Answered step by step

Verified Expert Solution

Question

1 Approved Answer

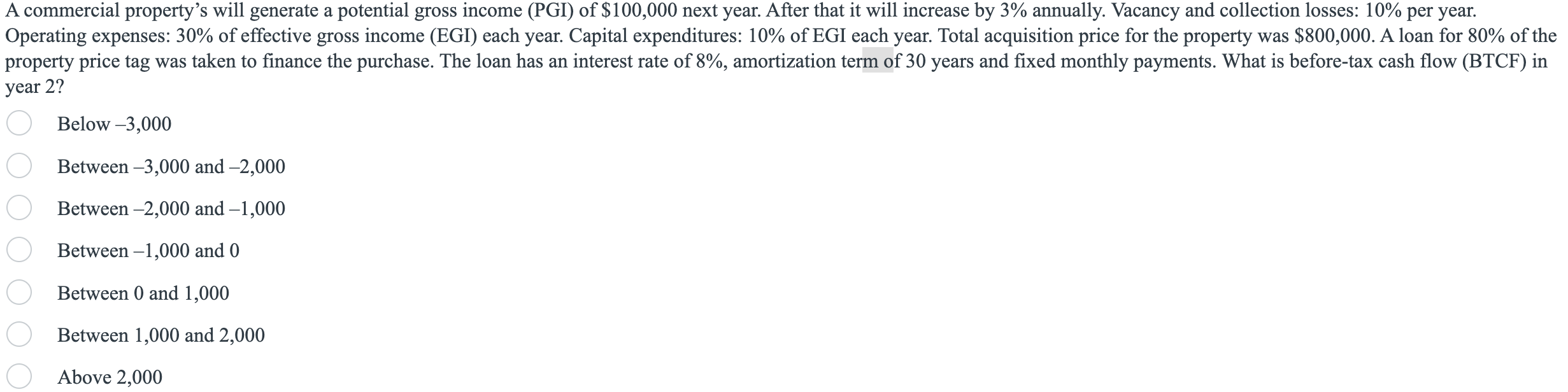

A commercial property's will generate a potential gross income (PGI) of ( $ 100,000 ) next year. After that it will increase by 3 annually.

A commercial property's will generate a potential gross income (PGI) of \\( \\$ 100,000 \\) next year. After that it will increase by \3 annually. Vacancy and collection losses: \10 per year. Operating expenses: \30 of effective gross income (EGI) each year. Capital expenditures: \10 of EGI each year. Total acquisition price for the property was \\( \\$ 800,000 \\). A loan for \80 of the property price tag was taken to finance the purchase. The loan has an interest rate of \8, amortization term of 30 years and fixed monthly payments. What is before-tax cash flow (BTCF) in year 2? Below \\( -3,000 \\) Between \\( -3,000 \\) and \\( -2,000 \\) Between \\( -2,000 \\) and \\( -1,000 \\) Between \\( -1,000 \\) and 0 Between 0 and 1,000 Between 1,000 and 2,000 Above 2,000

A commercial property's will generate a potential gross income (PGI) of \\( \\$ 100,000 \\) next year. After that it will increase by \3 annually. Vacancy and collection losses: \10 per year. Operating expenses: \30 of effective gross income (EGI) each year. Capital expenditures: \10 of EGI each year. Total acquisition price for the property was \\( \\$ 800,000 \\). A loan for \80 of the property price tag was taken to finance the purchase. The loan has an interest rate of \8, amortization term of 30 years and fixed monthly payments. What is before-tax cash flow (BTCF) in year 2? Below \\( -3,000 \\) Between \\( -3,000 \\) and \\( -2,000 \\) Between \\( -2,000 \\) and \\( -1,000 \\) Between \\( -1,000 \\) and 0 Between 0 and 1,000 Between 1,000 and 2,000 Above 2,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started