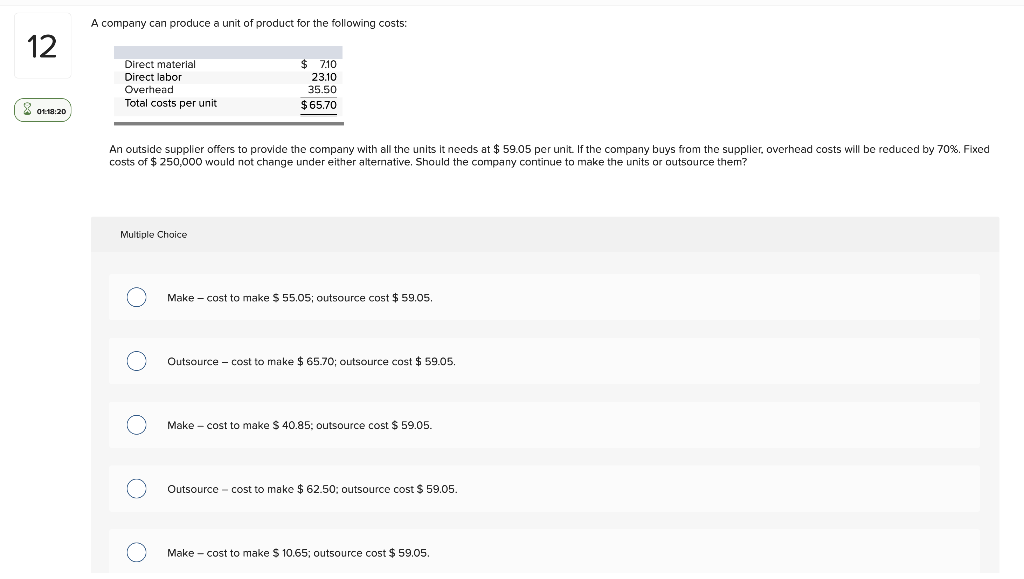

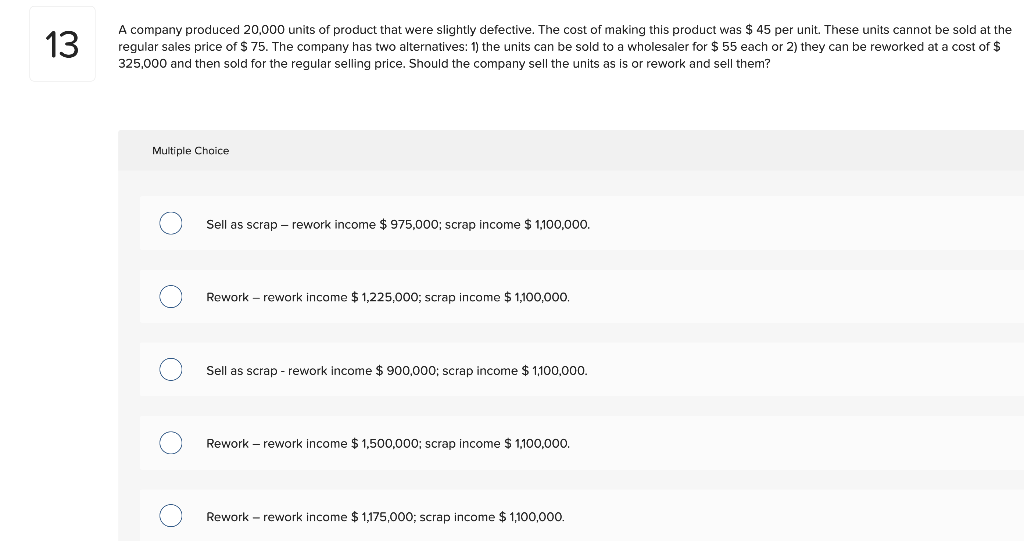

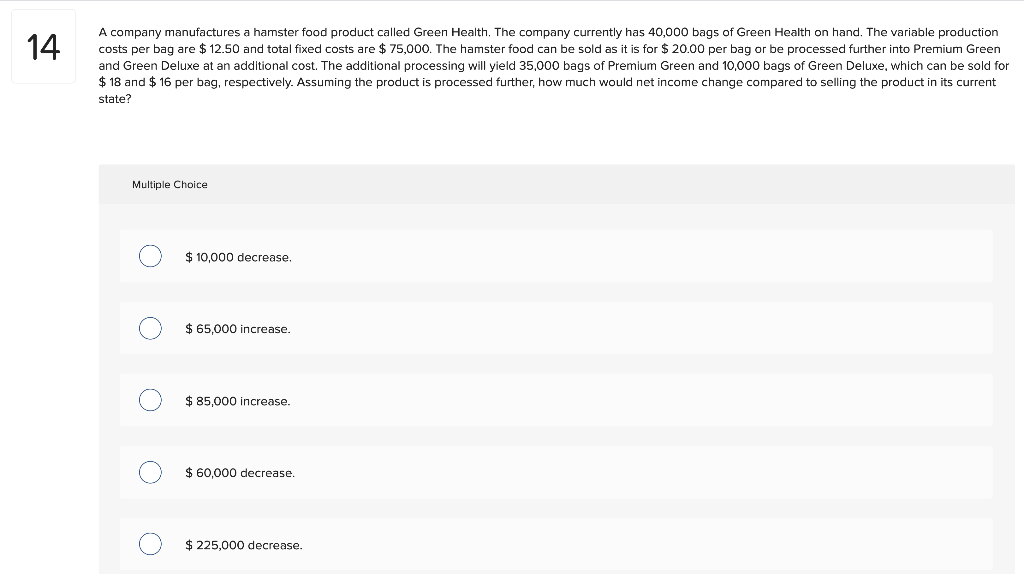

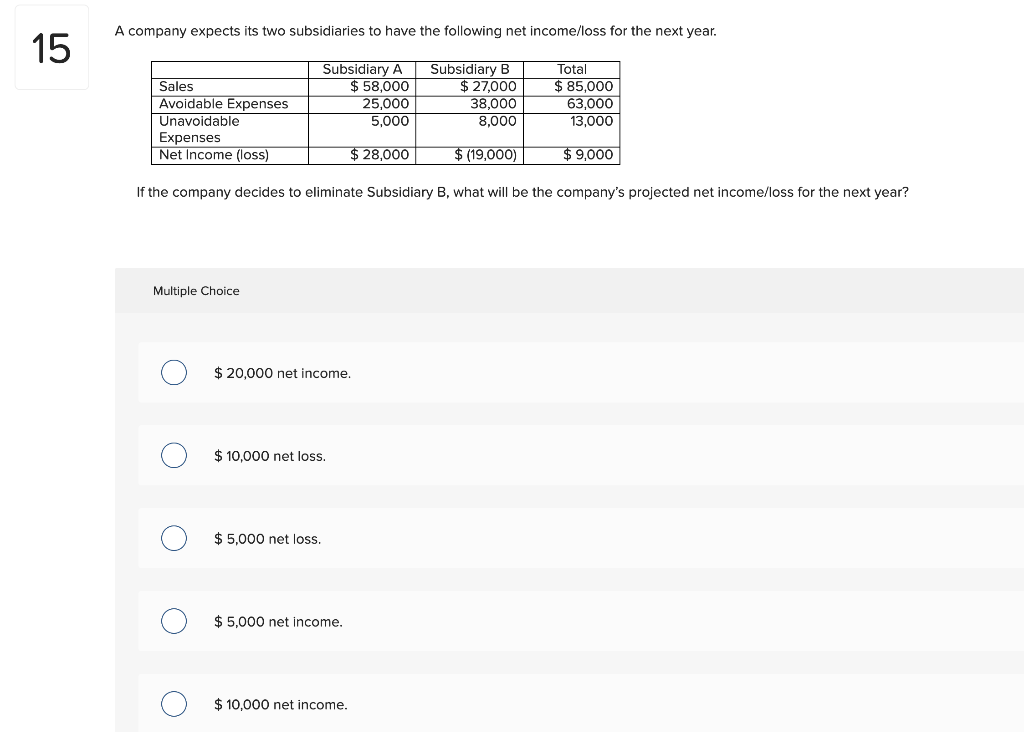

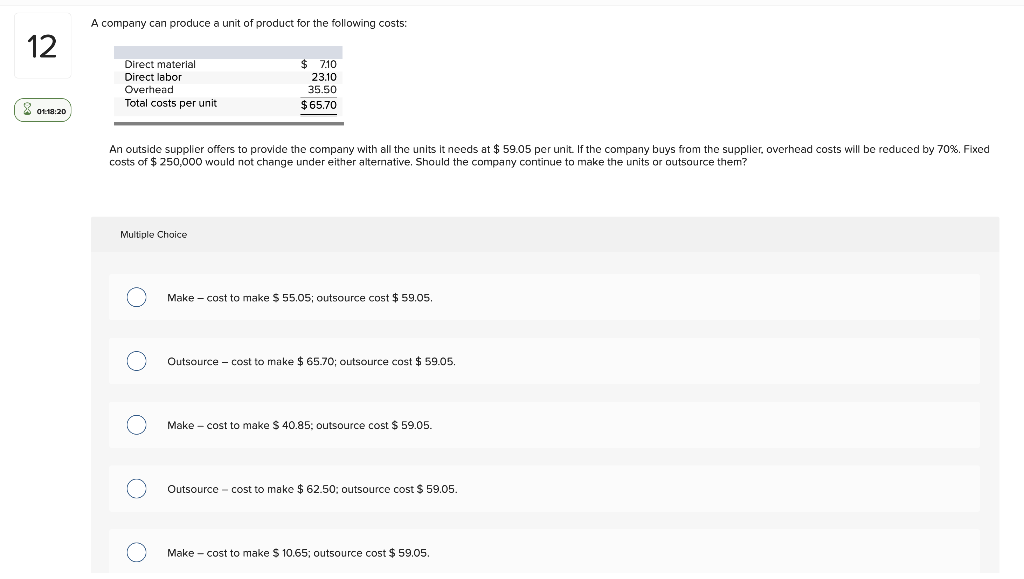

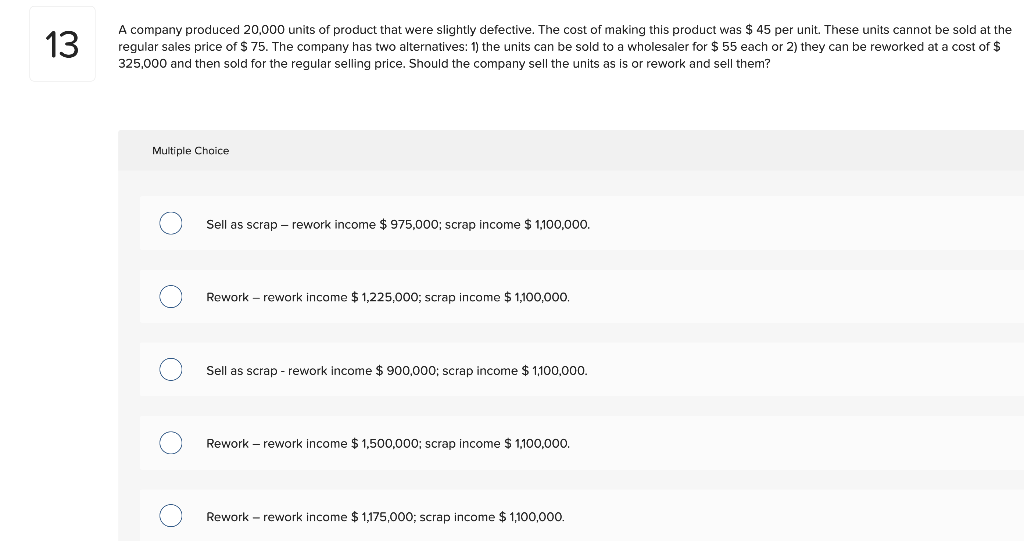

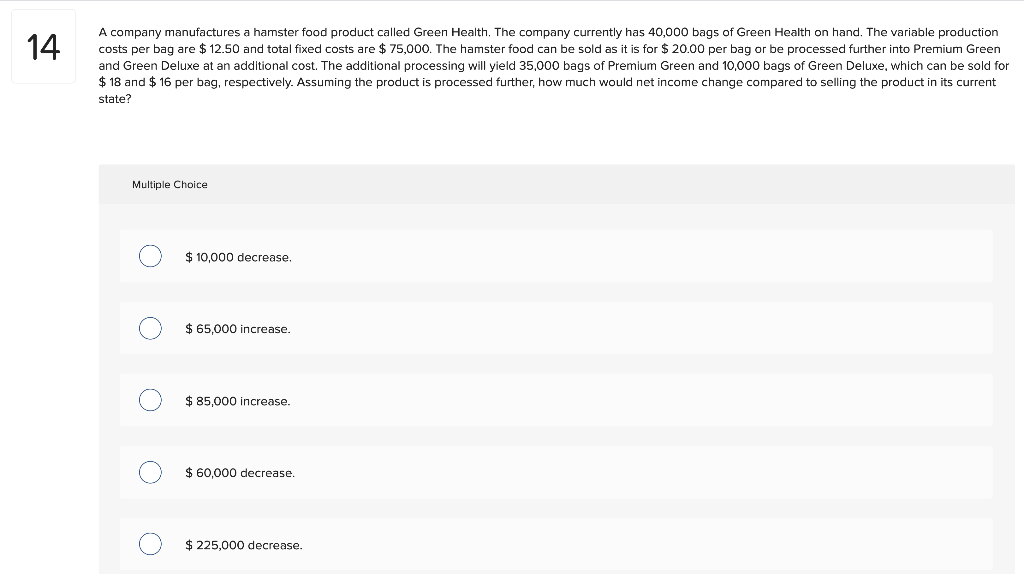

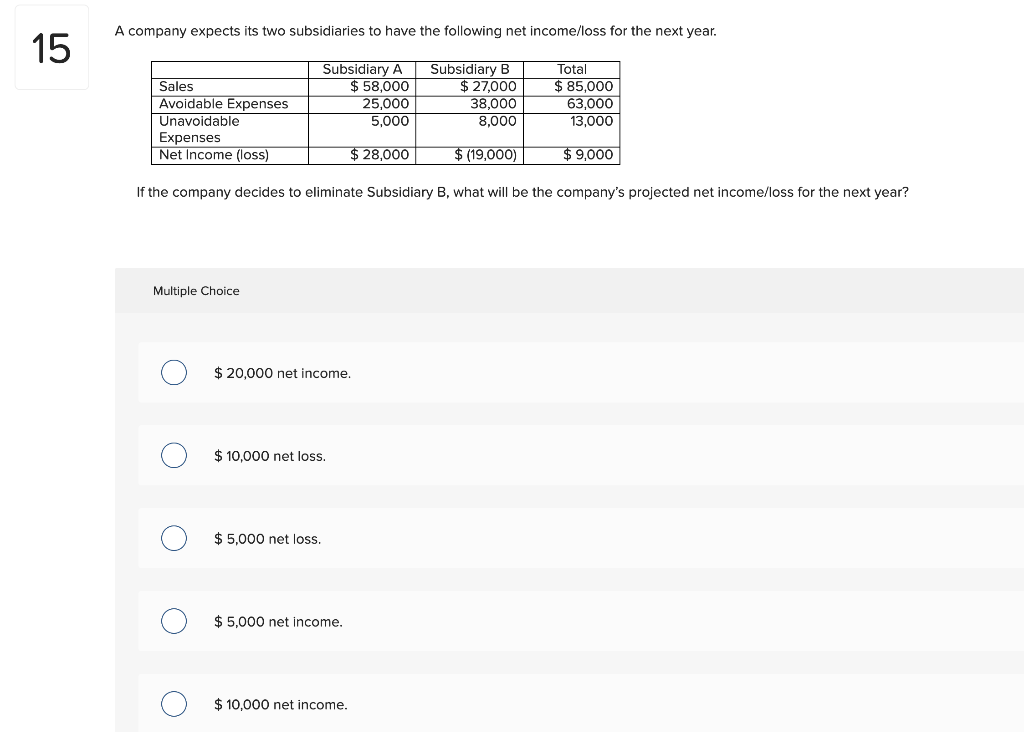

A company can produce a unit of product for the following costs: 12 Direct material Direct labor Overhead Total costs per unit $ 7.10 23.10 35.50 $65.70 X 01:18:20 An outside supplier offers to provide the company with all the units it needs at $ 59.05 per unit. If the company buys from the supplier, overhead costs will be reduced by 70%. Fixed costs of $ 250,000 would not change under either alternative. Should the company continue to make the units or outsource them? Multiple Choice o Make - cost to make $ 55.05; outsource cost $59.05. Outsource - cost to make $ 65.70; outsource cost $ 59.05. Make - cost to make $ 40.85: outsource cost $ 59.05. Outsource-cost to make $ 62.50: outsource cost $ 59.05. Make - cost to make $ 10.65; outsource cost $59.05. 13 A company produced 20,000 units of product that were slightly defective. The cost of making this product was $ 45 per unit. These units cannot be sold at the regular sales price of $ 75. The company has two alternatives: 1) the units can be sold to a wholesaler for $ 55 each or 2) they can be reworked at a cost of $ 325,000 and then sold for the regular selling price. Should the company sell the units as is or rework and sell them? Multiple Choice Sell as scrap - rework income $ 975,000; scrap income $ 1,100,000. Rework - rework income $1,225,000; scrap income $ 1,100,000, O Sell as scrap - rework income $ 900,000; scrap income $ 1,100,000. Rework - rework income $1,500,000; scrap income $ 1,100,000. Rework - rework income $1,175,000; scrap income $ 1,100,000. 14 A company manufactures a hamster food product called Green Health. The company currently has 40,000 bags of Green Health on hand. The variable production costs per bag are $12.50 and total fixed costs are $ 75,000. The hamster food can be sold as it is for $ 20.00 per bag or be processed further into Premium Green and Green Deluxe at an additional cost. The additional processing will yield 35,000 bags of Premium Green and 10,000 bags of Green Deluxe, which can be sold for $ 18 and $ 16 per bag, respectively. Assuming the product is processed further, how much would net income change compared to selling the product in its current state? Multiple Choice $ 10,000 decrease, $ 65,000 increase. O O $ 85,000 increase. $ 60,000 decrease. . $ 225,000 decrease. A company expects its two subsidiaries to have the following net income/loss for the next year. 15 Sales Avoidable Expenses Unavoidable Expenses Net Income (loss) Subsidiary A $ 58,000 25,000 5,000 Subsidiary B $ 27,000 38.000 8,000 Total $ 85,000 63,000 13,000 $ 28,000 $ (19,000) $ 9,000 If the company decides to eliminate Subsidiary B, what will be the company's projected net income/loss for the next year? Multiple Choice $ 20,000 net income. $ 10,000 net loss. o $ 5,000 net loss. $ 5,000 net income. O $ 10,000 net income