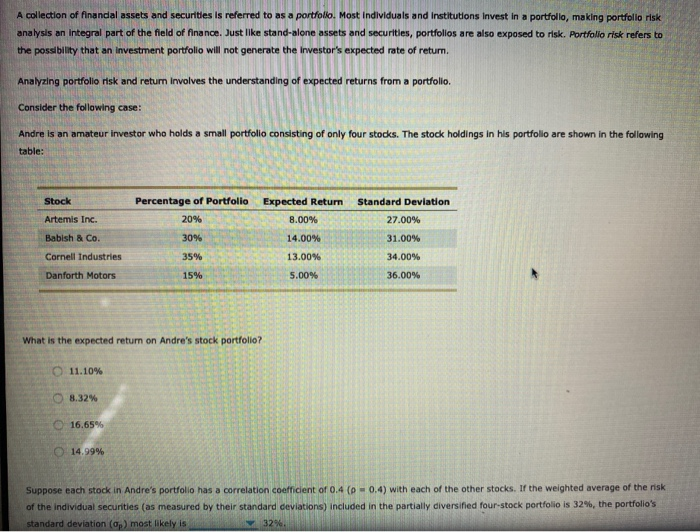

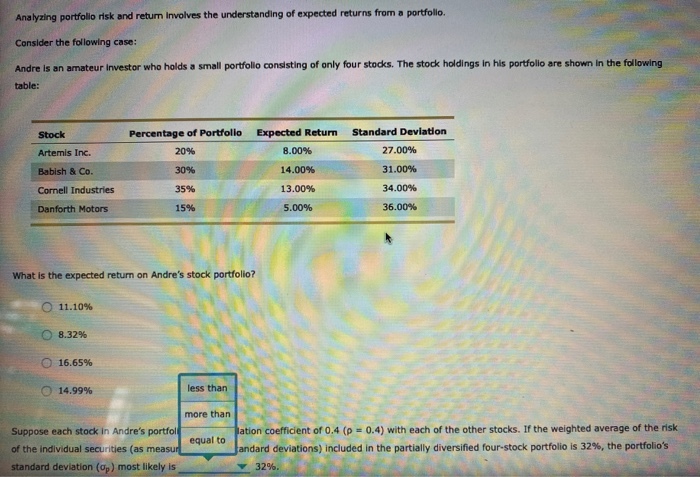

A collection of financial assets and securities is referred to as a portfolio. Most Individuals and Institutions Invest in a portfolio, making portfolio risk analysis an integral part of the field of hinance. Just like stand-alone assets and securities, portfolios are also exposed to risk. Portfolio risk refers to the possibility that an investment portfolio will not generate the investor's expected rate of retum. Analyzing portfolio risk and retum Involves the understanding of expected returns from a portfolio. Consider the following case: Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following Percentage of Portfolio Standard Deviation 27.00% Stock Artemis Inc. Babish & Co. Cornell Industries Danforth Motors 30% Expected Return 8.00% 14.00 13.00% 5.00% 14.00% 31.00% 34.00% 36.00% What is the expected return on Andre's stock portfolio? 11.10% 8.32% 16.65% 14.99% Suppose each stock in Andre's portfolio has a correlation coefficient of 0.4 ( 0.4) with each of the other stocks. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified four-stock portfolio is 32%, the portfolio's standard deviation (op) most likely is Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio Consider the following case: Andre is an amateur Investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following table: Stock Expected Return 8.00% Artemis Inc. Babish & Co. Cornell Industries Danforth Motors Percentage of Portfolio 20% 30% 35% 15% 14.00% 13.00% Standard Deviation 27.00% 31.00% 34.00% 36.00% 5.00% What is the expected return on Andre's stock portfolio? O 11.10% 8.32% 16.65% 14.99% less than more than Suppose each stock in Andre's portfolk ation coefficient of 0.4 ( 0.4) with each of the other stocks. If the weighted average of the risk of the individual securities (as measur_ equal to Jandard deviations) included in the partially diversified four-stock portfolio is 32%, the portfolio's standard deviation (op) most likely is