Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A commodity holding company is heavily invested in cocoa and its current portfolio is worth $4.5 million dollars. The company would like to hedge its

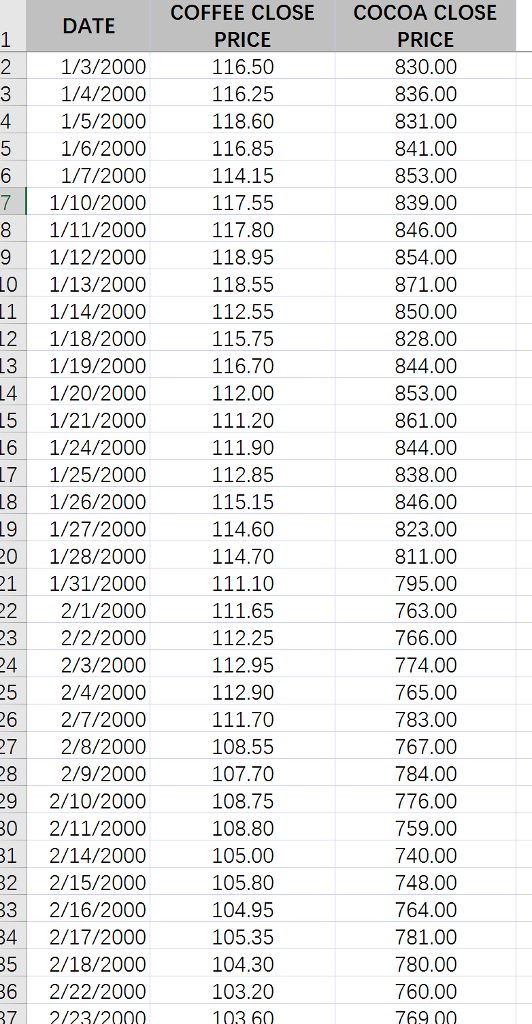

A commodity holding company is heavily invested in cocoa and its current portfolio is worth $4.5 million dollars. The company would like to hedge its current investment using coffee futures. The historical price data on cocoa and coffee is provided in FIN 4021 HW2 Q2 DATA.xlsx. Given that coffee futures trade at 148.90 cents/pound and each contract is for 37,500 pounds of coffee, what is the optimal hedge ratio and the number of contracts that the company needs to buy or sell to execute the hedge?

COFFEE CLOSE COCOA CLOSE DATE 1/3/2000 116.50 830.00 116.25 836.00 3 1/4/2000 118.60 831.00 4 1/5/2000 5 1/6/2000 116.85 841.00 6 1/7/2000 114.15 853.00 117.55 839.00 1/10/2000 117.80 846.00 8 1/11/2000 118.95 854.00 9 1/12/2000 118.55 10 1/13/2000 871.00 112.55 850.00 1 1/14/2000 115.75 828.00 12 1/18/2000 844.00 116.70 13 1/19/2000 4 1/20/2000 112.00 853.00 15 1/21/2000 111.20 861.00 16 1/24/2000 844.00 112.85 838.00 17 1/25/2000 115.15 846.00 18 1/26/2000 114.60 823.00 19 1/27/2000 20 1/28/2000 114.70 811.00 111.10 795.00 21 1/31/2000 22 2/1/2000 111.65 763.00 23 2/2/2000 112.25 766.00 24 2/3/2000 112.95 774.00 25 2/4/2000 112.900 765.00 26 2/7/2000 111.70 783.00 27 2/8/2000 108.55 767.00 28 2/9/2000 107.70 784.00 29 2/10/2000 108.75 776.00 30 2/11/2000 108.800 759.00 31 2/14/2000 105.00 740.00 32 2/15/2000 105.80 748.00 104.95 764.00 33 2/16/2000 781.00 34 2/17/2000 105.35 35 2/18/2000 104.30 780.00 36 2/22/2000 103.20 760.00 102 60 769 00 37 2/23/2000 COFFEE CLOSE COCOA CLOSE DATE 1/3/2000 116.50 830.00 116.25 836.00 3 1/4/2000 118.60 831.00 4 1/5/2000 5 1/6/2000 116.85 841.00 6 1/7/2000 114.15 853.00 117.55 839.00 1/10/2000 117.80 846.00 8 1/11/2000 118.95 854.00 9 1/12/2000 118.55 10 1/13/2000 871.00 112.55 850.00 1 1/14/2000 115.75 828.00 12 1/18/2000 844.00 116.70 13 1/19/2000 4 1/20/2000 112.00 853.00 15 1/21/2000 111.20 861.00 16 1/24/2000 844.00 112.85 838.00 17 1/25/2000 115.15 846.00 18 1/26/2000 114.60 823.00 19 1/27/2000 20 1/28/2000 114.70 811.00 111.10 795.00 21 1/31/2000 22 2/1/2000 111.65 763.00 23 2/2/2000 112.25 766.00 24 2/3/2000 112.95 774.00 25 2/4/2000 112.900 765.00 26 2/7/2000 111.70 783.00 27 2/8/2000 108.55 767.00 28 2/9/2000 107.70 784.00 29 2/10/2000 108.75 776.00 30 2/11/2000 108.800 759.00 31 2/14/2000 105.00 740.00 32 2/15/2000 105.80 748.00 104.95 764.00 33 2/16/2000 781.00 34 2/17/2000 105.35 35 2/18/2000 104.30 780.00 36 2/22/2000 103.20 760.00 102 60 769 00 37 2/23/2000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started