Question

A colleague who is interested in studying the causal effects of disclosure on innovation needs your help. She has been reviewing the literature and found

A colleague who is interested in studying the causal effects of disclosure on innovation needs your help. She has been reviewing the literature and found there are three main channels through which financial reporting may have an effect over corporate innovation. She mentioned these channels are:

- Financing Channel: Better quality of disclosure may foster innovation by reducing information asymmetry between managers and capital providers, leading to more external funds available to finance innovations at a lower cost.

- Compensation Channel: Disclosure may facilitate monitoring and contracting and mitigate moral hazard problems (i.e., risk aversion/effort aversion) that hinder innovation, but linking compensation to disclosure may also induce myopic behaviour.

- Learning Channel: More/better disclosure increase the costs related with revealing proprietary information to competitors, which reduces the value of the innovation.

She mentioned that it is likely that the relationship between disclosure and innovation is endogenous for a few reasons (i.e., reverse causality, omitted variables, etc.), and that a simple OLS multivariate regression model will not help her uncover a causal relationship. However, she has an idea and wants to know what do you think about it. Your colleague tells you that she heard about a change in a regulation that she might use to implement a difference-indifferences (DID) model. She goes on and tells you about the Securities and Exchange Commission (SEC) Act Rule 12h-6:

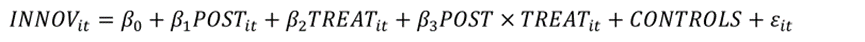

"...back in March 2007, after 2 years of discussions and different proposals, the SEC implemented Rule 12h-6 this rule makes it relatively for cross-listed firms to deregister from the United States (US) market and terminate their reporting obligations associated with US exchange listings when US investors are not very much interested on these firms. Prior to the passage of Rule 12h-6, a foreign private issuer (FPI) who wished to deregister its securities had to meet the following conditions: (1) the FPI's security was held by fewer than 300 US record holders or (2) the security was held by fewer than 500 US record holders around the world for FPIs with assets below US$10 million. Proving this was very costly for the firms. Rule 12h-6, simplifies the deregistration rules for FPIs, after the new rule an FPI can terminate its reporting obligations if its average daily trading volume in the US does not exceed 5% of its worldwide average daily trading volume. Information on trading volume is easier to get than information relative to individual stock holders, making it easier for FPIs to show that the conditions to deregister are met. Moreover, prior to Rule 12h-6 FPIs could only suspend their reporting obligations rather than terminate, and the reporting exemption criteria had to be assessed repeatedly on an annual basis." Then, she says: "..I think I can use the implementation of Rule 12h-6 as a source of exogenous variation in disclosure and use a difference-in-difference approach to test what is the causal effect of disclosure on innovation" Finally, she describes to you her research design: "... to empirically examine the effect of disclosure on firms' innovation, I will employ a DID design and estimate the following regression using panel data (i denotes firms and t years):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started