Answered step by step

Verified Expert Solution

Question

1 Approved Answer

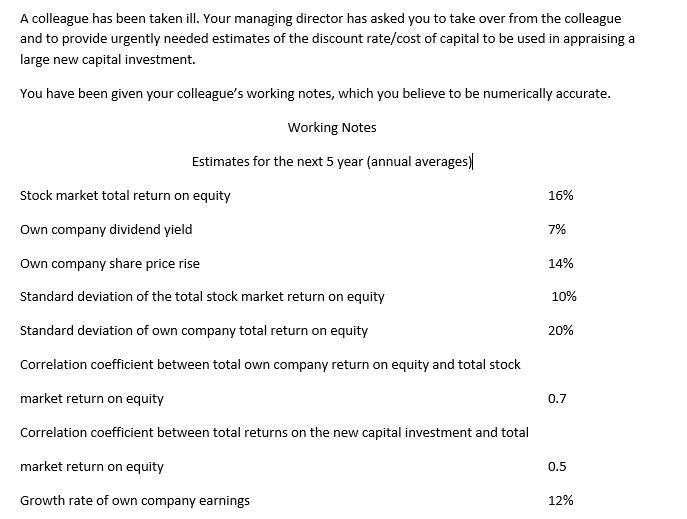

A colleague has been taken ill. Your managing director has asked you to take over from the colleague and to provide urgently needed estimates

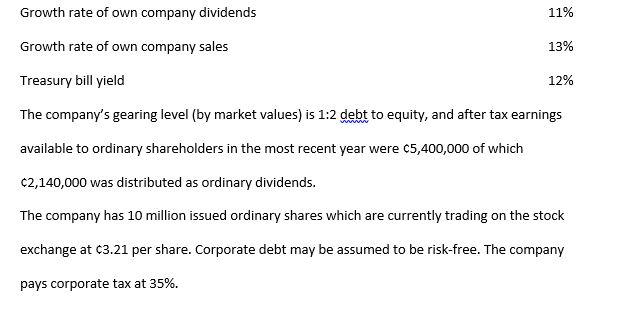

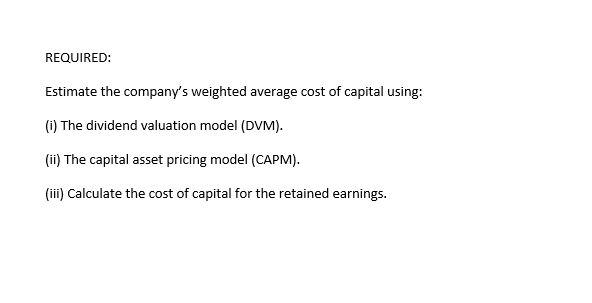

A colleague has been taken ill. Your managing director has asked you to take over from the colleague and to provide urgently needed estimates of the discount rate/cost of capital to be used in appraising a large new capital investment. You have been given your colleague's working notes, which you believe to be numerically accurate. Working Notes Estimates for the next 5 year (annual averages) Stock market total return on equity 16% Own company dividend yield 7% Own company share price rise 14% Standard deviation of the total stock market return on equity 10% Standard deviation of own company total return on equity 20% Correlation coefficient between total own company return on equity and total stock market return on equity 0.7 Correlation coefficient between total returns on the new capital investment and total market return on equity 0.5 Growth rate of own company earnings 12% Growth rate of own company dividends 11% Growth rate of own company sales 13% Treasury bill yield 12% The company's gearing level (by market values) is 1:2 debt to equity, and after tax earnings available to ordinary shareholders in the most recent year were c5,400,000 of which c2,140,000 was distributed as ordinary dividends. The company has 10 million issued ordinary shares which are currently trading on the stock exchange at c3.21 per share. Corporate debt may be assumed to be risk-free. The company pays corporate tax at 35%. REQUIRED: Estimate the company's weighted average cost of capital using: (i) The dividend valuation model (DVM). (ii) The capital asset pricing model (CAPM). (iii) Calculate the cost of capital for the retained earnings.

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Cost of equity using a DVM 1477 b CAPM 1433 To calculate weighted average cost of capital WACC we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started