Question: A company buys a 2-year zero coupon bond that will mature for $10,000. It plans to use this asset to make two payments to a

A company buys a 2-year zero coupon bond that will mature for $10,000. It plans to use this asset to make two payments to a customer, the first in one year and the second in 3 years. The effective annual rate of interest is 8%. Determine the amounts of the two payments, respectively, in order to satisfy the first two conditions of Redington immunization. (15 pts)

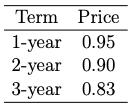

Anna expects to invest $1,000 at the beginning of the third year, and to invest $800 at the beginning of the fourth year. How much is she expected to accumulate by the end of the fourth year? (15 pts) The CEO of company TXC wants to sign a 3-year interest rate swap with level annual interest rate R. The notional amount in the first year is 10 million dollars, 12 million in the second year, and 14 million in the third year. The swap has a settlement period of 1 year, with the first settlement date one year from now. The prices for zero coupon bonds per $1.00 of maturity value are provided. Determine the fair value of R.

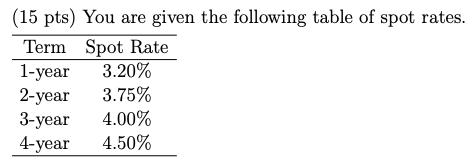

(15 pts) You are given the following table of spot rates. Term Spot Rate 1-year 3.20% 2-year 3.75% 3-year 4.00% 4-year 4.50%

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Lets tackle each question one by one 1 Redington immunization requires matching the duration of the assets and liabilities and ensuring that the convexity of the assets is greater than the convexity o... View full answer

Get step-by-step solutions from verified subject matter experts