Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company currently pays a dividend of $1.96 per share. It is estimated that the company's dividend will grow at a rate of 25.0% per

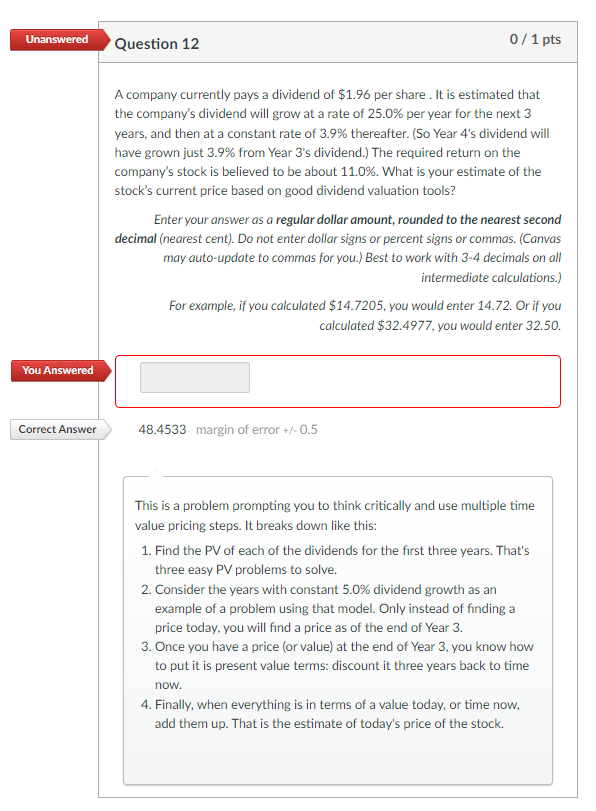

A company currently pays a dividend of $1.96 per share. It is estimated that the company's dividend will grow at a rate of 25.0% per year for the next 3 years, and then at a constant rate of 3.9% thereafter. (So Year 4's dividend will have grown just 3.9\% from Year 3's dividend.) The required return on the company's stock is believed to be about 11.0%. What is your estimate of the stock's current price based on good dividend valuation tools? Enter your answer as a regular dollar amount, rounded to the nearest second decimal (nearest cent). Do not enter dollar signs or percent signs or commas. (Canvas may auto-update to commas for you.) Best to work with 3-4 decimals on all intermediate calculations.) For example, if you calculated $14.7205, you would enter 14.72. Or if you calculated $32.4977, you would enter 32.50 . 48.4533 margin of error +/=0.5 This is a problem prompting you to think critically and use multiple time value pricing steps. It breaks down like this: 1. Find the PV of each of the dividends for the first three years. That's three easy PV problems to solve. 2. Consider the years with constant 5.0% dividend growth as an example of a problem using that model. Only instead of finding a price today, you will find a price as of the end of Year 3. 3. Once you have a price (or value) at the end of Year 3, you know how to put it is present value terms: discount it three years back to time now. 4. Finally, when everything is in terms of a value today, or time now, add them up. That is the estimate of today's price of the stock

A company currently pays a dividend of $1.96 per share. It is estimated that the company's dividend will grow at a rate of 25.0% per year for the next 3 years, and then at a constant rate of 3.9% thereafter. (So Year 4's dividend will have grown just 3.9\% from Year 3's dividend.) The required return on the company's stock is believed to be about 11.0%. What is your estimate of the stock's current price based on good dividend valuation tools? Enter your answer as a regular dollar amount, rounded to the nearest second decimal (nearest cent). Do not enter dollar signs or percent signs or commas. (Canvas may auto-update to commas for you.) Best to work with 3-4 decimals on all intermediate calculations.) For example, if you calculated $14.7205, you would enter 14.72. Or if you calculated $32.4977, you would enter 32.50 . 48.4533 margin of error +/=0.5 This is a problem prompting you to think critically and use multiple time value pricing steps. It breaks down like this: 1. Find the PV of each of the dividends for the first three years. That's three easy PV problems to solve. 2. Consider the years with constant 5.0% dividend growth as an example of a problem using that model. Only instead of finding a price today, you will find a price as of the end of Year 3. 3. Once you have a price (or value) at the end of Year 3, you know how to put it is present value terms: discount it three years back to time now. 4. Finally, when everything is in terms of a value today, or time now, add them up. That is the estimate of today's price of the stock Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started