Answered step by step

Verified Expert Solution

Question

1 Approved Answer

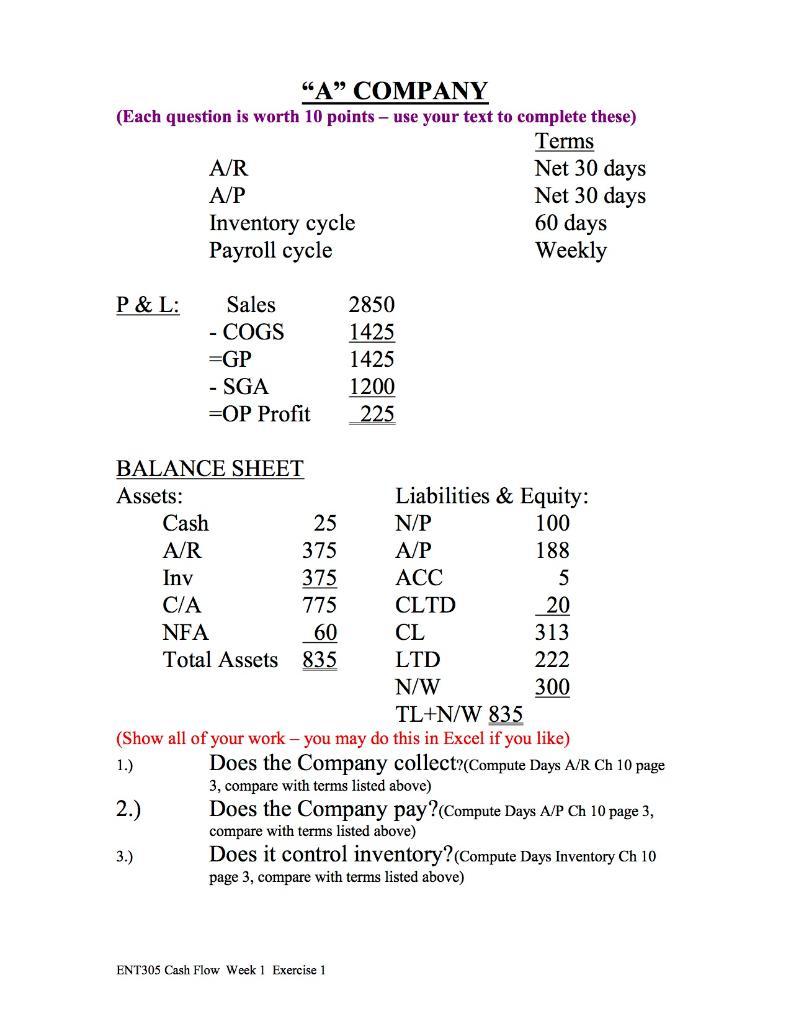

A COMPANY (Each question is worth 10 points- use your text to complete these) Terms Net 30 days Net 30 days 60 days Weekly

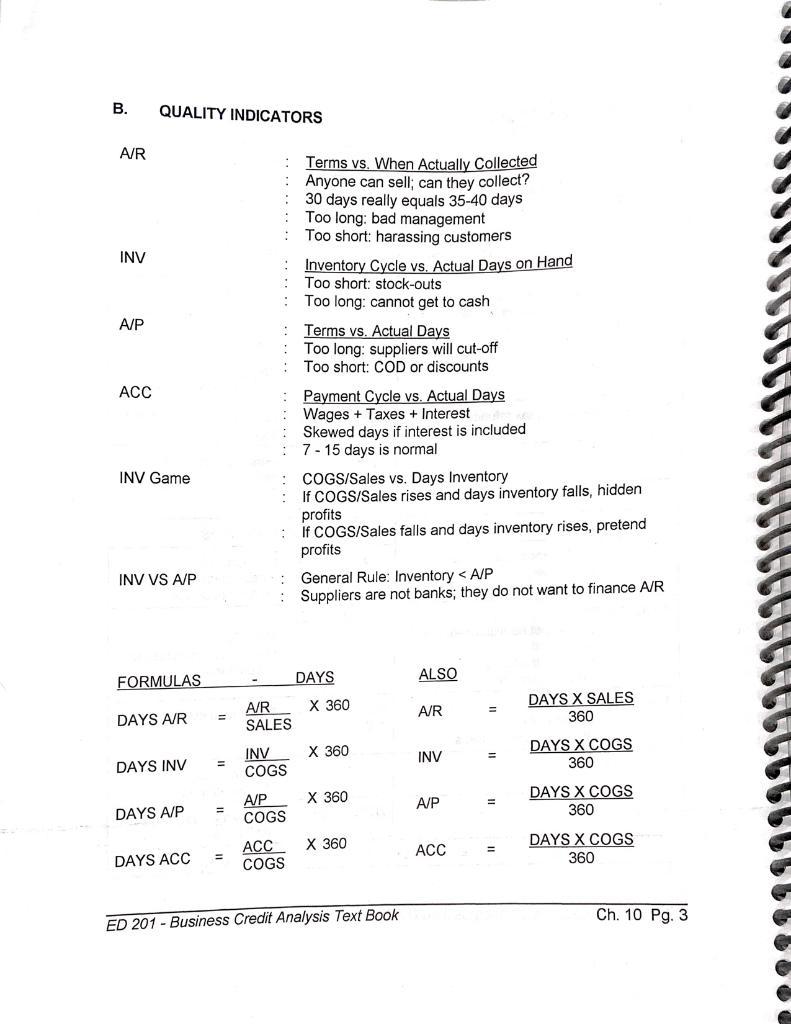

"A" COMPANY (Each question is worth 10 points- use your text to complete these) Terms Net 30 days Net 30 days 60 days Weekly A/R A/P Inventory cycle Payroll cycle P & L: Sales 2850 - COGS 1425 =GP 1425 - SGA 1200 =OP Profit 225 BALANCE SHEET Assets: Liabilities & Equity: Cash 25 N/P 100 A/R 375 A/P 188 Inv 375 5 C/A 775 CLTD 20 NFA 60 CL 313 Total Assets 835 LTD 222 N/W 300 TL+N/W 835 (Show all of your work - you may do this in Excel if you like) 1.) Does the Company collect?(Compute Days A/R Ch 10 page 3, compare with terms listed above) Does the Company pay?(Compute Days A/P Ch 10 page 3, 2.) compare with terms listed above) 3.) Does it control inventory?(Compute Days Inventory Ch 10 page 3, compare with terms listed above) ENT305 Cash Flow Week 1 Exercise 1 . QUALITY INDICATORS A/R Terms vs. When Actually Collected Anyone can sell; can they collect? 30 days really equals 35-40 days Too long: bad management Too short: harassing customers INV Inventory Cycle vs. Actual Days on Hand Too short: stock-outs Too long: cannot get to cash A/P Terms vs. Actual Days Too long: suppliers will cut-off Too short: COD or discounts C Payment Cycle vs. Actual Days Wages + Taxes + Interest Skewed days if interest is included 7- 15 days is normal COGS/Sales vs. Days Inventory If COGS/Sales rises and days inventory falls, hidden profits If COGS/Sales falls and days inventory rises, pretend profits INV Game General Rule: Inventory < A/P : Suppliers are not banks; they do not want to finance A/R INV VS A/P DAYS ALSO FORMULAS DAYS X SALES 360 360 A/R SALES A/R DAYS A/R DAYS X COGS 360 360 INV COGS INV DAYS INV %3D DAYS X COGS 360 360 A/P COGS A/P %3D DAYS A/P DAYS X COGS 360 360 ACC COGS ACC %3D DAYS ACC %3D Ch. 10 Pg. 3 ED 201 - Business Credit Analysis Text Book *..... ...

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Given AR net 30 days AR 3752850360 47 days The company needs to col...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started