Answered step by step

Verified Expert Solution

Question

1 Approved Answer

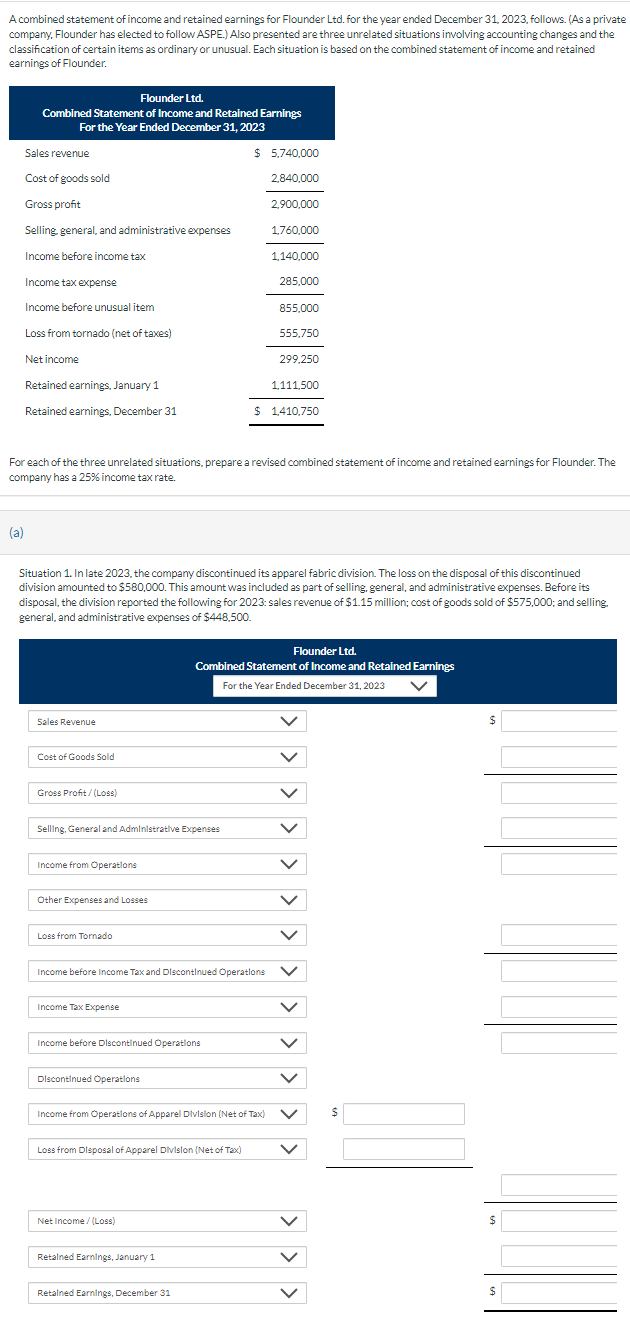

A combined statement of income and retained earnings for Flounder Ltd . for the year ended December 3 1 , 2 0 2 3 ,

A combined statement of income and retained earnings for Flounder Ltd for the year ended December follows. As a private

company. Flounder has elected to follow ASPE. Also presented are three unrelated situations involving accounting changes and the

classification of certain items as ordinary or unusual. Each situation is based on the combined statement of income and retained

earnings of Flounder.

For each of the three unrelated situations, prepare a revised combined statement of income and retained earnings for Flounder. The

company has a income tax rate.

a

Situation In late the company discontinued its apparel fabric division. The loss on the disposal of this discontinued

division amounted to $ This amount was included as part of selling, general, and administrative expenses. Before its

disposal, the division reported the following for : sales revenue of $ million; cost of goods sold of $; and selling.

general, and administrative expenses of $

Flounder Ltd

Combined Statement of Income and Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started