Answered step by step

Verified Expert Solution

Question

1 Approved Answer

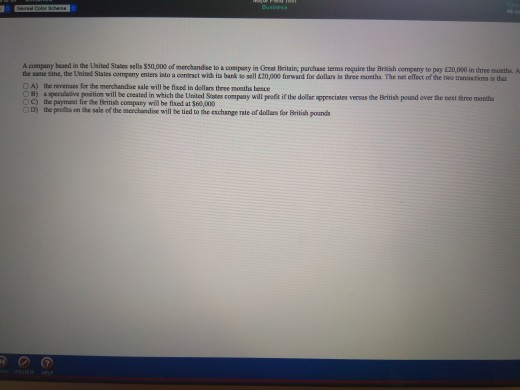

A company based in the Ulaited Staie sells $50,000 of merchandise to acompuny in Great Britain parchase terms require the Brikish company lo Saies company

A company based in the Ulaited Staie sells $50,000 of merchandise to acompuny in Great Britain parchase terms require the Brikish company lo Saies company enters into a centract with its bank to sell 120,000 forward for dollars is three months. The net effect of the two traniactions is tha D A) the revenses for the merchandise sale will be fixed in dellars three months besce D B) a peculeive position will be crealed in which the Ueitel States company will prot if the dollar appeeciates versas the British pound over he next tree mond the payment for the British company will be fixed at 560,000 OD) the peods on the sale of the merchandise will be tied to the exchange rate of dollurs for Brilish pounds A company based in the Ulaited Staie sells $50,000 of merchandise to acompuny in Great Britain parchase terms require the Brikish company lo Saies company enters into a centract with its bank to sell 120,000 forward for dollars is three months. The net effect of the two traniactions is tha D A) the revenses for the merchandise sale will be fixed in dellars three months besce D B) a peculeive position will be crealed in which the Ueitel States company will prot if the dollar appeeciates versas the British pound over he next tree mond the payment for the British company will be fixed at 560,000 OD) the peods on the sale of the merchandise will be tied to the exchange rate of dollurs for Brilish pounds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started