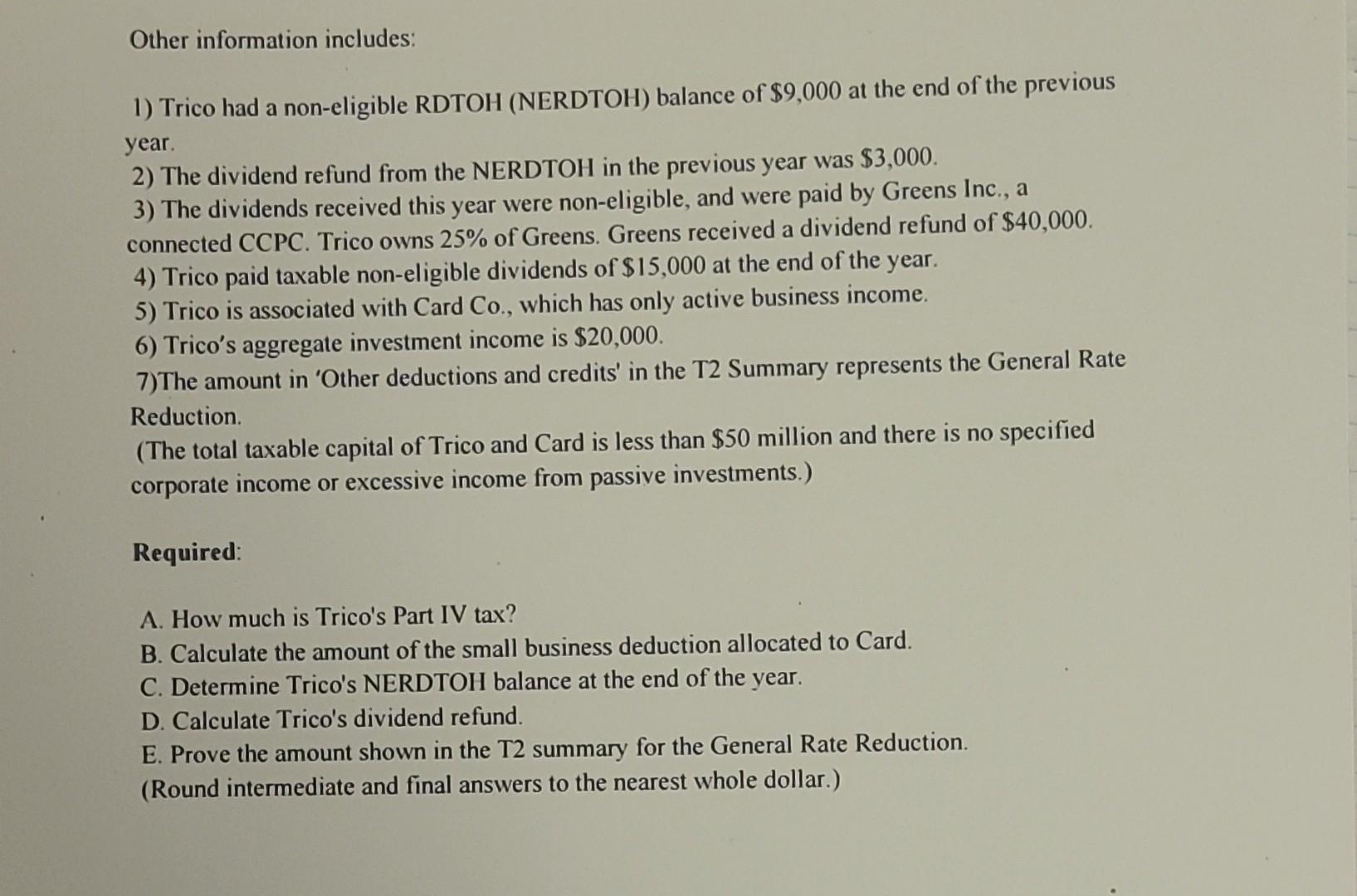

A cnanchat of a nortion of Trico Inc.'s T2 Summary shows the following: \begin{tabular}{|c|c|} \hline Charitable donations and gifs & (70,000) \\ \hline Taxable dividends & (12,500) \\ \hline Losses of prior years & 0 \\ \hline Other adjustments & $270,000 \\ \hline Taxable income = & \\ \hline Part I tax & $102,600 \\ \hline 38% of taxable income & 0 \\ \hline Surtax & 0 \\ \hline Recapture of investment tax credit & 2,133 \\ \hline Refundable tax on CCPC investment income & \\ \hline Active business income 320,000 & (39,900) \\ \hline Small business deduction & (27,000) \\ \hline Federal tax abatement & 0 \\ \hline Manufacturing and processing deduction & 0 \\ \hline Foreign tax credits & 0 \\ \hline Investment tax credits & (5,200) \\ \hline Other deductions and credits & $32,633 \\ \hline Part I tax = & \\ \hline \end{tabular} Other information includes: 1) Trico had a non-eligible RDTOH (NERDTOH) balance of $9,000 at the end of the previous year. 2) The dividend refund from the NERDTOH in the previous year was $3,000. 3) The dividends received this year were non-eligible, and were paid by Greens Inc., a connected CCPC. Trico owns 25% of Greens. Greens received a dividend refund of $40,000. 4) Trico paid taxable non-eligible dividends of $15,000 at the end of the year. 5) Trico is associated with Card Co., which has only active business income. 6) Trico's aggregate investment income is $20,000. 7)The amount in 'Other deductions and credits' in the T2 Summary represents the General Rate Reduction. (The total taxable capital of Trico and Card is less than $50 million and there is no specified corporate income or excessive income from passive investments.) Required: A. How much is Trico's Part IV tax? B. Calculate the amount of the small business deduction allocated to Card. C. Determine Trico's NERDTOH balance at the end of the year. D. Calculate Trico's dividend refund. E. Prove the amount shown in the T2 summary for the General Rate Reduction. (Round intermediate and final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started