Answered step by step

Verified Expert Solution

Question

1 Approved Answer

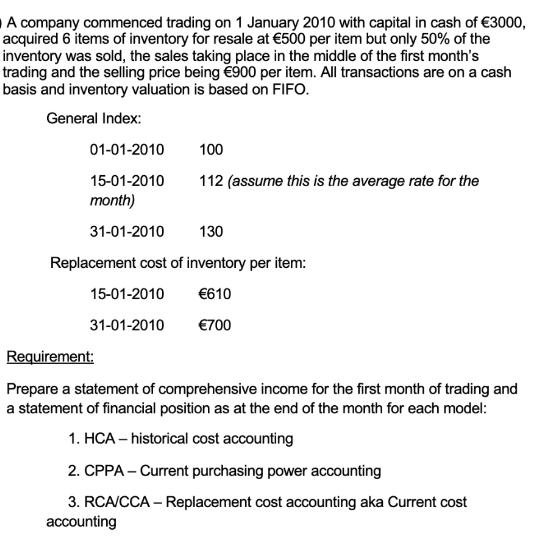

A company commenced trading on 1 January 2010 with capital in cash of 3000, acquired 6 items of inventory for resale at 500 per

A company commenced trading on 1 January 2010 with capital in cash of 3000, acquired 6 items of inventory for resale at 500 per item but only 50% of the inventory was sold, the sales taking place in the middle of the first month's trading and the selling price being 900 per item. All transactions are on a cash basis and inventory valuation is based on FIFO. General Index: 01-01-2010 15-01-2010 month) 31-01-2010 100 112 (assume this is the average rate for the 130 Replacement cost of inventory per item: 610 700 15-01-2010 31-01-2010 Requirement: Prepare a statement of comprehensive income for the first month of trading and a statement of financial position as at the end of the month for each model: 1. HCA-historical cost accounting 2. CPPA - Current purchasing power accounting 3. RCA/CCA - Replacement cost accounting aka Current cost accounting

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 HCA historical cost accounting Statement of comprehensive income Revenue 3 items 900 2700 Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started