Question

Explain how each of these matters should be accounted for in accordance with the requirements of IAS 16. (a) A company buys an aircraft for

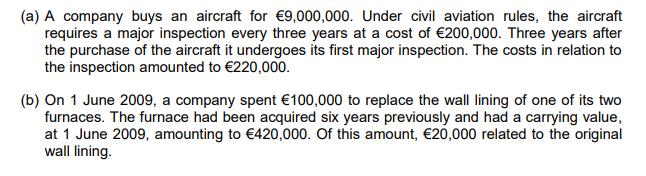

Explain how each of these matters should be accounted for in accordance with the requirements of IAS 16.

Explain how each of these matters should be accounted for in accordance with the requirements of IAS 16.

(a) A company buys an aircraft for 9,000,000. Under civil aviation rules, the aircraft requires a major inspection every three years at a cost of 200,000. Three years after the purchase of the aircraft it undergoes its first major inspection. The costs in relation to the inspection amounted to 220,000. (b) On 1 June 2009, a company spent 100,000 to replace the wall lining of one of its two furnaces. The furnace had been acquired six years previously and had a carrying value, at 1 June 2009, amounting to 420,000. Of this amount, 20,000 related to the original wall lining.

Step by Step Solution

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Given From given information A Company buys Aircr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Management A Systems Approach to Planning Scheduling and Controlling

Authors: Harold Kerzner

10th Edition

978-047027870, 978-0-470-5038, 470278706, 978-0470278703

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App