Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company based in the US has two subsidiaries, one in the UK (GBP) and the other in South Africa (ZAR) These subs would

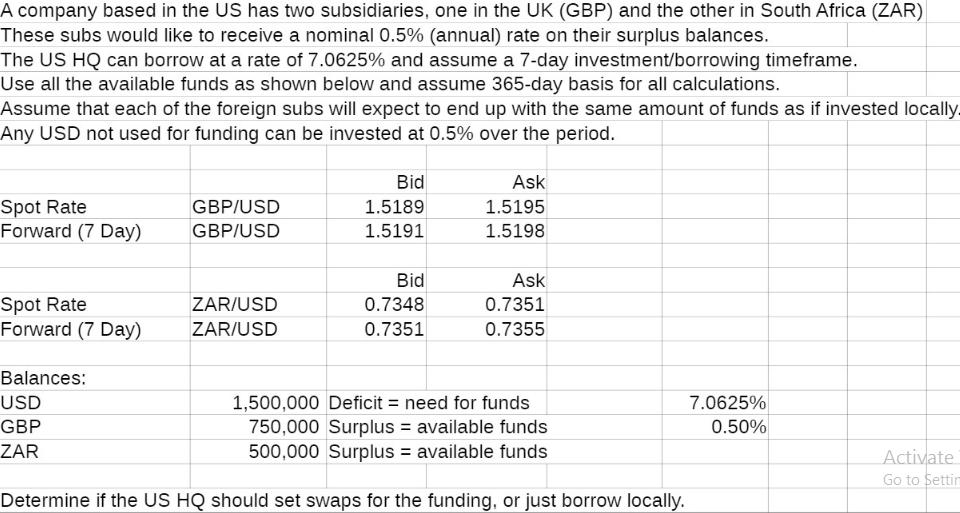

A company based in the US has two subsidiaries, one in the UK (GBP) and the other in South Africa (ZAR) These subs would like to receive a nominal 0.5% (annual) rate on their surplus balances. The US HQ can borrow at a rate of 7.0625% and assume a 7-day investment/borrowing timeframe. Use all the available funds as shown below and assume 365-day basis for all calculations. Assume that each of the foreign subs will expect to end up with the same amount of funds as if invested locally. Any USD not used for funding can be invested at 0.5% over the period. Spot Rate Forward (7 Day) Spot Rate Forward (7 Day) Balances: USD GBP ZAR GBP/USD GBP/USD ZAR/USD ZAR/USD Bid 1.5189 1.5191 Bid 0.7348 0.7351 Ask 1.5195 1.5198 Ask 0.7351 0.7355 1,500,000 Deficit = need for funds 750,000 Surplus = available funds 500,000 Surplus = available funds Determine if the US HQ should set swaps for the funding, or just borrow locally. 7.0625% 0.50% Activate Go to Settin

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the US HQ should set up swaps for funding or just borrow locally we need to com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started