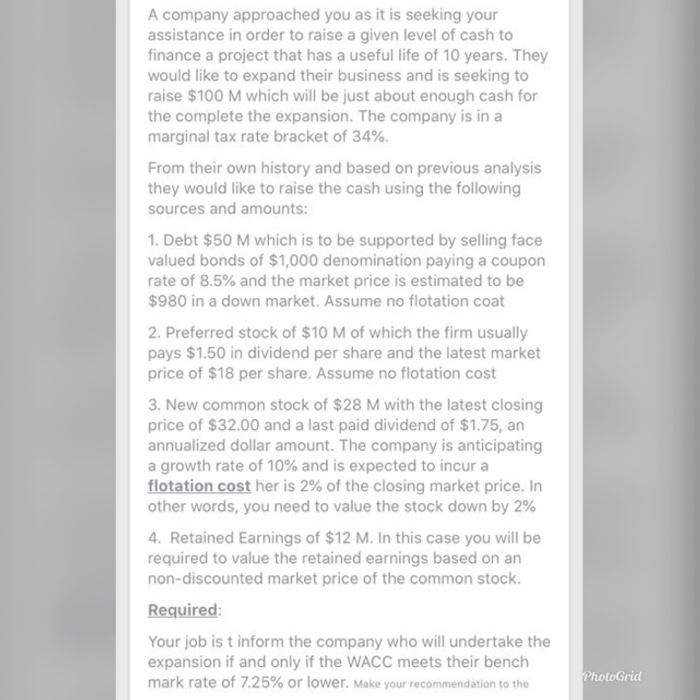

A company approached you as it is seeking your assistance in order to raise a given level of cash to finance a project that has a useful life of 10 years. They would like to expand their business and is seeking to raise $100 M which will be just about enough cash for the complete the expansion. The company is in a marginal tax rate bracket of 34%. From their own history and based on previous analysis they would like to raise the cash using the following sources and amounts: 1. Debt $50 M which is to be supported by selling face valued bonds of $1,000 denomination paying a coupon rate of 8.5% and the market price is estimated to be $980 in a down market. Assume no flotation coat 2. Preferred stock of $10 M of which the firm usually pays $1.50 in dividend per share and the latest market price of $18 per share. Assume no flotation cost 3. New common stock of $28 M with the latest closing price of $32.00 and a last paid dividend of $1.75, an annualized dollar amount. The company is anticipating a growth rate of 10% and is expected to incur a flotation cost her is 2% of the closing market price. In other words, you need to value the stock down by 2% 4. Retained Earnings of $12 M. In this case you will be required to value the retained earnings based on an non-discounted market price of the common stock. Required: Your job is t inform the company who will undertake the expansion if and only if the WACC meets their bench mark rate of 7.25% or lower. Make your recommendation to the PhotoGrid A company approached you as it is seeking your assistance in order to raise a given level of cash to finance a project that has a useful life of 10 years. They would like to expand their business and is seeking to raise $100 M which will be just about enough cash for the complete the expansion. The company is in a marginal tax rate bracket of 34%. From their own history and based on previous analysis they would like to raise the cash using the following sources and amounts: 1. Debt $50 M which is to be supported by selling face valued bonds of $1,000 denomination paying a coupon rate of 8.5% and the market price is estimated to be $980 in a down market. Assume no flotation coat 2. Preferred stock of $10 M of which the firm usually pays $1.50 in dividend per share and the latest market price of $18 per share. Assume no flotation cost 3. New common stock of $28 M with the latest closing price of $32.00 and a last paid dividend of $1.75, an annualized dollar amount. The company is anticipating a growth rate of 10% and is expected to incur a flotation cost her is 2% of the closing market price. In other words, you need to value the stock down by 2% 4. Retained Earnings of $12 M. In this case you will be required to value the retained earnings based on an non-discounted market price of the common stock. Required: Your job is t inform the company who will undertake the expansion if and only if the WACC meets their bench mark rate of 7.25% or lower. Make your recommendation to the PhotoGrid