Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company called Mr Miller would like to start a new project. To finance the initial cost of this project, it has just issed

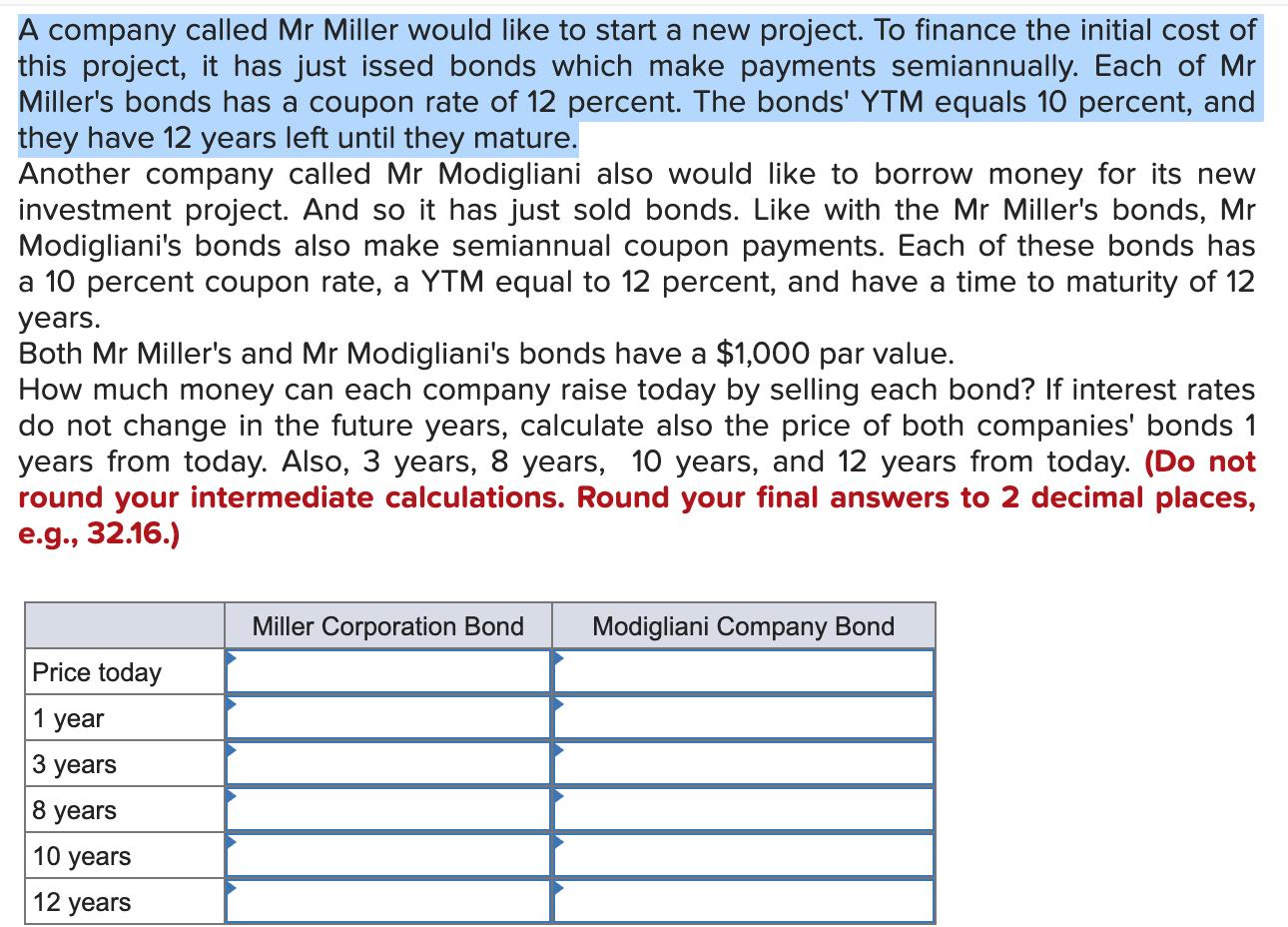

A company called Mr Miller would like to start a new project. To finance the initial cost of this project, it has just issed bonds which make payments semiannually. Each of Mr Miller's bonds has a coupon rate of 12 percent. The bonds' YTM equals 10 percent, and they have 12 years left until they mature. Another company called Mr Modigliani also would like to borrow money for its new investment project. And so it has just sold bonds. Like with the Mr Miller's bonds, Mr Modigliani's bonds also make semiannual coupon payments. Each of these bonds has a 10 percent coupon rate, a YTM equal to 12 percent, and have a time to maturity of 12 years. Both Mr Miller's and Mr Modigliani's bonds have a $1,000 par value. How much money can each company raise today by selling each bond? If interest rates do not change in the future years, calculate also the price of both companies' bonds 1 years from today. Also, 3 years, 8 years, 10 years, and 12 years from today. (Do not round your intermediate calculations. Round your final answers to 2 decimal places, e.g., 32.16.) Price today 1 year 3 years 8 years 10 years 12 years Miller Corporation Bond Modigliani Company Bond

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the price of the bonds today and in the future years well use the present value formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started