Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were

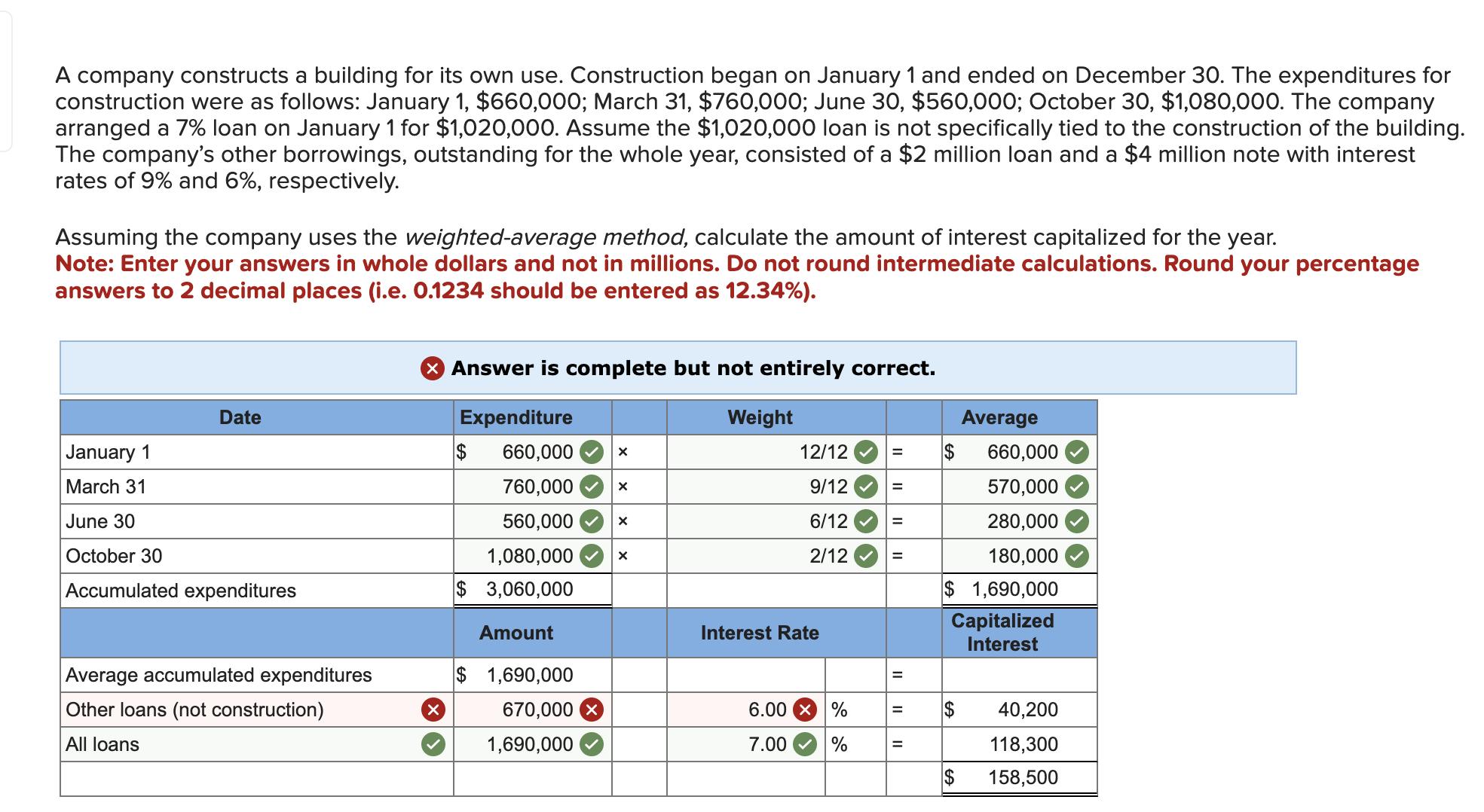

A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $660,000; March 31, $760,000; June 30, $560,000; October 30, $1,080,000. The company arranged a 7% loan on January 1 for $1,020,000. Assume the $1,020,000 loan is not specifically tied to the construction of the building. The company's other borrowings, outstanding for the whole year, consisted of a $2 million loan and a $4 million note with interest rates of 9% and 6%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%). > Answer is complete but not entirely correct. Date January 1 March 31 June 30 October 30 Accumulated expenditures Average accumulated expenditures Other loans (not construction) All loans Expenditure Weight Average $ 660,000 X 12/12 = $ 660,000 760,000 9/12 = 570,000 560,000 6/12 = 280,000 1,080,000 2/12 = 180,000 $ 3,060,000 Amount $ 1,690,000 Capitalized Interest Rate $ 1,690,000 Interest 670,000 1,690,000 6.00 % = $ 40,200 7.00 % = 118,300 $ 158,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 WeightedAverage Accumulated Expenditures January 1 expenditure 660000 March 31 expenditure 760000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started