Question

A company adopted dollar-value LIFO in 2018. At the end of 2018, inventories were reported at $120,000, with a price index of 100. The

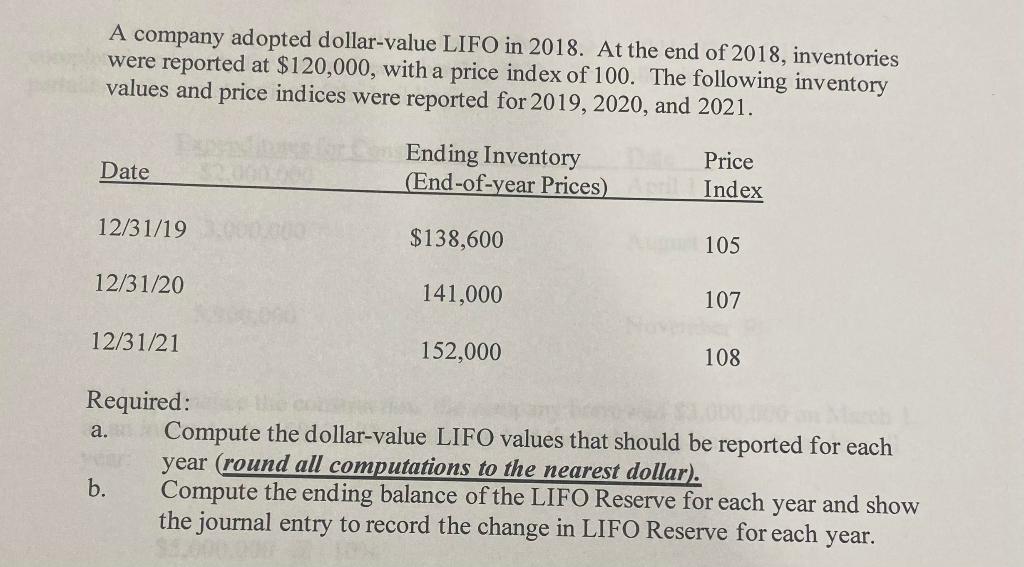

A company adopted dollar-value LIFO in 2018. At the end of 2018, inventories were reported at $120,000, with a price index of 100. The following inventory values and price indices were reported for 2019, 2020, and 2021. Ending Inventory (End-of-year Prices) Price Date Index 12/31/19 $138,600 105 12/31/20 141,000 107 12/31/21 152,000 108 Required: Compute the dollar-value LIFO values that should be reported for each year (round all computations to the nearest dollar). Compute the ending balance of the LIFO Reserve for each year and show the journal entry to record the change in LIFO Reserve for each year. a. b.

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Page 1 a The LIFO method uses LastinFirstout model The model ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Supply Chain Focused Manufacturing Planning and Control

Authors: W. C. Benton

1st edition

2901133586714 , 1133586716, 978-1133586715

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App