Answered step by step

Verified Expert Solution

Question

1 Approved Answer

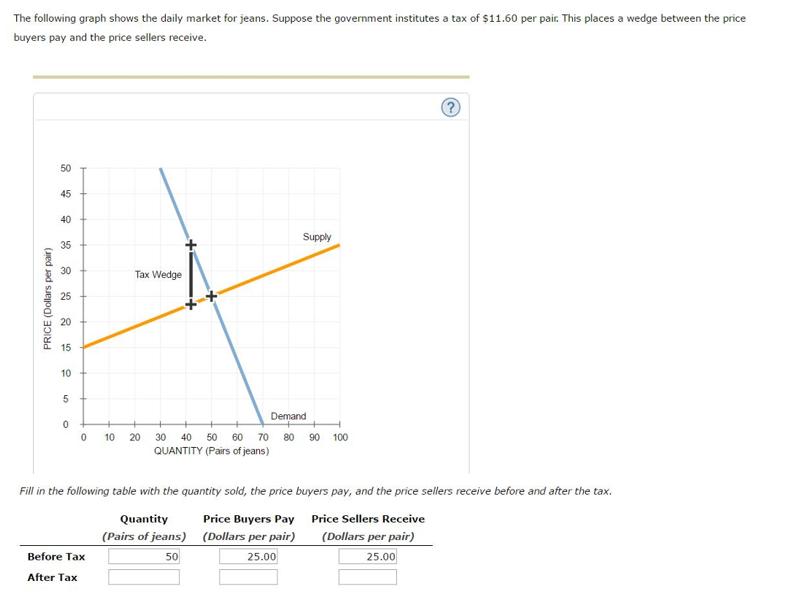

The following graph shows the daily market for jeans. Suppose the government institutes a tax of $11.60 per pair. This places a wedge between

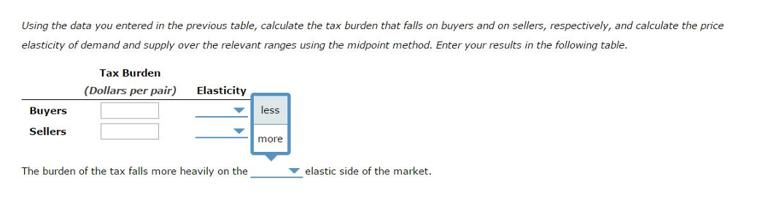

The following graph shows the daily market for jeans. Suppose the government institutes a tax of $11.60 per pair. This places a wedge between the price buyers pay and the price sellers receive. 50 45 40 Supply 35 30 Tax Wedge 25 20 15 10 Demand O 10 20 30 40 50 60 70 90 100 QUANTITY (Pairs of jeans) Fill in the following table with the quantity sold, the price buyers pay, and the price sellers receive before and after the tax. Quantity Price Buyers Pay Price Sellers Receive (Pairs of jeans) (Dollars per pair) (Dollars per pair) 25.00 Before Tax 50 25.00 After Tax PRICE (Dollars per pair) Using the data you entered in the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price elasticity of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table. Tax Burden (Dollars per pair) Elasticity Buyers less Sellers more The burden of the tax falls more heavily on the elastic side of the market. 45 40 Supply 35 30 Tax Wel 42, 23.4 15 10 25 20 PRICE (Dollars per pair)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63657c83b6c8d_238628.pdf

180 KBs PDF File

63657c83b6c8d_238628.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started