Question

A company called Borduria Energy owns a nuclear power plant and a gas-fired power plant. Its trading division has entered into the following contracts for

A company called Borduria Energy owns a nuclear power plant and a gas-fired power plant. Its trading division has entered into the following contracts for 25 January: T-1. A forward contract for the sale of 50 MW at a price of 21.00 $/MWh. This contract applies to all hours. T-2. A long-term contract for the sale of 300 MW during off-peak hours at a price of 14.00 $/MWh T-3. A long-term contract for the sale of 350 MW at 20 $/MWh during peak hours. In addition, for the trading period from 2 : 00 to 3 : 00 P.M. on that day, it has entered into the following transactions: T-4. A future contract for the purchase of 600 MWh at 20.00 $/MWh T-5. A future contract for the sale of 100 MWh at 22.00 $/MWh T-6. A put option for 250 MWh at an exercise price of 23.50 $/MWh T-7. A call option for 200 MWh at an exercise price of 22.50 $/MWh T-8. A put option for 100 MWh at an exercise price of 18.75 $/MWh T-9. A bid in the spot market to produce 50 MW using its gas-fired plant at 19.00 $/MWh T-10. A bid in the spot market to produce 100 MW using its gas-fired plant at 22.00 $/MWh The option fee for all call and put options is $2.00/MWh. The peak hours are defined as being the hours between 8 : 00 A.M. and 8 : 00 P.M. Borduria Energy also sells electrical energy directly to small consumers through its retail division. Residential customers pay a tariff of 25.50 $/MWh

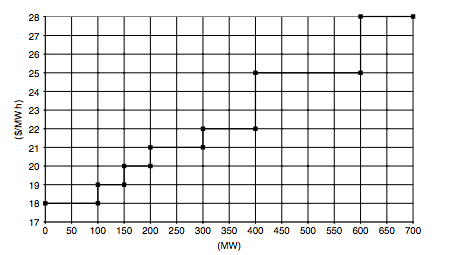

and commercial consumers pay a tariff of 25.00 $/MWh. Borduria Energy does not sell electricity to industrial consumers. The graph on Figure 3.3 shows the stack of bids that the spot market operator has received for the trading period from 2 : 00 to 3 : 00 P.M. on 25 January. In order to balance load and generation, it accepted bids for 225 MW in increasing order of price for that hour. The spot price was set at the price of the last accepted bid. During that hour, the residential customers served by Borduria Energy consumed 300 MW, while its commercial customers consumed 200 MW. The nuclear power plant produced 400 MWh at an average cost of 16.00 $/MWh. Its gas-fired plant produced 200 MWh at an average cost of 18.00 $/MWh. All imbalances are settled at the spot market price. a. Calculate the profit or loss made by Borduria Energy during that hour. b. Calculate the effect that the sudden outage of the nuclear generating plant at 2 : 00 P.M. on 25 January would have on the profit (or loss) of Borduria Energy for that hour.

24 21 17 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 (MW)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started